Product Formulas

Not to be confused with Business Formulas, Product Designer Formulas help you process different inputs from your journeys (such as income, age, assets, risk class, etc.) to generate desired outputs (such as credit scores, interests, discounts, etc.). You can create the formulas you need, or you can select existing ones.

When writing a formula in Product Designer, start by entering the desired expression and then configure each attribute from the formula, defining what it is (input, dataset, or even another formula).

When you’re adding a formula or a data set, the editor assists you in defining each attribute you've entered. An extensive dictionary holds predefined attributes, which can be:

- Product-type specific attributes - e.g., Term, Amount, InstallmentAmount for loan products;

- Business data model attributes - e.g., customer name, customer address, customer age, customer income, customer job duration;

- User-defined attributes - you can easily extend the dictionary with your attributes, as needed (e.g., CustomerEnjoysTravels, with Yes or No values).

If you’re using an attribute that already belongs to the dictionary within your formulas or data sets, the attribute is automatically detected. If the attribute is not found, it will be saved to the dictionary according to your definition, so you can reuse it. Thus, you can customize and extend the product data to fit your business.

Follow these formatting rules for formulas:

1. Attribute names cannot have spaces;

2. Use simple mathematical operations (+, -, *, /, <, <=, >, >=).

Formula attributes can be defined as:

Input: The value of the attribute must be entered when applying the formula. Attributes defined as input will be addressed in any journey that uses this product so that the value is set during run-time. The input value will be set through the journey as user input, from a service integration, or from a data query.

Data set: The value is extracted from a data set. For more details, see Product Data Sets.

Based on formula: The value is calculated using another mathematical formula.

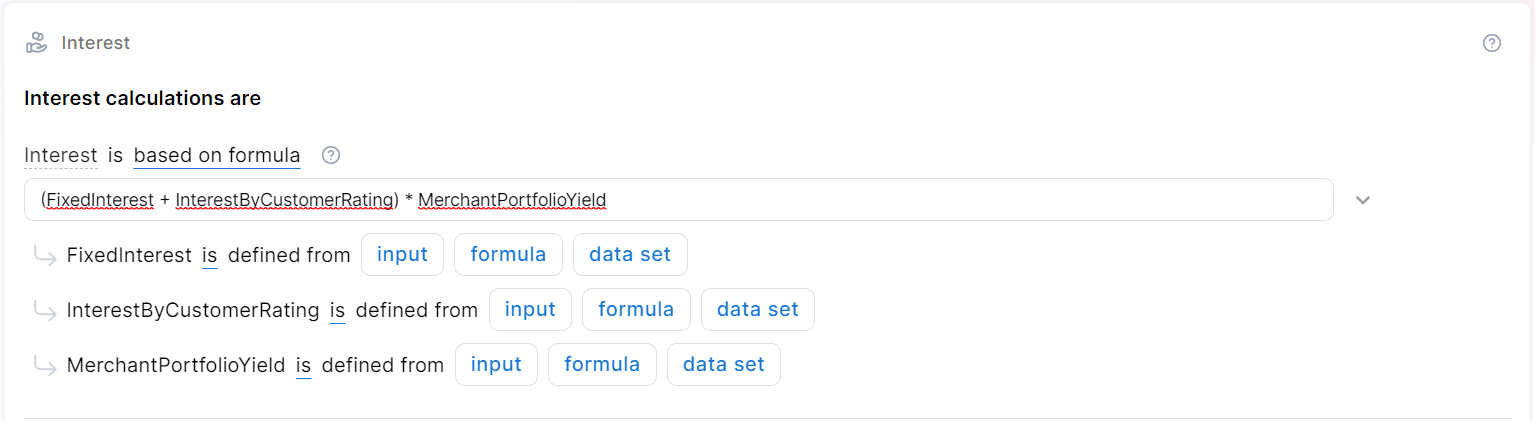

Interest = (FixedInterest + InterestByCustomerRating) * MerchantPortfolioYield

All three formula arguments are defined as data set types.

The customer's rating adds to a fixed interest rate to determine your product’s interest rate. It also considers the historical yield your financial institution had with a certain type of merchant who sold the product to customers.

Sample data for the FixedInterest, InterestByCustomerRating, and MerchantPortfolioYield data sets are provided below:

FixedInterest data set:

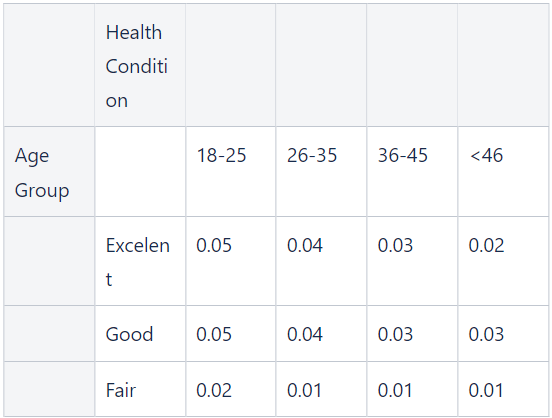

InterestByCustomerRating data set:

MerchantPortfolioYield data set:

Assume your customer has a B2 credit rating and needs a $10,000 loan for three years (36 months). Considering that the merchant type is gold, the system will calculate the interest by extracting values from the data sets and entering them into the formula using these variables. This is the result: (6 * 3.5) * 1 = 21

Credit Amount * (1 - (Income Level Factor * Loan-to-Value))

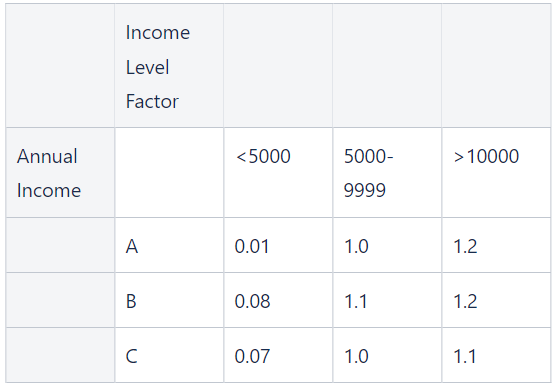

You calculate the discount based on two factors:

Income Level Factor: This factor represents the borrower's income level since you want a higher income level factor to indicate a stronger income profile.

Loan-to-Value Ratio Factor: This factor represents the loan amount's ratio to the collateral's appraised value. A lower loan-to-value ratio factor indicates a lower risk for the lender.

Sample data for the Income Level Factor data set is provided below:

Assume a B income level factor customer with a $7,000 annual income applies for a mortgage to buy a $300,000 home. They have saved $60,000 for a down payment and require a $240,000 loan.

First, the Loan-to-Value Ratio Factor would be calculated as follows:

Loan-to-Value Ratio Factor = Credit Amount / Property Value

Loan-to-Value Ratio Factor = $240,000 / $300,000

Loan-to-Value Ratio Factor = 0.8

Then, you must extract the value for your customer from the data set and replace the arguments in your formula. This is the result:

240000 * (1- (1.2 * 0.8) = 9600

The final amount the customer needs to pay is the initial amount, minus the calculated discount. In this example, if the loan amount was $300,000 and the discount was $9,600, the customer would need to repay $290,400.

You want to calculate the premium for a property insurance policy. The premium amount is determined based on the Building sum insured, Building flexa coefficient, Building NatCat coefficient, and Payment frequency coefficient. These coefficients are obtained from data sets that account for various factors, such as property characteristics, location, and payment preferences.

Let's walk through an example to demonstrate how the next formula works:

InsuredAmount * 0,00048 * Building Flexa coefficient * Building Natcat coefficient * Payment Frequency Coefficient

Sample data for the needed data sets is provided below:

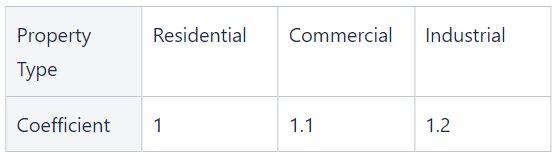

Building Flexa coefficient data set:

Building NatCat coefficient data set:

Payment frequency data set:

We are insuring a building situated in an industrial area and the premium will be paid in one installment (annual). Assume these details for the specific insurance policy; the coefficients will have the values below:

Building sum insured: $200,000

Building flexa coefficient: 1.2

Building NatCat coefficient: 0.9

Payment frequency coefficient: 0.95

You will use these variables to compute the pricing by inserting them into the formula. This is the result:

200,000 * 0.00048 * 1.2 * 0.9 * 0.95 = 98.496

Based on this scenario, you will charge a premium of $98.496 for the specified property insurance policy. The formula incorporates the relevant coefficients from the data sets to price the insurance coverage.

CurrentDTI < MaxDTI

Let’s assume you want to use the Debt-to-Income (DTI) ratio as one of the criteria for assessing a new loan’s eligibility. The DTI ratio measures the borrowers' ability to manage additional debt based on their current financial obligations and income.

The current DTI initial formula argument will be based on another formula, which is the following:

CurrentDTI = (ExistingInstallmentsAmount + LoanInstallmentAmount) / Income

Let's consider the following details for a customer loan application:

-

Existing monthly installments (such as credit card payments, car loans, etc.): $500

-

Loan installment for the new loan: $200

-

Customer monthly income: $2,000

This is the current DTI formula result: (500 + 200) / 2000 = 0.35

Consider the data set for the MaxDTI formula argument provided below, resulting in a value of 0.4 based on the customer's income.

Next, the formula will evaluate the initial underwriting rule by replacing the formula arguments with values. This is the result: 0.35 < 0.4.

Since your customer’s current DTI of 0.35 is less than the maximum DTI ratio of 0.4, the customer meets the eligibility criteria for your product.

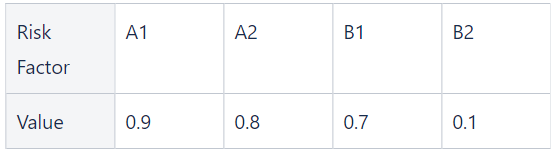

As part of the underwriting process, you must assess an insurance application to determine eligibility.

You consider the risk factor allocated to the applicant based on their insurance history, the requested coverage level, the length of the policy's term, and the premium rate.

The risk factor and premium rate are data set formula arguments, whereas the coverage amount and premium rate are defined as input type.

Let's walk through an example to demonstrate how the next formula works:

(RiskFactor * CoverageAmount) / (PolicyDuration * PremiumRate) > 1.5

Below is sample data for the risk factor and premium rate data sets:

Risk Factor data set:

Premium rate data set:

Assume your A2 risk factor customer wants coverage of $100,000 for the duration of one year. This is the result:

(0.8 * $100,000) / (1 * 0.03) > 1.5

19.2 > 1.5

Based on this result, you can offer the insurance policy with the desired coverage while meeting your guidelines.