View Dashboard

You can see an overview on the customer's profile for quick access to general contact information, transaction history, and if the customer is flagged under any circumstance (a politically exposed person, embargo list, terrorist list, etc.) on the Dashboard tab.

From here, you can visualize the customer's data or navigate to specific details through the interactive widgets.

View the products and services best suited for the customer's needs. The product suggestions are generated by using the campaign module. Product suggestions can also be generated from external sources through an endpoint that comes bundled with the Customer 360 for Private Individuals solution.

When the product suggestions become inactive, they are no longer displayed in the widget. Product suggestions become inactive in the following scenarios:

- When the campaign activity is closed either by the user or the system.

- When the Available Until field value is in the past at campaign stage level.

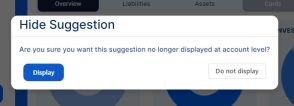

- When using the Close (X) button. In this case the below message is displayed:

Are you sure you want this suggestion no longer display at account level?

For product suggestions generated through the campaign module, the Details button displays the following campaign activities:

- The internal campaign activity, if the stage generates internal activities.

- The external campaign activity, if the stage generates external activities.

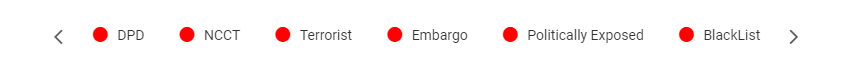

View the warning flags set at the customer's account level. The flags are set with the purpose of indicating if the customer has any potential issues in relation with the financial institution or other third parties.

The following negative flags are displayed:

- DPD - indicates if the account has overdue amounts. This flag is displayed if the customer has at least one overdue installment linked to their account.

The flag redirects to the account Overdue Installments section of the Financial Info tab. - Garnishments - indicates if the account has garnishments. This flag is displayed if the customer has at least one garnishment set on their account.

This flag redirects to the account Garnishments section of the Financial Info tab. - NCCT List - indicates if the customer is found on a non-cooperative countries and territories (NCCT) list.

The flag redirects to the account Compliance tab. For additional details see NCCT List. - Terrorist List -indicates if the customer is found on a terrorist list. The flag redirects to the account Compliance tab. For additional details see Terrorist List.

- Embargo List - indicates if the customer is found on an embargo list. The flag redirects to the account Compliance tab. For additional details see Embargo List.

- Politically Exposed Person - indicates if the customer is a politically exposed person (PEP). The flag redirects to the account Compliance tab. For additional details see Politically Exposed Person.

- Black List - indicates if the customer is found on a blacklist. The flag redirects to the account Compliance tab. For additional details see Black List.

View the customer's product portfolio at account level. This widget is split into three tabs:

On the Overview tab, you can view a summary of the customer's liabilities, assets and investments displayed in pie charts for easier data visualization.

On the Liabilities tab, you can view information for:

- Current account financial data:

- total balance: calculated as the total balance from all active current accounts.

- last opened date: the activation date from the last current account opened.

- blocked amount: calculated as the total blocked amount from all active current accounts.

- Deposits financial data:

- total financed amount: calculated as the sum of the financed amount from all active deposits.

- last opened data: the activation date of the last opened deposit account.

- next maturity date: the deposit account with the most recent maturity date.

- accrued interest: calculated as the sum of the accrued interest of all the active deposits.

- Savings account financial data:

- total balance: calculated as the total balance of all active savings accounts

- last opened date: the activation date of the last opened savings account

- accrued interest: calculated as the total active savings account accrued interest amount

On the Assets tab, you can view information for:

- total exposure: calculated as the sum of the used amount from all the active asset contracts (term loan, credit card, current account with overdraft)

- next installment: the next installment for the active contract with the most recent next installment date

- next installment date: the next installment date from all active asset contracts

- total monthly installments: calculated as the sum of next installment amount and the minimum payment amount from all active asset contracts.

- debt to income: calculated using the total monthly installments/ monthly income * 100 (%) formula.

- outstanding chart: calculated using (sum of the used amount from all active asset contracts/ sum of the amount from all active contracts) * 100 (%) formula.

Relationship managers can view a repayment plan for the customer's installments. To do so, go to the Assets tab and click View Schedule.

View the following product categories: Cards, Loans, Mortgages and Savings.

Click on an icon to add a new product. The simulator can help customers make a decision whether to add a new product to their account or not.

To view all the application's linked to the customer's account, click the View all applications buttons. The button redirects to the Sales tab of the customer's profile.

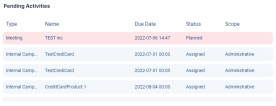

This widget helps relationship managers view the pending activities related to the customer's account and handle daily tasks.

The records are color-coded based on the activity due date:

-

If the due date of the activity is reached or exceeded, the record is displayed in red.

-

Activities with deadlines between one and three days, are displayed in yellow.

-

Activities with over three days left until their due date, are displayed in green.

The following records are displayed:

- Internal campaign activities

- Phone calls

- Meetings

- Leads

- Tasks

Click on a record to view additional information.

View the customer's three most recent interactions. Click on an icon to open the record to see additional information. This widget redirects to the Sales tab of the customer's profile.

The customer's risk profile aids financial institutions identify customer's with a higher risk of being involved in illegal activities or money laundering.

You can view the following information:

- Credit score with the Poor, Fair, Good, Very Good, and Exceptional values.

- Risk class with the Low, Medium, and High values.

This widget redirects to the Compliance tab of the customer's profile.