Introduction

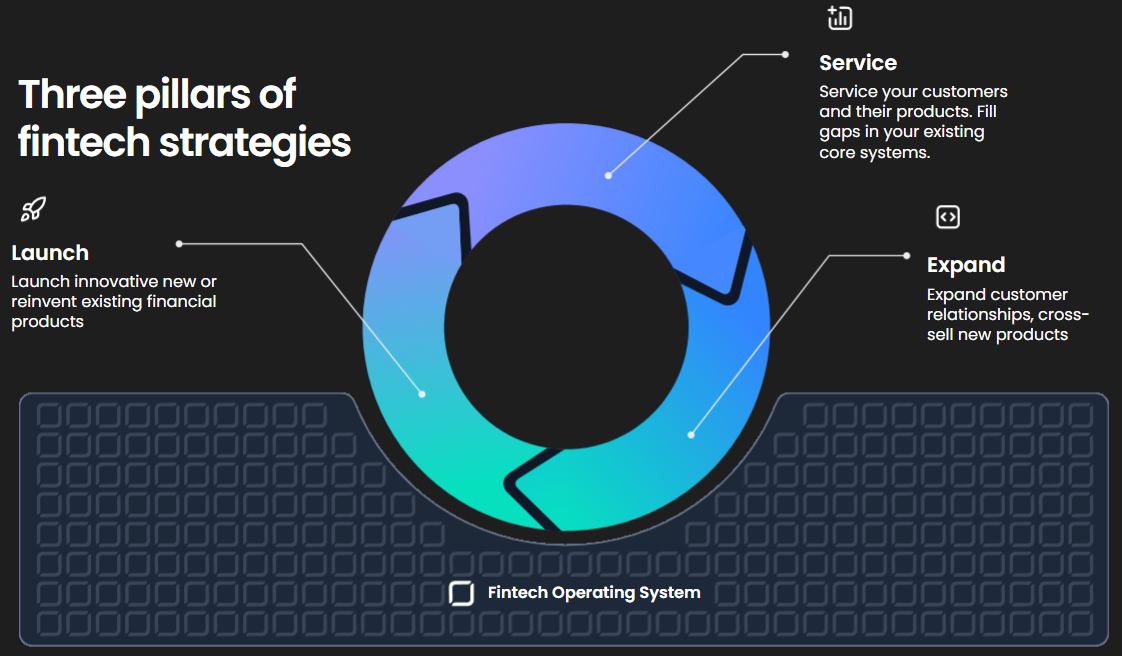

The FintechOS Platform empowers any organization to create innovative financial products that meet changing consumer needs. The platform makes it easy for consultants and developers alike to create and launch financial products, service and expand these products, and make use of advanced capabilities to add complexity to products and customer journeys.

The FintechOS Platform is comprised of three main pillars, Launch, Service, and Expand, all of them enhanced with advanced capabilities under the Fintech Operating System.

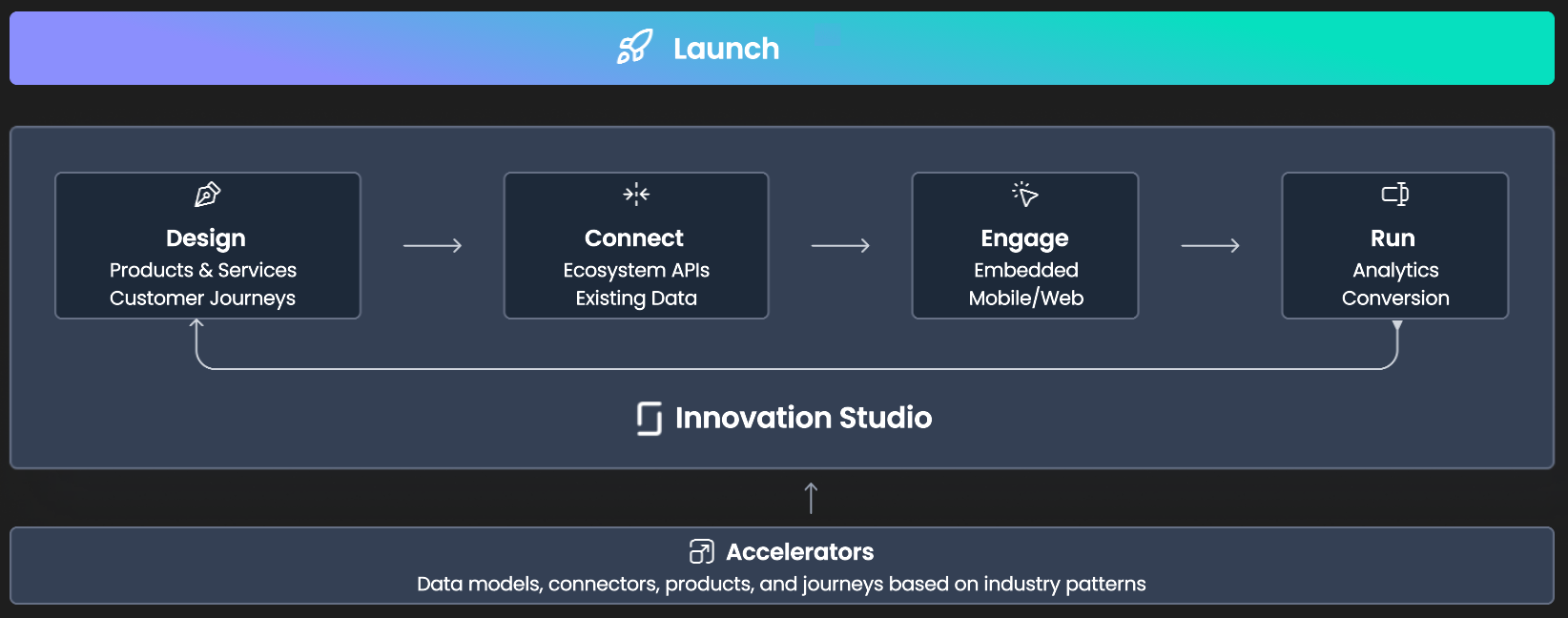

Launch

The Launch pillar is about designing products and services, underwriting, and integrating them in customer journeys enhanced with connectors that pull together data through APIs from external systems. Such journeys can then be embedded in your company's web pages, either on desktop browsers or on the mobile. Use analytics to see the performance of your financial products.

Accelerators are also part of Launch, and are key to speeding up the launch of financial products by offering out-of-the-box journeys that can be customized to fit your product and branding needs.

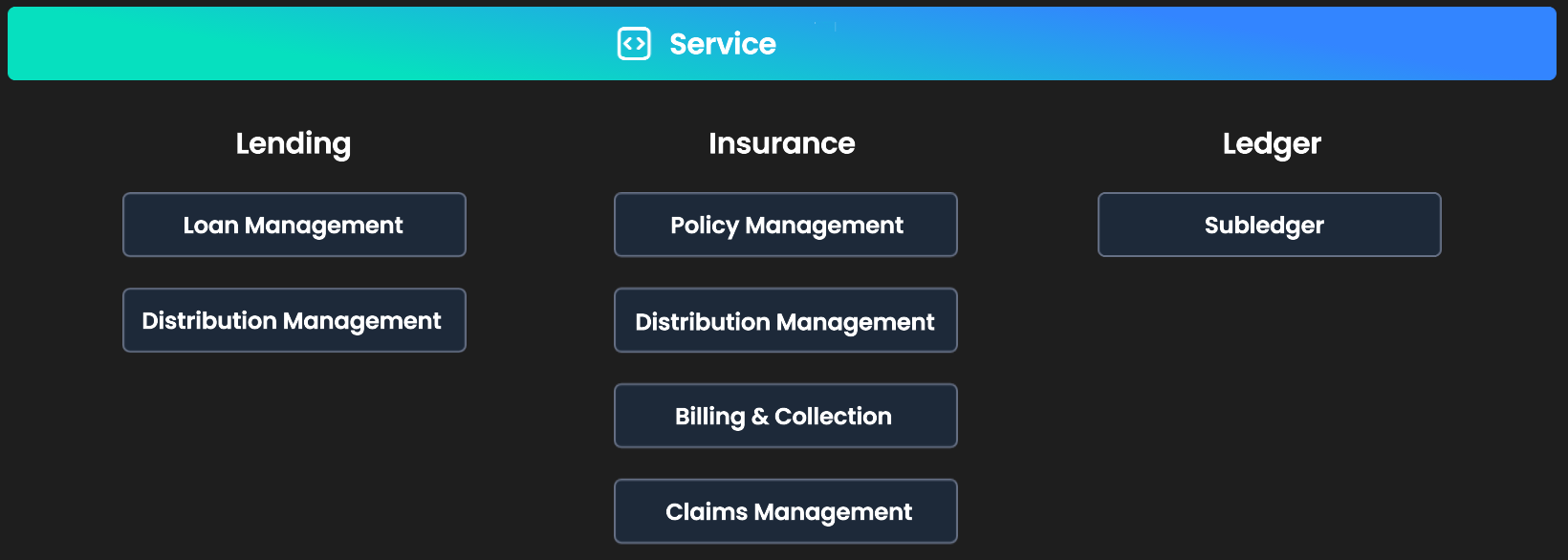

Service

The Service pillar comes with financial capabilities that can be combined in different ways to service customers and enhance financial products created with Launch. Loan Management helps manage loans by leveraging its capability for managing contracts, credit facilities, collateral and more. Distribution Management enables you to manage third-party entities and their agreements, while automating their invoice payments. When it comes to insurance, solutions such as Claims Management, Policy Administration and Billing and & Collection bring more capabilities to the insurance products created during Launch. Lastly, the Subledger helps perform financial transactions and to gather the specific accounting information needed for ledger reports and other financial statements.

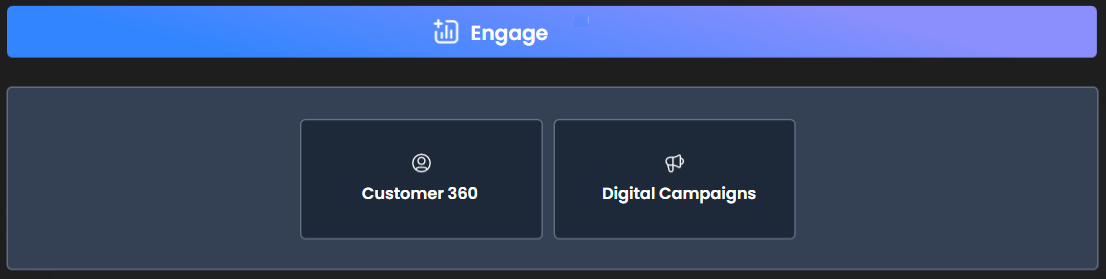

Expand

The Expand pillar comes with capabilities to further enhance journeys and products by offering a way to create digital campaigns and define user personas by personalizing financial products to meet the needs of your customers. The Customer360 module helps collect, aggregate, and process customer data for legal entities and private individuals in order to have easy access to the customer's profile and accelerate the onboarding process.

Fintech Operating System

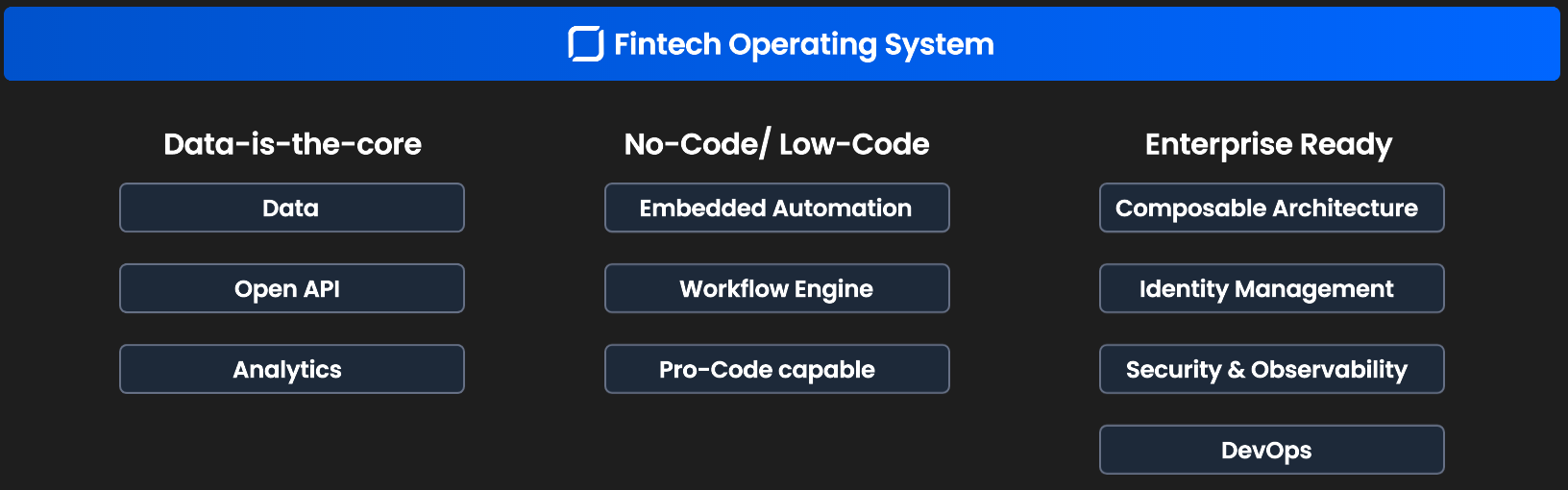

Lastly, the Fintech Operating System is the foundation of the FintechOS Platform and it focuses on bringing the data into a layer that can be used to drive personalization. Embedded automation allows you to add blocks that help extend capabilities of your customer journeys, such as eSign, documents processing, face recognition, co-browsing, and many more. In terms of security, the platform covers data encryption, authentication, authorization and audit.