Personal Unsecured Loan

An unsecured loan is a loan that doesn't require any type of collateral![]() An asset or property that the borrower pledges to the lender as security for the repayment of a loan, giving the lender the right to take ownership of the pledged asset in the event of default.. Instead of relying on the borrower's assets as security, lenders approve unsecured loans based on the borrower's creditworthiness. Examples of unsecured loans include personal loans or student loans.

An asset or property that the borrower pledges to the lender as security for the repayment of a loan, giving the lender the right to take ownership of the pledged asset in the event of default.. Instead of relying on the borrower's assets as security, lenders approve unsecured loans based on the borrower's creditworthiness. Examples of unsecured loans include personal loans or student loans.

In the title field, enter a name for the product. Optionally, you can click the ellipsis button (...) to also provide a description and/or an availability period. Below, fill in the following product configurations.

Main Info

This section determines the amount, term, disbursement, codebtors![]() Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt., refinancing

Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt., refinancing![]() Taking out a new loan to replace an existing loan, usually to obtain more favorable loan terms, such as a lower interest rate, extended repayment period, or different monthly payment amounts., and restructuring

Taking out a new loan to replace an existing loan, usually to obtain more favorable loan terms, such as a lower interest rate, extended repayment period, or different monthly payment amounts., and restructuring![]() Modifying the original terms and conditions of the loan to provide a more affordable repayment plan, typically when a borrower is facing financial difficulties or is struggling to meet their loan obligations.

Can provide relief in the form of lower interest rates, extended repayment periods, deferred payments, changes in payment frequency, debt consolidation, waiving of penalties or fees, partial write-offs, etc. characteristics of the loan.

Modifying the original terms and conditions of the loan to provide a more affordable repayment plan, typically when a borrower is facing financial difficulties or is struggling to meet their loan obligations.

Can provide relief in the form of lower interest rates, extended repayment periods, deferred payments, changes in payment frequency, debt consolidation, waiving of penalties or fees, partial write-offs, etc. characteristics of the loan.

| Parameter | Description |

|---|---|

| Loan amount and loan term |

E.g.: Loan amount from 1,000 to 10,000 Euro with a term of 1 to 5 years. |

| Disbursement |

|

| Codebtors |

E.g.: Allows up to 2 codebtors. |

| Refinancing |

|

| Restructuring |

|

Interest

The interest sets up the amount of money (which is distinct from the principal repayments) that the borrower pays as a cost for borrowing money when repaying the loan. You can set up both regular and penalty interests![]() Additional interest charged when a borrower fails to make timely payments on a loan (misses a payment deadline or makes a payment that is less than the agreed-upon amount)., with interest rates

Additional interest charged when a borrower fails to make timely payments on a loan (misses a payment deadline or makes a payment that is less than the agreed-upon amount)., with interest rates![]() The interest rate is the amount a lender charges a borrower and is a percentage of the principal (i.e., the amount loaned). that are fixed, variable or based on a formula.

The interest rate is the amount a lender charges a borrower and is a percentage of the principal (i.e., the amount loaned). that are fixed, variable or based on a formula.

| Parameter | Description |

|---|---|

| Interest |

Click + Add interest to set up an interest for the loan based on the desired interest rate(s).

E.g.: Interest is fixed at 5% for the first 6 installments and then variable indexed to EURIBOR 3M with a margin of 1% until end. NOTE

If you define multiple interests, the user will have the option to select one of them during the application. |

| Penalty |

Click + Add penalty to set up a penalty interest for the loan.

E.g.: Penalty is 1.5% from Loan Interest. NOTE

If you define multiple penalty interests, all will be applied. For instance, if you set up a 1.5% penalty from interest and a 1% penalty from principal, the borrower will pay both when missing a payment. |

Fees

- Click +Add fee.

- Select a predefined type of fee from the list, or click Create new to define a new fee type (you can also rename an existing fee by clicking the fee name). The type of fee determines parameters such as the the conditions under which the fee is applied, how often the fee is charged, whether the fee is refundable or not, etc. For more information, see Fee Types.

- Enter the amount of the fee:

- value - a fixed value in the specified currency.

- percentage - a specified percentage of either the remaining value, financed value, payed value, unused amount, used amount, overdraft limit amount, or amount.

- based on formula - Allows you to set fees based on Product Formulas.

You can set up multiple fees that will be charged independently, based on their Fee Types. E.g.:

- Front-end fee is 25 $.

- Repayment fee is 4% over remaining value.

This will always charge the borrower a $25 fee on loan application. If, during the loan, the borrower decides to repay the loan in advance, a 4% fee is charged over the loan's remaining value.

Insurances

Insurances are required for borrowers that meet certain risk criteria, in order to cover the potential losses if they default on the loan.

To set up an insurance for your product:

- Click +Add insurance.

- Select the amount to insure:

- value - A fixed amount in the specified currency.

- percentage - A specified percentage of either the remaining value, financed value, payed value, unused amount, used amount, overdraft limit amount, or amount.

- Select when the insurance should be issued based on the value of a specified Lexicon Term.

You can set up multiple insurances that will be issued independently, depending on whether they meet the issuance condition. E.g.:

- Insurance of 2,500 Euro when loan purpose is Auto Purchase, Home Refinance.

- Insurance of 50% over financed value when In BlackList is In BlackList.

This will issue a fixed value insurance for 2,500 Euro if the Loan Purpose, which is a value list lexicon term, is either an auto purchase or a home refinance.

If the applicant is marked as In BlackList, which is a boolean lexicon term, an insurance of 50% over the financed value must be issued.

Remember to go to the Provided Documents section and add a document template to be signed by the customer for each insurance you've configured.

Repayment

The Repayment section determines the periodicity and repayment schedule for the loan's installments![]() Regular payment that a borrower is required to make to the lender to repay a loan over time., and how the repayments are impacted by holiday shifts

Regular payment that a borrower is required to make to the lender to repay a loan over time., and how the repayments are impacted by holiday shifts![]() Adjustment of installment due dates that coincide with public holidays by moving the due date to the last working day prior or first working day after the holiday. and grace periods

Adjustment of installment due dates that coincide with public holidays by moving the due date to the last working day prior or first working day after the holiday. and grace periods![]() A specified period of time during which a borrower is not required to make regular loan payments without incurring late fees or penalties. Typically granted immediately after the loan disbursement or before the start of the regular repayment schedule..

A specified period of time during which a borrower is not required to make regular loan payments without incurring late fees or penalties. Typically granted immediately after the loan disbursement or before the start of the regular repayment schedule..

| Parameter | Description |

|---|---|

| Repayment |

Sets up the periodicity and schedule type of the repayment.

E.g.: Repayment is performed on monthly in equal installments with schedule Equal Installment Monthly 365_TLU. NOTE

You can add multiple repayment schedules that the applicant can choose from by clicking +Add repayment repeatedly. |

| Holiday Shift |

Determines what happens if an installment's due date overlaps a public holiday.

|

| Grace Period |

Determines what expenses are exempted during the grace period and how long the grace period is.

E.g.: Grace period interest 2 installments. |

Discounts

In the Discounts section, you can define discounts on any of the already configured interest items, commission items, or on all pricing elements.

There are three ways to create discounts:

- Follow the sentence-based interface to configure a condition based on a dictionary attribute (e.g., Age >18), for which you define a discount. Note that you can also create new attributes, extending your dictionary (+Add discount > Create New).

- Add a Dataset based on one, two, or more attributes for a pricing item. You can add more data sets, one for each pricing item. For more details on how to create Data Sets, see Product Data Sets.

- Add a formula to define discounts with more advanced conditions based on mathematical expressions, data sets, and other inputs. You can add more formulas, one for each pricing item. For more details on how to create formulas in Product Designer, see Product Formulas.

A discount does NOT override the previous value of a pricing item, but is applied to it, decreasing the pricing item's final value. For example:

- A discount of 10% applied to an existing 10€ commission results in a new value of 9€ for the commission;

- A discount of 2€ applied to an existing 10€ commission results in a new value of 8€ for the commission.

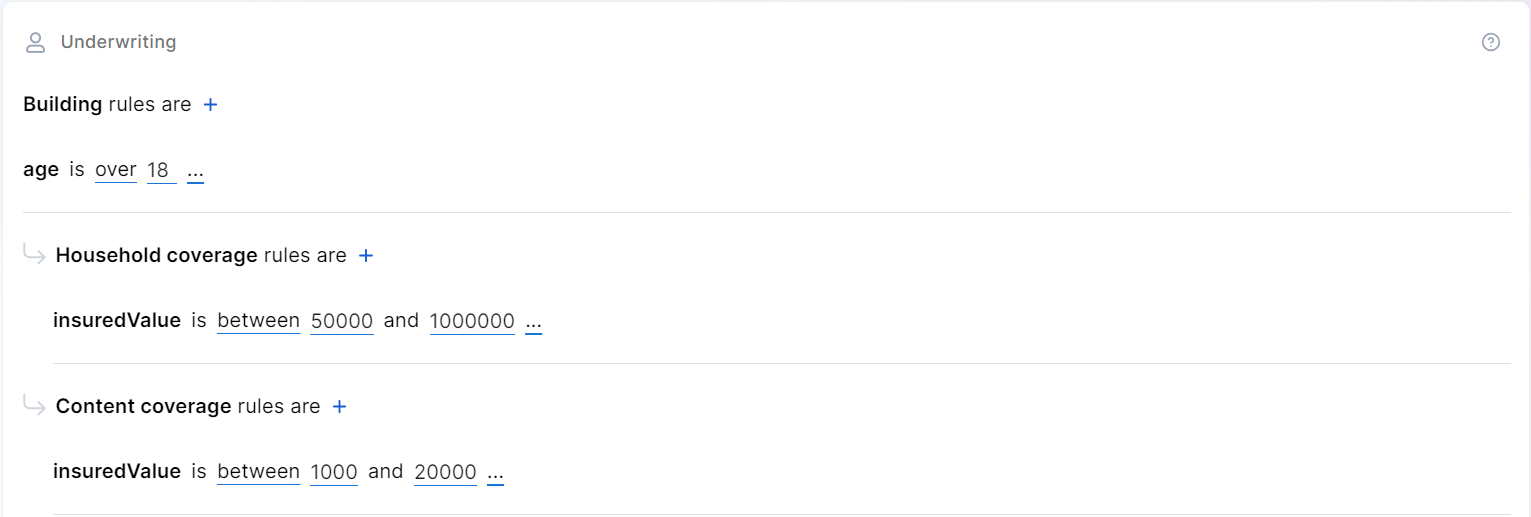

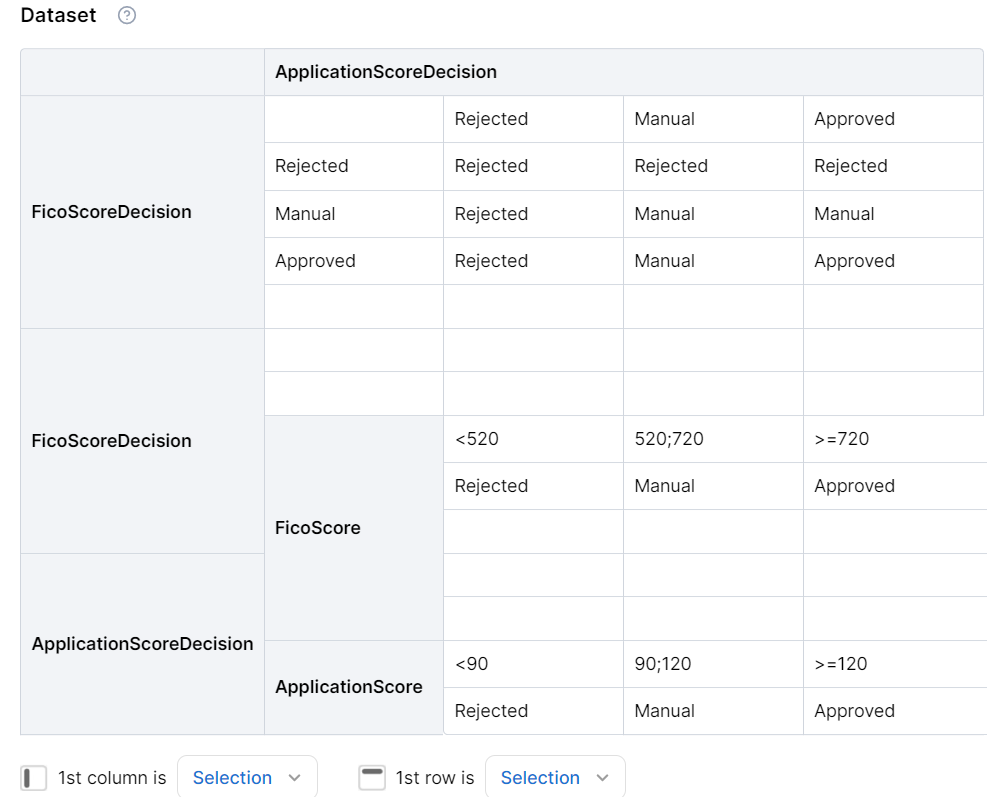

Underwriting

The underwriting rules determine an applicant's eligibility for the product and whether or not a manual approval process is required (available only for underwriting rules based on Product Data Sets).

There are three ways to add Underwriting rules:

- Add Rule - Follow the sentence-based interface to configure a condition based on a Lexicon Term (e.g. Property Condition is Good or Excellent).HINT

In the attributes' pop-up window, you can click +New Attribute to quickly add a new lexicon term or Product Settings to edit the current lexicon term. - Add Formula - Use Product Formulas that return a boolean result ("True" for approval and "False" for rejection);

- Add Data Set - Use Product Data Sets for the evaluation. This is mandatory if the rule can return an outcome where the application must go through a manual approval process. The data set can return only the Approved, Derrogation, or Rejected results (or an equivalent terminology defined in the Underwriting Data Set Values, e.g. Passed, Manual Analysis, or Not Passed).

For each rule, you can select the used in eligibility option to mark it as a knock-out rule, which automatically disqualifies the applicant if its condition is not met. Otherwise, the rule is submitted to the final approval review.

For the manual approval result, you need to configure the journey to direct the application to a back-office manual approval process. If you are using Multi-Dimensional Data Sets based on cascading data sets, the manual approval outcome must be defined in the top-level data set.

Documents

Specify the document types required from the applicants (and/or others involved in the origination process, e.g. codebtors![]() Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt.), as well as the document types provided to the applicants.

Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt.), as well as the document types provided to the applicants.

| Parameter | Description |

|---|---|

| Required Documents |

Documents that the applicant must provide in order to verify identity, income, product eligibility, etc. To add a required document:

E.g.: Income statement mandatory for debtor and mandatory for co-debtor. |

| Provided Documents |

Documents that must be provided to the applicant typically in order to obtain an agreement and/or signature. To add a provided document:

E.g.: Terms and conditions is static requires accord and requires signature. |

Service

The Service section is used to define the configuration structure and characteristics of your banking product. The following options are available:

- Commission on unused amount: The number of months after which the system starts calculating commissions for any unused amount.

- Disbursement allowed: The number of months for disbursing funds to the borrower.

- Minimum principal for early repayment: Minimal principal allowed for early repayment.

Once you’ve configured all the fields, change the status from Draft to Approved to save your Personal Unsecured Loan product. For details on versions, see Product Approval and Versioning.

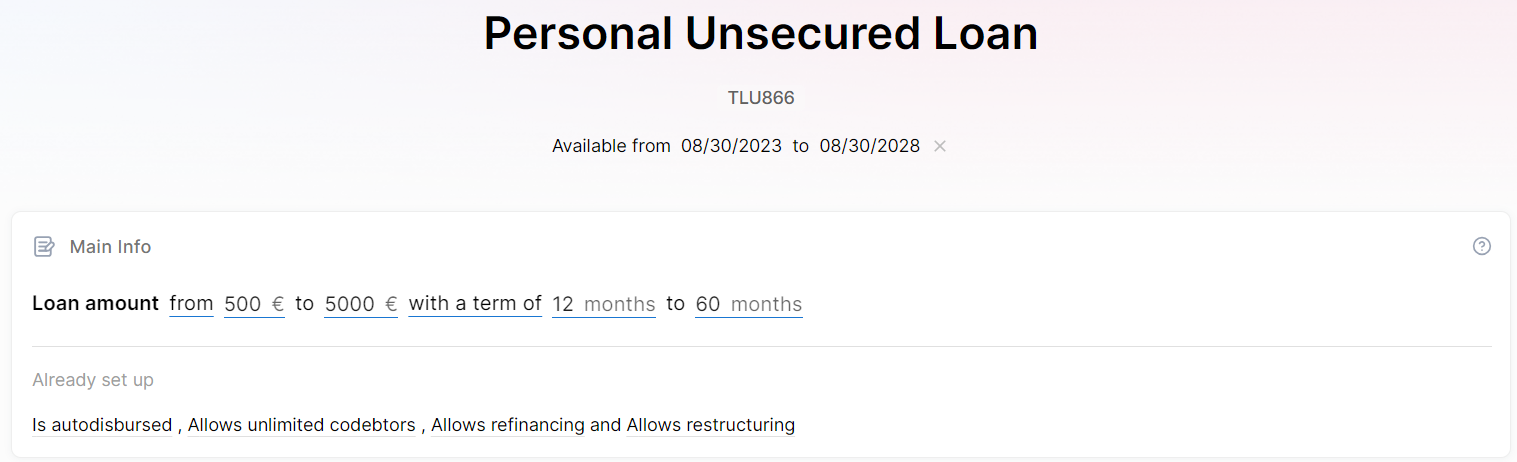

Below you can check a real-life example of how an Unsecured Personal Loan product is built in Product Designer.

1. For our use case, in the Main Info section, we've set the loan amount for 500 to 5,000 EUR, with a duration of 12 to 60 months. Also, auto-disbursement, unlimited co-debtors, refinancing, and restructuring are allowed. The product is available from 08/30/2023 to 08/30/2028.

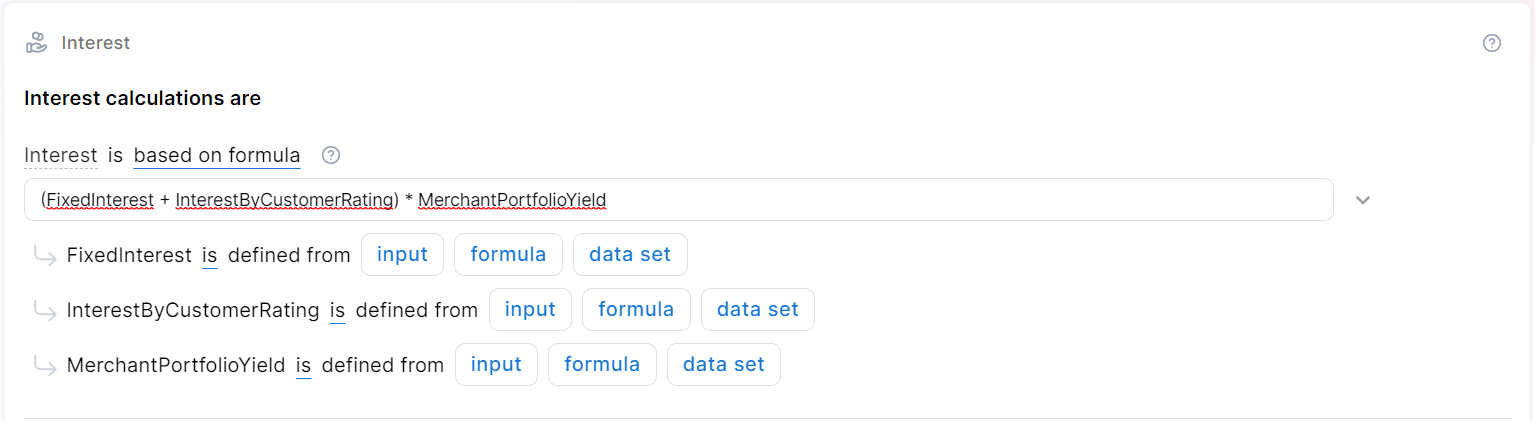

2. The Interest rate is based on a formula. Say the interest rate should be calculated using a fixed interest and increasing it by the customer's rating, while also considering the historical yield your financial institution had with a certain type of broker or merchant who sold the product to customers:

Interest = (FixedInterest + InterestByCustomerRating) * MerchantPortfolioYield

3. We've set two Commissions for the loan: a Repayment Fee of 5% over the Remaining Value, and a Front-End Fee of 10 EUR.

4. The Insurance section, a Monthly Insurance is configured for 5 EUR if the loan amount exceeds 2,500 EUR.

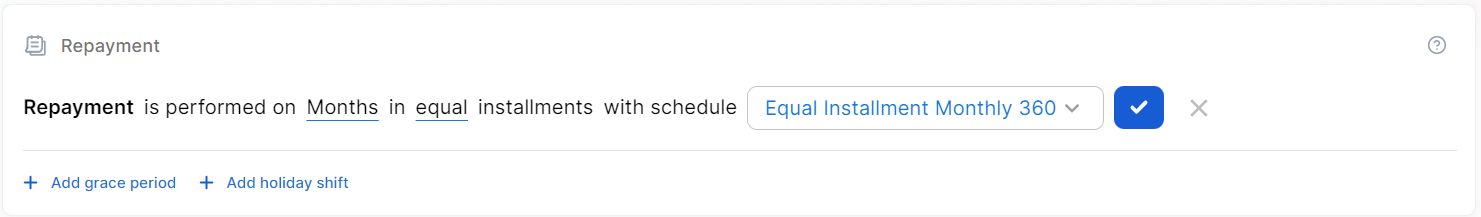

5. The Repayment fee is set for equal installments, with a monthly 360 schedule.

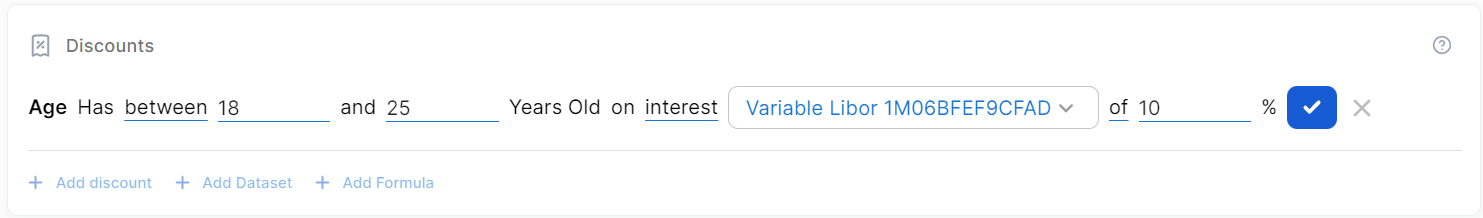

6. In the Discounts section, we've set a 10% discount for Interest, if the applicant's age is between 18 and 25 years old.

7. The Underwriting section is configured as follows:

- Rule 1: Age higher than 18 years old

- Rule 2: Is not BlackListed

- Rule 3: Not in litigation

- Rule 4: CompanyState has following values bankruptcy, liquidation, active

- Formula: CurrentDTI < MaxDTI, where CurrentDTI = (ExistingInstallmentsAmount + LoanInstallmentAmount) / Income

- Dataset: FicoScore vs. Score

ApplicationScore = AgeScore+MaritalStatusScore+EmploymentStatusScore+TimeWithCurrentEmployerScore+HighestDPDScore+NoActiveLoans12MonthsScore