Overview

The SME Commercial Combined Quote and Buy accelerator helps brokers conveniently handle the quotation process and create policies for eligible SMEs. During the journey, a customer record, a quote, and a policy (with attached broker collection payment details) are created.

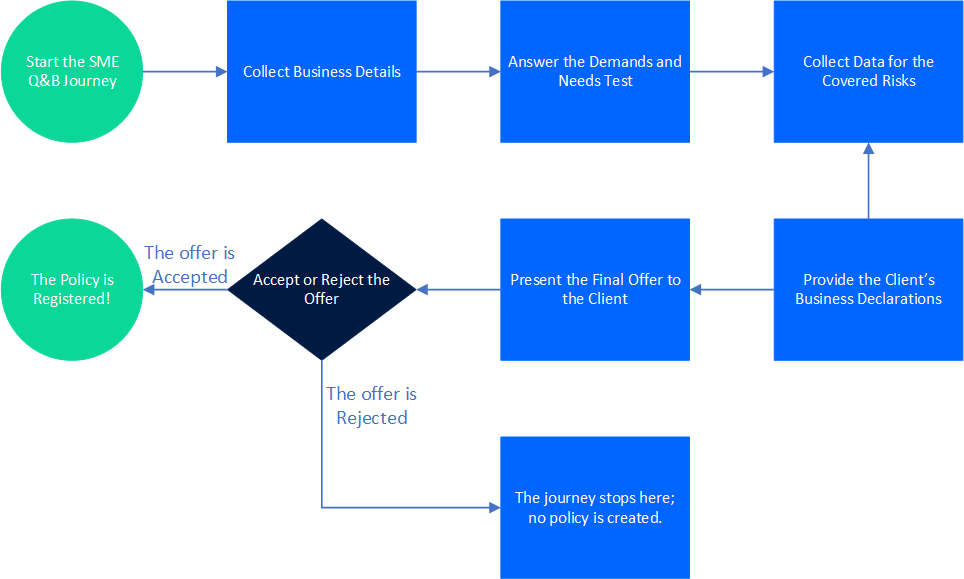

Insurers willing to leverage their broker networks can use the solution right away, as opposed to starting a broker distribution operation from scratch. Brokers willing to do more with less have a browser-optimised quote and buy journey at their disposal, which performs on top of automation processors that deal with rating, pricing, and generating proposals. SME customers seeking insurance for their enterprise, are offered the right insurance cover based on their Demands and Needs Test (DNT) at the right price. View the flow of the SME Commercial Combined Quote and Buy journey below:

The solution integrates with different components, as follows:

-

Insurance Product Factory - for product management.

-

Business Formulas - for rating and pricing calculations.

-

Proposal Configurator - for DNT processing and generating insurance proposals.

-

Core Policy Admin - for generating insurance policies.

-

Digital Documents Processor - for generating personalized documents.

-

Core Insurance Master - for managing the behavior of major flows.

The journey uses UK Nature of Business Standard Industrial Classification (SIC) codes, ensuring uniform classification of business activity. This selection further determines the proposal presented to a particular SME, the processing route of the quote (Accept/ Refer/ Decline) and the base rate for the automated rating and pricing calculations.

-

Automatic quote and buy journey;

-

Automatic rating for prospective SMEs;

-

Automatic premium pricing, for the qualifying customers;

-

Automatic creation of personalized insurance documents;

-

Registration and storage of personal and contact details.