Overview

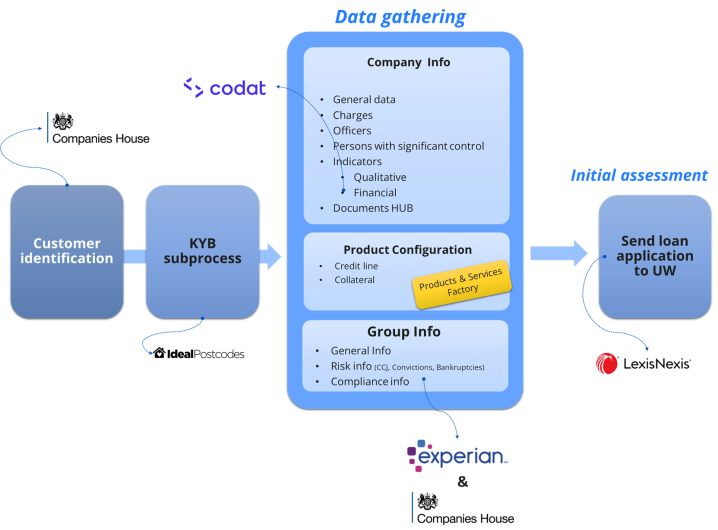

SME Digital Lending and Underwriting solution helps financial institutions cover one of the critical parts of an underwriting process: data collection and initial risk assessment.

The user is a financial institution representative, and the application process is assisted. This means that the customer goes through the process helped by a bank representative who operates the credit facility application in a branch to collect the necessary data for various analyzes in the application process.

The SME Digital Lending and Underwriting solution is aimed at resolving some of the pain points when collecting data for the underwriting process, such as increased costs due to manual data collection and processing, increased time to evaluate the application, and decreased customer experience due to difficult and time-consuming processes.

Here are some of the major benefits the solution offers:

-

The simplified process helps the bank representative automatically obtain or manually collect most of the data in minutes to submit an application.

-

Initial creditworthiness and financial assessments are performed to automatically determine whether to approve or reject the application early in the process.

-

All collected data is accessible from one place to help an underwriter make decisions with confidence.

-

Pre-integrations with third parties are available to collect critical data (KYB process Companies House and Ideal Postcodes), accounting data (Codat) and initial assessment (fetching info from Experian and Lexis Nexis) but can be easily modified to accommodate the bank’s current providers and reduce implementation time and budget.

The SME Digital Lending and Underwriting is further customizable and can be personalized according to specific requirements. For example, you can:

-

modify the algorithms for different calculations: eligibility, loan amount, scoring, etc.

-

modify the flow as per your business requirements.

-

integrate different platforms with APIs.

The solution uses data from third parties and enables data collection using the following connectors:

-

Companies House to get and display information such as company details, name and role of the representative in the company, and so on.

-

Ideal Postcodes to access and retrieve addresses.

-

Experian to get credit scores.

-

Lexis Nexis to retrieve data regarding fraud or potential fraud.

-

Codat to access and retrieve relevant financial information.

These integrations with third parties can be modified to accommodate the financial institution’s current providers.