Policy Administration

The Policy Administration solution provides capabilities to support your back-office policy administration for the usual life cycle of a contract after its issuance. You can alter a policy in order to adjust the insurance contract to a customer's need, manage renewals and multi-object/person contracts, lapse, and cancel policies.

The module encompasses the registration of permitted policy alterations, such as an upgrade or downgrade in covered benefits. It automatically identifies and communicates the requirements and evidence necessary to recalculate premium and complete the alteration. Evidence and document requirements gathering is orchestrated by FintechOS Portal and assisted by Automation Blocks.

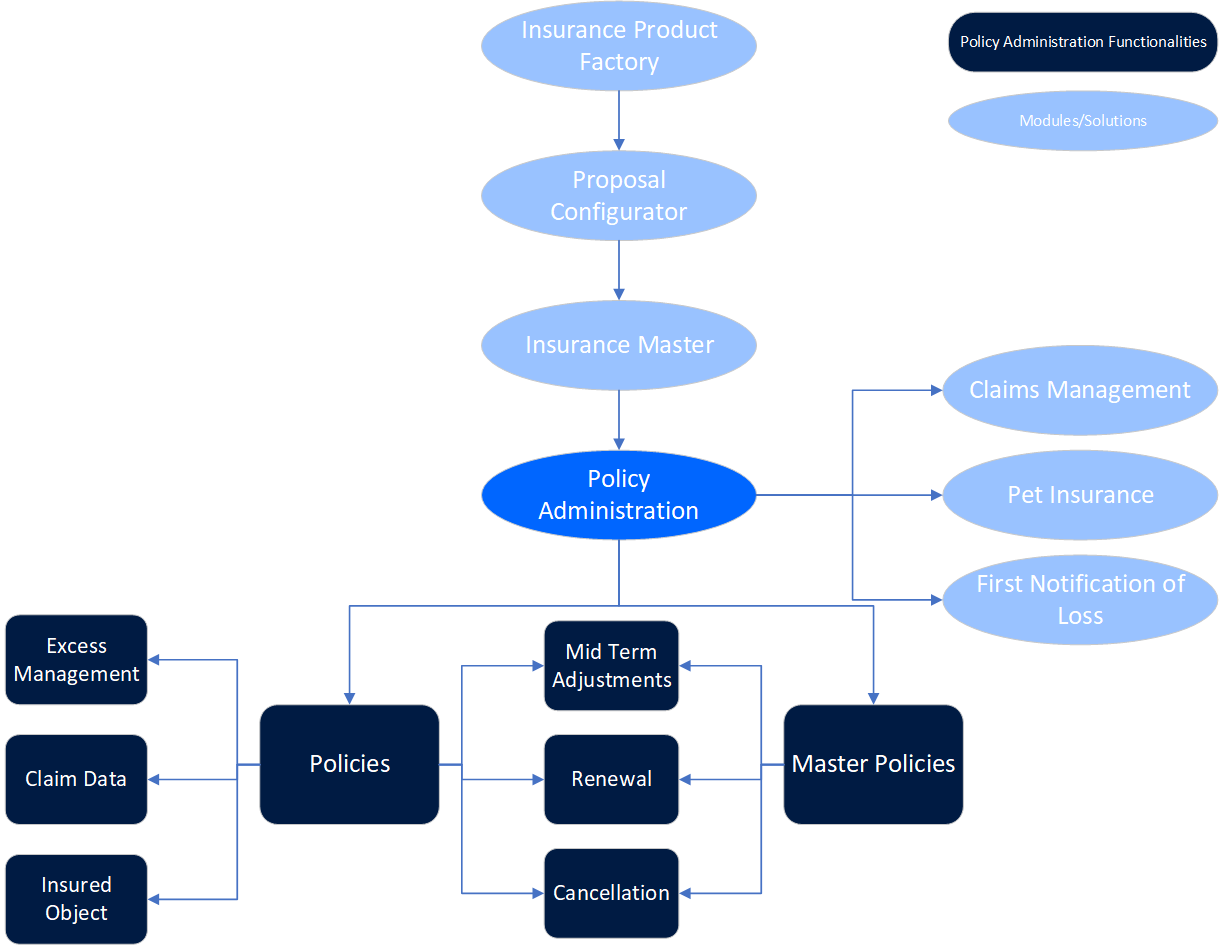

The diagram below presents the Policy Administration solution, along with its functionalities, dependencies, and solutions that use the solution.

Use Policy Administration along with other FintechOS Insurance solutions or accelerators to manage the life cycle of policies, Masterpolicies, and manage the claims made for them. With Claims Management, you can create claim requests for existing policies, and create a payment proposal. Use Policy Administration with the Pet Insurance Quote & Buy and First Notification of Loss accelerators to store the policies that are generated through a Quote & Buy journey, and manage the policies that are selected to go through a First Notification of Loss journey.

This guide focuses on the use of FintechOS Studio in the configuration of a customer journey that incorporates FintechOS Automation Blocks and highlights the existing opportunities to improve the process efficiency, Policy Administration automation, audit and management capabilities, and speed time to completion of administrative tasks.

The key features of the Policy Administration solution are listed below:

-

It enables a central point from which to initiate policy administration tasks that impact on multiple policies;

-

It allows the automatic identification of business requirements pertaining to the requested changes;

-

It allows the automatic initiation and completion of regular scheduled policy alterations, e.g. annual premium and benefit escalations;

-

It offers high levels of automation but with the capability to determine where intervention of experts is required;

-

Reverts to manual processing only where necessary for more complex or specialist cases.