Core Banking 3.0

October 22nd, 2021

This major release of FintechOS Core Banking aims to enhance the contract processing capabilities of the system. It comes with improvements regarding loan classification, mass penalty interest, purge Draft records capabilities, and some post-early repayment event processing changes targeted to automate the updates needed at the contract level. Our team also spent a great amount of time updating the Core Banking APIs so that you may benefit from more diverse returned information. In case you missed it, check out the improvements announced with our September release: Core Banking now has revolving limits, limits for individual customers, penalty interest calculation including grace period, payment schedule for any number of days, and future & past due installments reports which are also accessible through API calls.

Starting with this release, Core Banking comes with the Portal Profile that enables you to display only the Core Banking and Operational Ledger menus. Read more information about how to set this up after installation.

This is part of the FintechOS 22 release. Please check the main release notes for more information.

Improvements

Skip Contracts from Accrual Calculation Based on Loan Classification

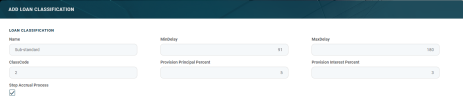

You can now stop the accrual process for contracts that fall under a specific classification. Select the Stop Accrual Process checkbox next to a record on the Loan Classifications List page to exclude all contracts that fall within that category from the accrual calculation processes. The contracts falling under all the subsequent categories are automatically marked with Stop Accrual and excepted from the accrual and penalty calculation processes. A new contract repayment schedule version is created with Process of Loss reason, where all un-notified installments are updated, following the Core Banking End Of Day job's Schedule versioning after stop accrual service. Read more about the new checkbox available at the loan classification records level within the Core Banking user guide's dedicated page.

To comply with the risk method calculation at the contract level, the DPD (days past due) value is now calculated as the number of days between the contract's oldest due date on a pending notification and the current system date of Core Banking.

Mass Penalty Interest

With the introduction of the Is General checkbox at the interest level for a banking product, you can define a penalty interest applied to all the loan contract's operation items that are overdue for payment, instead of having to define different penalty interests for each operation item that is subject to penalty interest calculation on a contract. This can be useful when you need to define one single penalty interest to be applied to all the overdue amounts subject to penalty interest calculation resulting from repayment schedule processing. As a side note, you can specify which operation items should be used by Core Banking for penalty interest calculation within the Add/ Edit Operation Item pages, selecting the Include In Penalty Calculation checkbox and then selecting an item from the Penalty Item list. Read more about operation items in the Core Banking user guide.

Contract Due Day at the End Of the Month

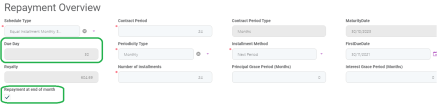

Starting now, you can set a contract's due day on the last day of the calendar month. Selecting the Repayment at the end of the month checkbox at the contract level, the repayment schedule is calculated with an installment on the last day of the month, and it will move on the 28th, 29th, 30th, or 31st, depending on the month.

Processing Contracts Following an Early Repayment Event

For a seamless experience, Core Banking automatically closes the contracts where early repayment events cover the entire outstanding amount, resulting in zero amounts on the contracts. Also following an early repayment event, for contracts based on banking products with the Is Revolving field set to False, when the installments number recalculated after such an event is lower than the previous installments number, the maturity date and the contract period are updated along with the number of installments.

Enhanced Core Banking API Experience

We've updated a series of Core Banking endpoints, such as FTOS_CB_GetContractData, FTOS_CB_AddUpdateEarlyRepayment, FTOS_BP_GetDataSourcePastDueInstallmentsReport, FTOS_BP_GetDataSourceFutureInstallmentsReport, FTOS_CB_AddUpdateContract and FTOS_CB_ApproveContract, to return more significant information about a contract.

Purge Records in Draft Status

Starting with this release you can opt to automatically purge records that stayed in Draft status for too long. How long and which records? This is up to your business needs. Core Banking offers you the DaysBeforePurge system parameter to set the default value of calendar days that a record will be kept in Draft status before it is purged. You can purge loan contract records and also transaction records, for these the number of days being specified at the transaction type level. The records that are due to be purged on the current day and have their transaction type's To Be Purged field marked as True are displayed in the Records To Be Purged Dashboard, within the section specific to the record's transaction type. The job performing the deletion is Delete Purged Entries and it should be scheduled at the bank's level.

_thumb_0_106.png)