FintechOS 22.R3

November 28th, 2022

FintechOS 22.R3 is cloud based only. Starting with FintechOS 22.S, only public cloud deployments are supported.

This version release of the FintechOS Platform comes with new features and improvements to current capabilities, as well as new out-of-the-box journey accelerators and ecosystem connectors. Notable new features are observability and telemetry data, product analytics to measure the performance of launched products, and a solid foundation to support efficient SME Lending and Underwriting.

In addition, with these release notes we are excited to unveil a new and simpler way of organizing platform capabilities:

-

Launch: improvements and new capabilities that enable organizations to efficiently launch new financial products including product definition, defining customer journeys, accelerators and connectors, analytics and monitoring the financial impact of new products, and more.

-

Service: improvements and new capabilities that enable organizations to service the financial products that they define.

-

Expand: improvements and new capabilities that enable organizations to expand their relationships with customers and build trust, including Customer 360 and Campaigns.

-

Fintech Operating System: improvements and new capabilities that are shared across the platform such as working with data, task management, embedded automation, and more. We will also include improvements across non-functional areas such as performance, security, and availability.

Launch

Define Journeys

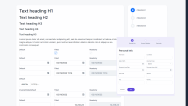

With this release, UI logic has been decoupled from journeys with the introduction of reusable UX libraries. With this new capability, the UX team can work independently on defining templates that can be shared across digital journeys. We are also including an elegant design kit, based on industry best practices, that serves as the starting point for your UX library. The design kit can be modified to match your UI standards and extended with additional components. Check out the dedicated release notes.

Define Financial Products & Services

This release comes with significant updates to the Banking Product Factory, aimed at simplifying the product creation processes via the user interface or API integration. Other components, such as banking product types, commission types, product hierarchy elements, or the newly introduced banking product system parameters, were also rethought for easier management and come with predefined values. Banking Product Factory also brings changes needed to support the new Core Banking v4.0, such as storing snapshots of interest at the contract level. Check out the dedicated release notes, including the Mandatory Changes for commissions.

With the Insurance Product Factory, you can now configure the suspension period for a policy, when creating an insurance product. You can choose either from the default 30 days, or, if needed, you can set up a different value for the suspension period. Check out the dedicated release notes.

Product analytics are also out, use them to monitor the performance of both existing and newly created banking/insurance products. For more information check out the dedicated release notes.

Underwriting

SME Digital Lending Underwriting helps financial institutions cover one of the most critical parts of the underwriting process: data collection and initial risk assessment.

It leverages third-party data seamlessly and enables the collection of critical data (KYB process) and decision-making (fetching credit scores, accounting data, group details, shareholders details, and compliance info). Pre-integrations with third parties are available but can be easily modified to accommodate the financial institution's current providers. Read more about this in the user guide.

Accelerators

The SME Insurance Quote & Buy accelerator helps small and medium businesses easily apply for an insurance quotation through the Quote & Buy journey, which performs on top of automation processors that deal with rating, pricing, and generating proposals. Read more about this in the user guide.

With the new SME First Notification of Loss (FNOL) accelerator, small and medium businesses can easily register a claim, and notify the insurer. The mobile self-service journey takes the user through a series of steps, including identifying the customer and matching the policy, providing details about the business, or receiving a claim registration confirmation. Read more about this in the user guide.

Ecosystem Connectors

This release introduces the new Codat connector. Codat facilitates the onboarding process by retrieving relevant financial information about the customer from multiple databases. It connects primarily with accounting tools and other related tools from small businesses to extract financial information such as balance sheets, profit and loss reports, cash flow statements, and so on. Read more about this in the Codat Connector user guide.

With the new Credit Kudos connector financial institutions can instantly and securely retrieve financial data from Credit Kudos such as account details, incoming and outgoing transactions, card number, account balance, and so on. Read more about this in the user guide.

Service

Loan Management

This version release of Loan Management comes with improved performance and long-awaited features such as banking formula-ready third-party commissioning processes, contract-level management of the penalty interest rates, and others. The API ecosystem was enriched with newly created third-party management endpoints. Check out the dedicated release notes, including the Mandatory Changes for repayment schedules.

Operational Ledger

This version release of Operational Ledger supports the features that come with Core Banking and it has improved performance. Check out the dedicated release notes.

Policy Admin

The new policy suspension process in Policy Admin allows for those policies with unpaid installments to move, after their due date passes, from the In Force to the Suspended status. As such, Suspended becomes an intermediate status between InForce and Lapsed, being the period in which the client can request the reinstatement of the policy.

The Suspended status will not trigger modifications within the existing installment structure. Payments can be allocated on unpaid installments and the payment schedule is updated with the subsequent status (e.g., Paid) for the installment.

A policy can go back to the InForce status through the Reinstatement process, which is one of the often encountered processes the admin of an insurance, allowing a business user to restore a policy from the Suspended status back to InForce, after the payments have been allocated on the unpaid installments and a Reinstatement request is processed and approved. Check out the dedicated release notes.

Fintech Operating System

This version release brings across-the-board improvements to the fintech operating system, from back-end performance updates and monitoring to a new ES6 compatible JavaScript interpreter with debugging support, to product analytics, to user interface customization features.

CI/CD

Query caching and improved digital solution packages allow your queries and imports to run faster.

Advanced (ProCode)

With the alternative script engine, which uses Microsoft's ClearScript library, you can edit server automation scripts using ES6 syntax and perform debugging using your browser's developer tools.

Monitoring

New observability & telemetry solution with Grafana, capable of monitoring application performance via CPU percentages, server logs, trace results and more.

Embedded Automation

With this version release, the AriadNext processor allows you to customize the background display. Read more about this in the AriadNext user guide.

The smsConfiguration parameter has been added to the eSign processor to better facilitate custom SMS text. Read more about this in the eSign user guide.

Workflow

Task Management now comes with two separate dashboards, one for Operators and one for Coordinators, allowing them to manage, filter, pick up and track all their tasks in one place. When creating a queue, the Coordinator can set the relevant visible tabs so only those will be available as filters in the dashboards. Users can now add notes on the task details page and view the activity history of the selected task. Read more about this in the dedicated release notes.