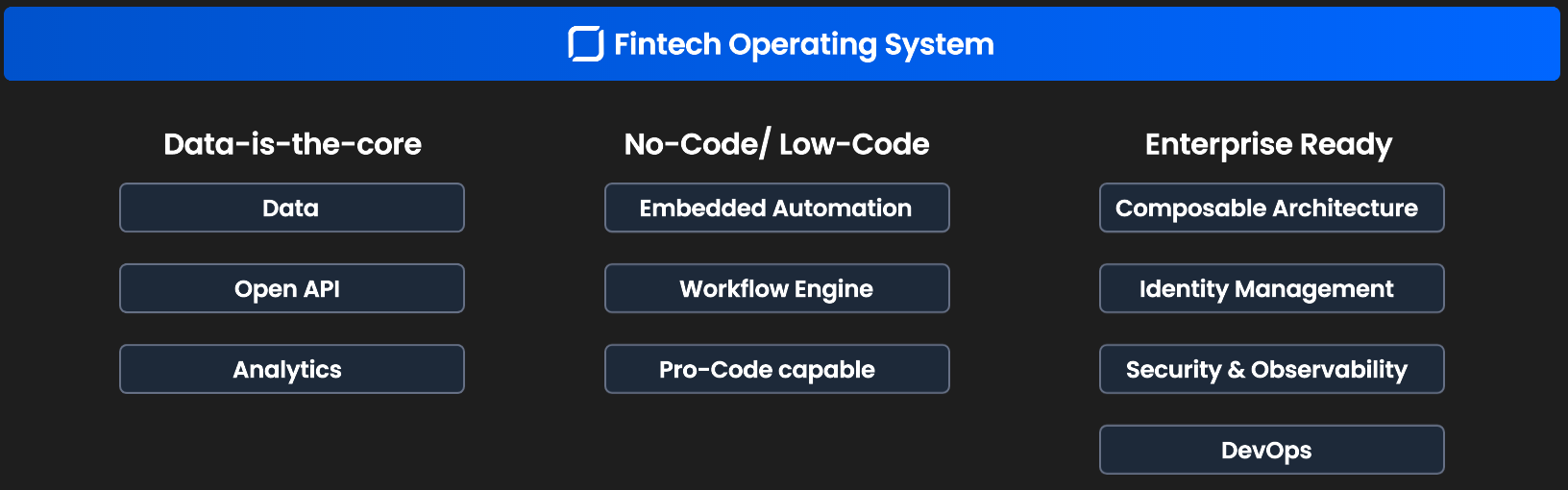

Fintech Operating System

The FintechOS Platform comes with features shared across the platform such as working with data, task management, embedded automation, and more. This also includes capabilities across non-functional areas such as performance, security, and availability.

Security

Security design is essential to protect information from being mishandled by users and ensure that users have access to information based on business needs.

To set up the organizational structure, you need to create the business units, security roles, and assign users the appropriate security roles to map the job-related responsibilities with the required level of access privileges within the platform. Read more about security in the FintechOS Studio user guide.

Advanced (ProCode)

FintechOS Studio provides developers with advanced capabilities to manage HTML, CSS, and JavaScript in forms at source code level, create and use scripts in digital journeys and forms, create script libraries to avoid writing the same lines of codes repeatedly, resulting in increased productivity, work with supporting assets like sequencers, code blocks, or stored procedures and set up multi-factor authorization for specific operations.

-

Code Editor: modern code editor built using Visual Studio Code, to visualize digital solutions and edit code in isolation through a private workspace where you easily review and manage changes through remote code Github repositories.

-

client-side scripting: define collections of custom JavaScript functions that you can use or reuse in your client scripts.

-

server-side scripting: manage complex and secure automation and validation tasks by triggering the execution of custom scripts on the server side.

Embedded Automation

Automation blocks are advanced pre-built features that you can customize and include in your digital journeys. They cover frequent use cases, such as OCR extraction, identity validation, video streaming and collaboration, marketing campaigns management, electronic signatures, digital documents, etc.

-

business formulas: formulas use a simple syntax and incorporate several steps where the result of a step is used in subsequent steps.

-

business workflows: coordinate tasks between people and synchronize data between systems, with the ultimate goal of improving efficiency and responsiveness.

-

digital document: leverage intelligent document automation to reduce errors, boost productivity and maximize business outcomes.

-

entity versioning: implement a record update process that is certified and documented.

-

omnichanel communication automation: use the FintechOS Gateway as email server and send emails on your company's behalf. You can handle email delivery and track real-time email events directly from within the FintechOS platform.

Evolutive Data Core

All business logic and presentation components of a software solution require access to a persistent data storage backbone in order to function. The Evolutive Data Core provides a data persistence layer where the information processed by FintechOS digital solutions is stored and managed.

-

Data Model Designer: a graphical tool that simplifies data modelling and increases user productivity when performing data modelling.

-

Data Model Explorer: create business entities, relationships and attributes in an entity-relationship framework, handling at the same time data persistence and automatic database provisioning.

-

Data Import Templates: import a package or data with its metadata from another system source.

-

Data Governance: classify sensitive data and anonymize it on request. This is particularly useful to ensure compliance with data protection regulations.

-

Data Pipes: extract data from external data sources and replicate (load) it in the FintechOS database or other data management systems.

-

Option Sets: an option set attribute allows you to define a list with several options available for selection.

CI/CD

Use Configuration management to control the ownership, versioning, deployment, and import/export of all components that fulfill a specific business need (such as a digital journey) by organizing them into digital assets. On top of this, deployment capabilities allow you to exchange data between FintechOS environments via deployment packages (deprecated), configuration data packages, and digital solutions packages.

Reporting

Analytics allow you to examine aggregated data from the database by extracting, filtering, and finally displaying results in a graphical or tabular form. For instance, you can use analytics to create a report that lists all delinquent debtors, along with their outstanding payments and days past due.

Use data sources to generate reports, and reports to generate simple grid reports that offer a tabular view of the data, or custom reports that are used for statutory reporting to legal authorities. Advanced analytics bring data examination using business intelligence (BI), in order to process large amounts of unstructured data, discover insights, make predictions, and generate recommendations.

Integrated into FintechOS, Microsoft Power BI helps analyze data, determine metrics, and share insights across the organization.

Charts are visual presentations of data that help you convey information, and understand data in a visual way. Use charts when a tabular report won't adequately show relationships between data points.

Integration

FintechOS Ecosystem Hub offers access to a variety of connectors that you can use in your customer journeys. Use API connectors to connect to external APIs where you could for instance, use a credit reporting agency's API to automatically check the creditworthiness of an applicant.

FintechOS Service Pipes are the integration layer of the FintechOS Platform. They use Apache Camel as a routing and mediation engine to integrate the HPFI with external systems.

Web API client libraries allow you to work with external APIs using proxy methods native to the FintechOS development environment.

External APIs allow you to access third party resources that are available through RESTful web services.

Admin

The Admin section in FintechOS Studio is a set of administrative configurations that allow you to manage the FintechOS Platform.

-

Settings: you can customize the Digital Experience Portals login and home page

-

System Parameters and groups: system parameters are used to apply default settings or requirements that are treated as rules in your environment.

-

Application Languages: localization allows you to adapt a product to the language and culture of a target audience.

-

Localization Resources:FintechOS Studio includes ro-RO and en-EN localizations for the generic UI elements, such as fields (password, username, etc.), buttons (Save and reload, OK, Delete), and others.