Overview

In the age of digitization and personalization, customer needs come first. This is why, insurance companies alike aim to provide products that are highly correlated with the needs of their customers, by taking into account personal and financial characteristics.

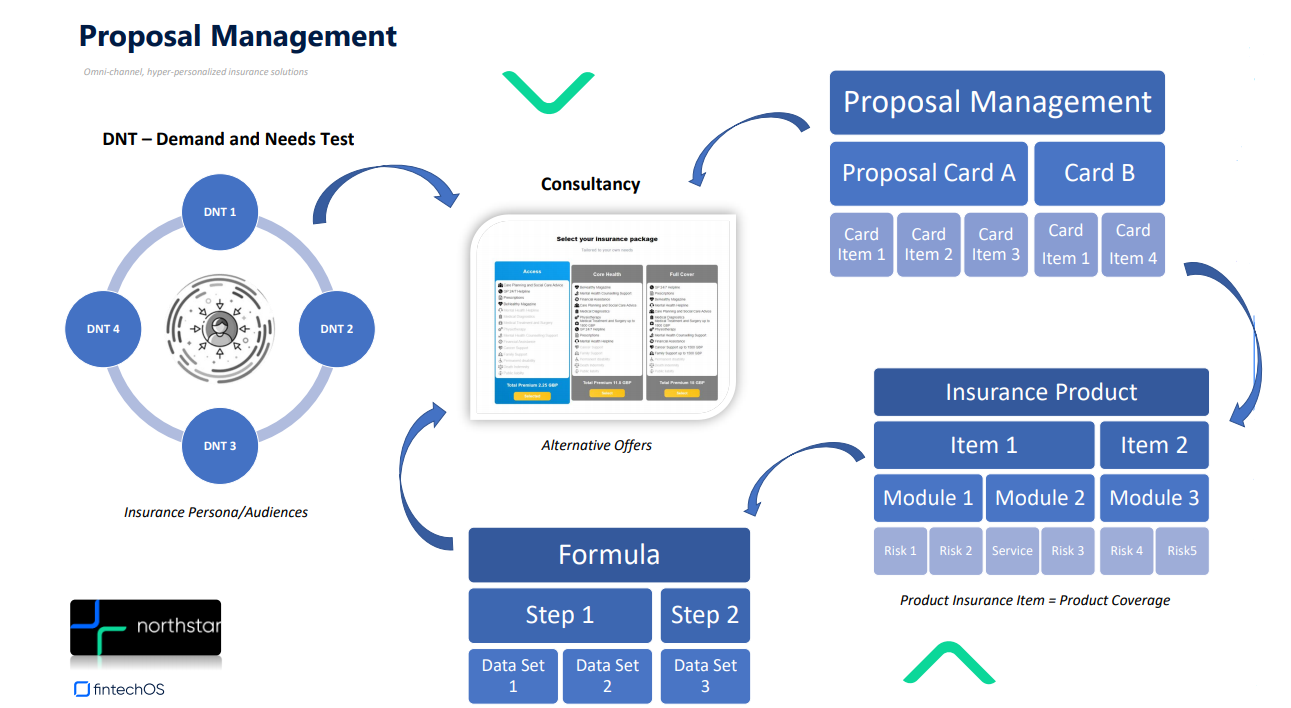

The key capability of Proposal Configurator is the ability to configure product offerings in logical bundles, covering core and optional benefits comparatively priced by level and benefit type.

The need to comply with Insurance Distribution Directive and Demands and Needs Test requirements, is leveraged by Proposal Configurator, to deliver customized insurance propositions to customers, with clarity around breadth of coverage and the cost associated with it.

Proposal Configurator offers the immediacy of response to identified and focused propositions, whether it’s to satisfy the needs of a valued distributor, employee benefits consultancy or direct to consumer offerings.

Utilize Proposal Configurator in conjunction with dynamic insurance customer journeys to:

-

Provide the ability to set up the Demands and Needs (DNT) questions and answers to be smart and configured to the audiences - Proposal Configurator offers the possibility to adopt digitalisation to generate aligned and suitable offers to meet customer needs;

-

Present benefits, options and costs in a clear way that is attuned and inclusive for customers, and is Insurance Distribution Directive (IDD) compliant;

-

Configure the proposal - Combine benefits to present multiple and comparable offer cards, assisting the customer to select the best product mix and benefit levels to fit their profile;

-

Ensure the service matches the person.

Proposal Configurator Benefits and Features

The following sections highlight benefits and features of the Proposal Configurator module.

Proposal Configurator enables the dynamic assembly of propositions to be presented to those seeking insurance coverage, whether general insurance or life protection, at levels that can readily be compared and considered from the point of view of relevance and affordability. These propositions are formulated and presented at key stages in a FintechOS insurance customer journey, and can be stored and retrieved as required. They contribute to the interactive and inclusive user experience that cannot be delivered via the first-generation portal technologies.

It is therefore at this level that an insurer, managing general agent (MGA) or other form of distributor is able to differentiate itself from their competitors whilst satisfying IDD requirements of working within a level playing field from a product perspective.

By completing the Demands and Needs Test (DNT), the customer provides personal and financial details that are pertinent to the lines of business they are inquiring into, including:

-

Personal details relating to all family members and dependents;

-

Financial details, including income, liabilities, outgoings, assets, etc;

-

Existing personal insurance and employee benefit levels - life, health and pensions.

The information gathered through DNT is used to formulate coverage options that are aligned to the individuals' stated needs. It offers the benefit of gathering information and presenting insurance coverage options in a way that is:

-

Accurate, personalised, suitable;

-

Accessible, fair, inclusive;

-

Affordable;

-

Compliant.

Proposal and Proposition Pain Points

The pain points center around the digital user experience, or rather the lack of it due to:

-

Digital de-personalisation, disempowerment;

-

Customer uniqueness, complexity;

-

Lack of customer expertise;

-

Regulatory uncertainty, risk and ethics;

-

Difficulty in obtaining guidance;

-

Provision of clear, comparable and priced propositions to the customer that have been formulated in a understandable way.

The Proposal Configurator module provides insurers and distributors with the means to differentiate themselves on the customer experience realm by being all inclusive, intuitive, and presenting options and solutions to personalize the user experience. The selected results are then used to generate an automated quote and apply journey for the products finally selected by the customer.

This Proposal Configurator solution allows system operators to organize data for the Quote&Bind process and insurance products.