Reinstate a Master Policy

The Masterpolicy reinstatement is the process of restoring an insurance Masterpolicy back in effect after it has been previously terminated due to various reasons, most often scenario being that the insured has missed the premium payments. The reinstatement is usually done at the request of the Insured and can be accepted in most cases conditionally by the Insurer.

When a Masterpolicy has at least one policy with unpaid installments and its grace period expired, both said policy and the Masterpolicy transitions either to the Suspended or to the Lapsed status, according to the configuration at product level. Its linked policies inherit the Grace Period and Suspension Duration set at Masterpolicy level.

When a master policy becomes Suspended, any MTAs that are in Draft or Registered status are automatically closed, and become Cancelled.

If during the Suspended period a master policy reinstatement process becomes Approved, then the master policy transitions from the Suspended status back into In Force.

There are two ways to start the master policy reinstatement process. The first one is to go to the suspended policy, and click Reinstate.

The second way is to go to the policy and master policy search page of the Reinstatement requests grid. Follow the steps below to reinstate a suspended master policy:

-

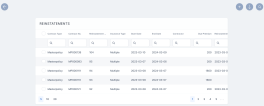

In the main menu, go to Policy Admin > Reinstatements. A grid is displayed, listing the reinstatement request issued within the system, with their statuses.

-

Click Insert to open the master policy search form.

-

For the Search Type field, select Masterpolicy. Fill in the fields with details of the master policy, and click Search.

-

Once the master policy is found, click the record, and the Policy results grid is unfolded. This displays the records of the policies belonging to said master policy, that are in Suspended status.

-

Click Choose Option, on the master policy record to start the reinstatement process.

-

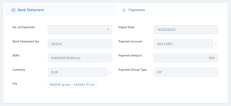

On the Request Details page, view the policy details, payment schedule, and information about the due premium, the start date and end date of the suspension. In the Payment Schedule grid, the Payment Delay is calculated as Last Payment Date - Due Date - 1.

-

Click Register. The Request Type and Reinstatement Request Date fields are now available to edit. You can only move forward and propose the reinstatement request after you have paid the unpaid installment. While the installment is unpaid, the Propose Request button remains inactive.

-

Allocate the payment to the installment.

-

Go back to the reinstatement request record, and refresh the page. The installment is now in Paid status.

-

The Request Type and the Reinstatement Request Date fields are automatically filled.

-

Click Propose Request. The Request Approval tab is now available. In order to move forward, you need to approve the reinstatement request.

-

In the Request Approval tab, you have the following options:

-

Click Approve, and the current status of the reinstatement request is changed to Approved. The master policy and its policy are reinstated to the In Force status. In the Cover Suspension section of the policy, you can view the time in which it was suspended.

The Suspension End Date, in this case, is the date when the Reinstatement is approved. The Duration is measured in days.

-

Click Decline, and the current status of the reinstatement request is changed to Declined. The master policy remains in the Suspended status, as well as the policy belonging to it.

-

Click Send Back, and you will be redirected to the Request Details page, where you can edit any mistakes you might have in the reinstatement request, and send it back to approval.

-

If you have wrongly allocated a payment to a master policy for reinstatement, you can deallocate the premium, and assign it to another contract. When you deallocate the payment, the installment's Paid status is changed, and the reinstatement for the master policy and its linked policies are invalidated. Full Payment Dates for the installment details become null and Payment Delays are updated to reflect the Due Date of the installment.

If the payment is deallocated from a previous Paid installment related to an reinstatment that is in Draft or InProgress status, the payment date, payment delays and suspension period details are reset from the Reinstatement. The Reinstatement remains in the Draft or InProgress status, without being invalidated.

If you deallocate a payment when the reinstatement is in Paid in Grace Period, Pending Approval, or Approved status, after the deallocation, the trinstatement status becomes Invalid.

Learn how to deallocate a payment by accessing the Manage Incoming Payments page.

If a payment is allocated on an installment that is due, where the Payment Date is less than the Due Date of the previously unpaid installment, then the master policy is transitioned back into InForce without the need of a manual reinstatement.

If more than one installment are due during the Suspended period, the automatic transition into Inforce is made if only the Payment Dates are less than the unpaid installments Due Dates.

The Effective Date of this automatic transition is equal to the Payment Date. In the case where more payments are allocated, the Effective Date is equal to the most recent Payment Date.

In the case of an automatic reinstatement, this is automatically Approved. In the case there is a reinstatement inserted that is not approved as a consequence of this flow, said reinstatement is also automatically Approved.

For this case, Paid on time but unallocated is the default request type, the installment status is Paid and the reinstatement is in PaidInGracePeriod status.