Policy Administration 24

November 29th, 2023

This release of FintechOS Policy Administration comes with a new Change Engine that enables easier and, in some cases, full self-service configuration for mid-term adjustments (MTAs), along with other new features such as master policy reinstatement, self-service configurations for policy parties and payment schedules, and multiple MTAs registration card payments.

Policy Administration v24 is fully compatible with FintechOS Platform v24.

This is part of the FintechOS 24 release. Please check the main release notes for more information.

New Features

Change Engine

With the introduction of the Change Engine functionality, you can now handle more configurable policy alterations, resulting in improved performance and reduced implementation time. The mid-term adjustment (MTA) process now features a new workflow and an optimized viewing experience.

With Change Engine, you can configure the alteration types that you want to make for a contract and choose which type of contract these can be applied to. Learn how by accessing the Configure Alteration Types page.

The MTA form presents a refreshed user interface. You can easily choose what alteration you want to make and view the history and summary of all alterations made on the policy. Learn how to make alterations in the new interface by accessing the Perform Policy Mid Term Adjustments page.

Master Policy Reinstatement

The master policy reinstatement functionality facilitates the master policy transition from Suspended back to InForce, after all unpaid installments have been paid for the associated policies. The master policy can also transition from Suspended to Canceled/ Declined if the Suspension Period expires, and the installments remain unpaid. You can configure the time for policies or master policies to stay suspended before being canceled. Read more by accessing the Configure the Policy Suspension Duration page.

The master policy reinstatement can be done either manually or automatically. The latter happens when a payment is allocated on an installment that is due, where the Payment Date is less than the Due Date of the previously unpaid installment. Read more by accessing the Reinstate a Master Policy page.

Improvements

Single Policy Automated Renewal Offers

The policy renewal process is now linked with Quote Admin to generate new quote offers for the customers.

You can now generate policies with the Start Date equal to the current date.

The Draft and Registered MTAs are automatically closed when suspending policies or master policies.

The premium resulting from an MTA is now calculated based on the policy validity (e.g. less than 1 year) and considering also the prorate that applies to that contract (i.e. 1/365 or 1/12).

Register Multiple Mid Term Adjustments

You can now register multiple types of alterations within a single policy or master policy. This allows you to expand multiple selections at the same time, complete and validate them in your preferred order. Their future effective dates just need to be in a chronological sequence. Learn more by accessing the Perform Policy Mid Term Adjustments and the Perform Master Policy Mid Term Adjustments pages.

Card Payments Relevant Data

The card data used to pay the premium is now captured and stored. Also, the card details from the expiring policy are now transferred towards the renewal one in order to further support the continuous card payment logic from one contract to another. Card data can be updated using dedicated APIs.

Card payments integrations with specific providers can be orchestrated through the dedicated Billing and Collection’s Card Payment (Payment Hub) solution.

Policy Parties

Starting with this release, every policy form includes the Policy Parties section that provides a comprehensive list of all the parties along with their respective roles within the policy, as they were configured within the product. Once the configuration is done in a self-service way, the policy generation APIs consider the configurations without any need for development effort. Consult the Policies page to view the new section.

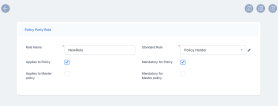

You can also define and configure new roles involved in a policy in the FintechOS Portal. Discover the process of setting up policy parties by accessing the Configure Policy Parties page.

Configure Payment Schedule Types

In FintechOS Portal you can add and configure payment schedule types, to define and set details pertaining to the way the payment schedule works for the product, like when the first installment and subsequent installments default due dates, digits rounding rules, and more. Once payment types are configured, they can be selected to apply to one or more products within the product definition.

APIs

The following new APIs are introduced with the new Policy Administration:

-

FTOS_INSP_RegisterCancellation: This API is used to register a cancellation.

-

FTOS_INSP_UndoCancellation: This API is used to undo a cancellation.

-

getPoliciesByClient: This API is used to gather the client policies' data.

-

MasterPolicyStatusChange: This API is used to transition the master policy to the Issued and InForce statuses.

-

getCardDetails: This API is used to provide details about what (payment) cards are saved against a contract.

-

addUpdateCardDetails: This API is used to receive instructions for inserting a new (payment) card data against the contract or updating the data for an existing one.

The following improvements are introduced:

-

The Policy Generation API is updated to work with the payment schedule type selected on product level.

-

The existing APIs are updated to include the string DNT responses.