Define Compliance

General know your customer (KYC) information regarding the customer's source of funds, risk class, public function, or if they appear on a blacklist, terrorist list, and so on is displayed in the Compliance tab. This data is relevant to ensure that all financial laws, policies and regulations are kept.

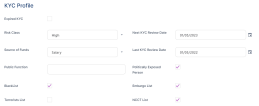

General data about your customers (KYC) that reflects their trust is displayed in the KYC Profile section:

-

Expired KYC: If selected, then the KYC profile is expired and the customer needs to validate their personal details.

-

Risk Class: The customer's risk class. The following options are available: Low, Medium or High.

-

Next KYC Review Date: The date of the next KYC profile review.

-

Source of Funds: The customer's source of funds. The following options are available: Salary, Rent, Dividends or Donations.

-

Last KYC Review Date: The date of the last KYC profile review.

-

Public Function: The customer's public function title.

-

Politically exposed person: If selected, then the customer is a politically exposed person (PEP). For such customers, financial institutions must follow specific regulations to ensure money laundering or bribery prevention.

-

Blacklist: If selected, then the customer is found on a blacklist due to not following business ethics.

-

Embargo List: If selected, then the customer is found on an embargo list which means they are restricted from importing or exporting different types of products.

-

Terrorists List: If selected, then the customer is found on a terrorist list implying that they are involved in terrorist acts or organizations.

-

NCCT List: If selected, then the customer is found on a non-cooperative countries and territories (NCCT) list. On this list, countries that fail to have strong anti-money laundering and anti-terrorist financing legislation are listed. This list is maintained by the Financial Action Task Force on Money Laundering (FATF).

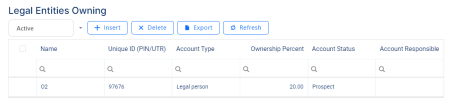

This section lists details, including the ownership percentage of private individuals that own shares at one or multiple companies.

Ownership of all active owners cannot exceed 100%. When new shareholders, participants, or affiliates are added to the account, the total ownership value is checked. If the sum of all active records exceeds 100%, the new record cannot be saved.

You can add a new record or retrieve an existing one from external files or systems, such as Core systems.

After the record is saved, click either Save and Close, or Save and Reload to continue to edit the record. The Edit Ownership Relation page displays and from here you can set a record to be either Inactive or Active from the Relation Status field.

To add a new record, click the Insert button and fill in the following fields:

-

Legal Entity Owning: Enter the name of the legal entity related to the customer's account. Select from the list or create a new one.

-

Ownership Type: Select the ownership type from the following options: Affiliate, Participant or Shareholder.

-

Ownership Percent: Enter the ownership percentage that a shareholder has in the company.

-

Contact Type: Select the contact type from the following options: Administrator, Clerk, Legal Representative, Manager, Secretary or 3rd Party.

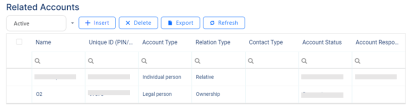

All the accounts associated with the customer's current account are displayed in the Related Accounts section.

You can add a new record or retrieve an existing one from external files or systems, such as Core systems.

After the record is saved, click either Save and Close, or Save and Reload to continue to edit the record. The Edit Related Account page displays and from here you can set a record to be either Inactive or Active from the Relation Status field.

To add a new record, click the Insert button and fill in the following fields:

-

Related Account: Select from the list the name of the account associated with the customer's current account or create a new one.

-

Relation Type: Select the relation type from the following options: Hierarchy, Participant, Administrator, Shareholder, Relative, Contact, Business, Affiliate, Ownership, Employer or Key Contact Person.

-

Contact Type: Select the contact type from the following options: Administrator, Clerk, Legal Representative, Manager, Secretary or 3rd Party.

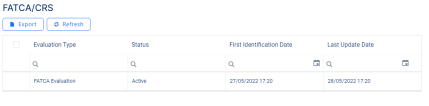

Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS) evaluation details are displayed in the FATCA/CRS section.

The Foreign Account Tax Compliance Act (FATCA) law requires all United States citizens to submit annual reports on any foreign accounts that they have. The Common Reporting Standard (CRS) is a information-gathering and reporting requirement that allow financial institutions to collect customer information such as name, address, taxpayer identification numbers, entity types, place of registration, and so on. Both FACTA and CRS have the purpose of eliminating tax evasion.

FACTA and CRS details cannot be added or deleted as they are retrieved from external systems, such as Core systems.