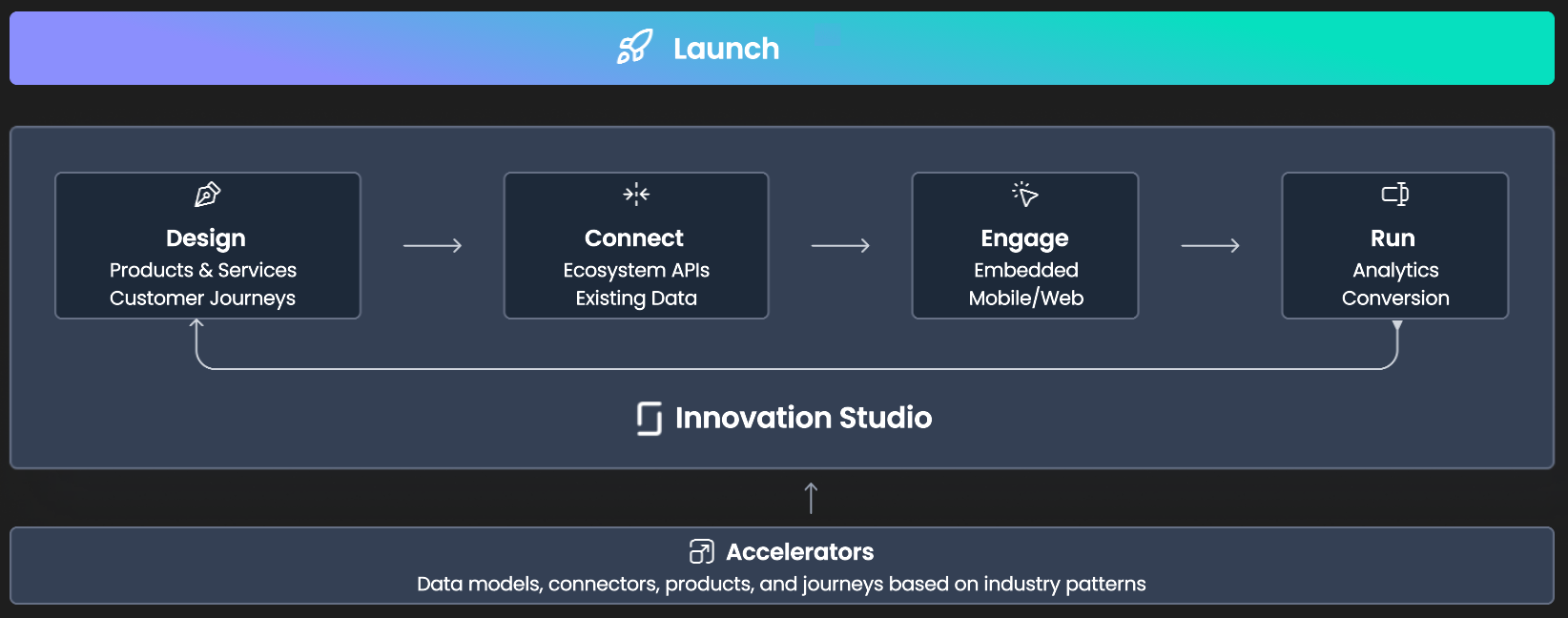

Launch

In a nutshell, the FintechOS platform enables you to create and launch financial products to your customers. You can define your financial products, be them loans, credit cards, insurance policies, create customized customer journeys, integrate accelerators and connectors, and use analytics to monitor the financial impact of your products.

Define Personalization

This is an important part of defining your financial products, determining who is the user personas you are targeting. With the FintechOS platform, you can create personalized content and business-tailored segments of audience (customer personas) to further create effective sales or administrative campaigns. Effectively this is done by defining:

- customer personas: define a specific customer profile, including by setting the demographic, location, age , needs, previous interaction with a business, etc. For example, a profile can represent customers with active contracts, which accepted marketing terms and conditions and which have more than five installments until the end of contract.

- audiences: define groups of people with specific interests, intents, demographics or education levels and can be reached based on who they are and how they have interacted with the business. The resulting list of individuals based on the defined conditions in the definition of customer personas and audiences will represent the target group of a campaign.

- personalized content: create effective and user-tailored ways of interacting with the customer. It can also be customized to better suit your needs if information should be extended to a desired communication channel.

- persona data model settings: leverage the customer persona data model to filter only the data (entities) you commonly use, leaving out all the structures that are meaningless for targeted business cases and audience segmentation needs.

- content types and personalized content types: create and manage customer engagement campaigns and interact with customers in a meaningful manner using personalized content templates. They allow you to remain on track by guiding you with useful fields, and minimizing the chance of mistakes by omission, and can also help the content team think strategically and holistically about the content they’re creating for each page.

Define Products

The Product Factory offers a new way of creating and defining financial products. It has a sleek and intuitive UI that enhances the user experience and provides, right at your fingertips, all the tools you need to define financial products.

Start from predefined templates and create Current Accounts, Unsecured Loans, Mortgages, Buy Now Pay Later loans, Individual Healthcare, Home, Pet, and Motor Insurance policies.

Go further and define formulas for commissions and fees, easy to set up underwriting rules, documents that can be defined with only a few clicks, and much more. Additionally, the Offers functionality enables building new commercial conditions over existing products, creating bundles of different products and services (financial or non-financial).

Define Customer Journeys

Journeys are definitely a core part of the FintechOS Platform, as you need to have a pleasant and efficient way to offer your financial products to customers.

- customer journeys: a set of steps and decision points which take the users throughout a process, carrying them from one step to another to achieve a goal such as an onboarding process, application for a home policy or a life insurance.

- form driven flows: a stream of steps that an user goes through to achieve a goal.

- custom flows: an ordered collection of components which address a singular need in the direction of componentization.

- digital frontends: define every interaction that your business has with your internal team as well as with the customers. Define dashboards, widgets, menu items, and portal profiles.

Digital Experience Portals

FintechOS Studio provides various ways for streamlining the experience of your business users by customizing the Digital Experience Portals in accordance to their needs. You can customize the login and home page, use a custom UI theme, use custom icons, visual branding, add digital journey sticky header, customize dashboards using widgets, and show tooltips (if allowed by the Portal customization).

Analytics

Analytics allow you to examine aggregated data from the database by extracting, filtering, and finally displaying results in a graphical or tabular form.

- journey analytics: a set of built-in indicators that offer insight on the performance and statistics of your digital journey.

- product analytics: key performance indicators that help with monitoring the banking or insurance products sales performance.