Dashboards and Reports

Loan Management facilitates user interaction with a series of in-built dashboards and reports. According to their specific destination, they aid the bank employees in their daily tasks, displaying important, up-to-date information on the statuses of different contracts, events, limits, needed approval tasks, generating reports or offering easy navigation through a button to record creation pages.

These dashboards can be accessed from the FintechOS Portal's Home page in accordance with each user's specific access rights.

The following dashboards and reports come along with your Loan Management package:

-

Contracts - displays a list of the contracts along with a pie-chart specifying the number of contracts in each business status, a list of contract approval requests and a button to access the Add Contract page.

-

Customer Limits - displays a list of the existing customer limit records, a list of the customer limit approval requests and a button for adding new customer limits.

-

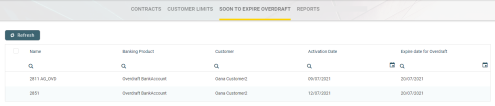

Soon to Expire Overdrafts - displays a list of contracts based on

current accounts with overdraftbanking products whose overdraft functionality is about to expire. -

Credit Facility Dashboard - displays a list of the credit facility records along with a pie-chart specifying the number of credit facilities in each business status, separate lists of credit facility approval requests, utilizations and utilizations approval requests, and a button to access the Create Credit Facility page.

-

Reports - contains links to a series of reports such as repayment notifications past due, collaterals in default, limits, closure of contracts, future installments or past due installments.

-

Records To Be Purged - displays the list of records in

Draftstatus that are scheduled to be deleted at the current day's end, grouped on tabs specific for each transaction type: disbursement, early repayments, top-ups, early termination for deposits, loan contracts, payment holidays, reschedule overdue, withdraws, transfers, returned amount or goods, or agreements. Also displays tabs with agreement records inDraftstatus that are scheduled to be purged. -

DLQ Messages - the dead letter queue dashboard stores messages about the requests that the Async Engine could not process for any reason and allows you to send them for reprocessing.

-

Back-Office Dashboard - focuses on improving the experience and productivity of Loan Admin Officer users in their day-to-day tasks, displaying important notices, KPIs and metrics, overview information about contracts, customers, limits, collaterals, credit facilities, third-party agreements, transactions, as well as an integrated journal for keeping notes and files meaningful for their work.

The Contracts dashboard displays a list of the contracts created in the system and a list of contract approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add Contract button facilitates your access to the Create Contract page, where you can create new contracts.

The dashboard also shows a visual of the contracts within the system, displaying a pie-chart that specifies the number of contracts in each status: Contract Draft, Contract Closed, Contract Approved , Contract Pending and Contract Canceled.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Supervisor Retail Loans Officer

-

Corporate Credit Officer

-

Retail Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Customer Limits dashboard displays a list of the customer limit records created in the system and a list of customer limit approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add New Customer Limit button helps you add new customer limits.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Soon to Expire Overdrafts dashboard displays a list of the contracts created in the system based on current account with overdraft banking products whose overdraft functionality is about to expire. The Loan Management system parameter CurrentAccount_WithOverdraft_DaysBeforeExpire determines the number of days before overdraft expiration when the contract can be displayed in this dashboard.

The lists can be filtered on every column. Access records from the lists by double-clicking them.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Supervisor Retail Loans Officer

-

Corporate Credit Officer

-

Retail Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Credit Facility dashboard displays a list of the credit facility records created in the system. It also displays separate lists of credit facility approval requests, utilizations and utilizations approval requests. The lists can be filtered on every column. Access records from the lists by double-clicking them.

The Add Credit Facility button facilitates your access to the Create Credit Facility page, where you can create new credit facilities.

The dashboard also shows a visual of the credit facilities within the system, displaying a pie-chart that specifies the number of records in each status: Credit Facility Draft, Credit Facility Closed, and Credit Facility Approved.

This dashboard can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Reports dashboard contains links to a series of reports:

-

Report Days Past Due - Click this link to display the report of repayment notifications past due date.

-

Collaterals in Default - Click this link to display the report of collateral records in default.

-

Limit Report - Click this link to display the report of limits records in Loan Management. The report displays different sections for expired limits, limits with available amount lower than 0, limits about to expire and limits to be reviewed, the latest two with the option to select the desired interval of dates. The reports are run automatically with a default value defined in the

DefaultIntervalLimitsReportLoan Management system parameter, but you can change the intervals according to your needs directly from the report.

-

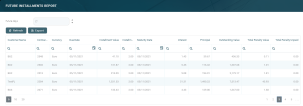

Future Installments - Click this link to display the list of installments that are due in the following X number of days from the current date. X represents a default value taken from the

DaysFutureInstallmentsReportLoan Management system parameter. You can generate the report for a different number of days simply by changing the value of the Future days field within the Future Installments Report page. The report displays the following information about the future installments: customer name, contract number, currency, due date, installment value, installment number, maturity date, interest, principal, outstanding value, total penalty value and total penalty unpaid.

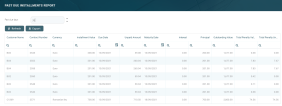

-

Past Due Installments - Click this link to display the list of installments that were due but not have been fully paid, no matter their origin - normal installments, penalties, transaction fees, etc, - in the last Y number of days from the current date. Y represents a default value taken from the

DaysPastDueInstallmentsReportLoan Management system parameter. You can generate the report for a different number of days simply by changing the value of the Past due days field within the Past Due Installments Report page. The report displays the following information about the past due installments: customer name, contract number, currency, installment total value, due date, unpaid amount, maturity date, interest, principal, outstanding value, total penalty value and total penalty unpaid.

-

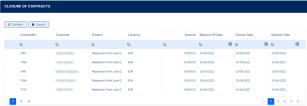

Closure of Contracts - Click this link to display the list of contracts that are ready to be closed because they meet the following conditions: the contracts are in

Approvedstatus, their maturity date < the current system date, their loan balance = 0, and the remaining amount for all their notifications = 0. The report displays the following information about the contracts that can be closed: contract number, customer name, product, currency, amount, balance off date, closure date, and maturity date.

You can also use the

GetClosureOfContractsendpoint to fetch the same information within your own API integration.

The lists can be filtered on every column. Access records from the lists by double-clicking them.

The charts can be downloaded by clicking the Chart context menu in the top right corner of each chart and selecting the desired format: PNG or JPEG image, PDF document or SVG vector image.

The reports can be accessed by users with the following predefined security roles, but note that some actions may be limited according to the role setup:

-

Loan Admin Officer

-

Supervisor Corporate Officer

-

Corporate Credit Officer

-

Supervisor Risk Officer

-

Risk Officer.

The Future Installments and the Past Due Installments reports can also be accessed by users with Supervisor Retail Officer and Retail Credit Officer roles.

The Records To Be Purged dashboard displays the records in Draft status that are due be purged on the current day and have their transaction type's To Be Purged field marked as True.

In order to be purged on the current day, the record's Created On date + the value of the Purge Number of Days parameter at transaction type level must be equal with the current date. If the Purge Number of Days parameter at transaction type is

0, then the value of the DaysBeforePurge system parameter is considered instead. The job performing the deletion is Delete Purged Entries and it should be scheduled at the bank's level. The lists can be filtered on every column. You can select to display only the records created on a specific day from the calendar button next to the Created On column.

The following tabs are available to display the records to be purged, based on their transaction type:

-

Disbursements - displays all the disbursement type transactions in

Draftstatus which are due to be purged on the current system date; -

Early Repayment - displays all the early repayments type transactions in

Draftstatus which are due to be purged on the current system date; -

Top-Ups - displays all the top-up account type transactions in

Draftstatus which are due to be purged on the current system date; -

Early Termination Deposit - displays all the early termination deposits type transactions in

Draftstatus which are due to be purged on the current system date; -

Loan Contract - displays all the contracts in

Draftstatus created based on Term Loan banking products which are due to be purged on the current system date; -

Payment Holidays - displays all the payment holidays type transactions in

Draftstatus which are due to be purged on the current system date; -

Reschedule Overdues - displays all the reschedule overdues type transactions in

Draftstatus which are due to be purged on the current system date; -

Withdraws - displays all the withdraw type transactions in

Draftstatus which are due to be purged on the current system date; -

Transfers - displays all the transfer type transactions in

Draftstatus which are due to be purged on the current system date. -

Return Fees - displays all the Returned Amount of Goods type transactions in

Draftstatus which are due to be purged on the current system date. -

Agreements - displays all the Agreement type transactions in

Draftstatus which are due to be purged on the current system date.

For each transaction type that can be purged (marked with Yes in the Predefined Transaction Types table's Can Be Purged column), Loan Management displays a tab in the Records To Be Purged dashboard only if their To Be Purged field is marked as

True.For each record, the following information is displayed: name, business status, creation date and transaction type.

The example below shows the Loan Contract tab, which displays all the contracts in Draft status created based on Term Loan banking products and which are due to be purged on the current system date.

This dashboard can be accessed by users with the Loan Admin Officer predefined security role.

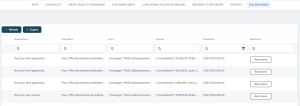

The DLQ Messages (the dead letter queue) dashboard lists messages about the requests that the Async Engine could not process for any reason. Each message contains the queue name, the flow name, the error message, the payload and the time stamp of the unprocessed request. The lists can be filtered on every column.

The Reprocess button next to each message allows you to send them for reprocessing.

This dashboard can be accessed by users with the Async Engine Admin security role.

The Back-Office Dashboard aims to be the main overview page for users with the associated role of Loan Admin Officer in their day-to-day tasks. It displays the most important information on one page, showing indicators and metrics, overview information about contracts, third-party agreements, customer limits, collateral evaluations, credit facilities and usages, and transactions. It enables users to access record search, creation, or viewing without having to navigate to the corresponding menu items, as well as to add notes or files related to their work.

The operations available for each user depend on their role and permissions, but users associated with the out-of-the box Loan Admin Officer security role can perform all the actions available on the dashboard.

The lists can be filtered on every column. Access records from the lists by double-clicking them. View detailed information clicking the Expand View buttons located in specific sections. Click the Export button to export the information within the section to .csv files for further analysis.

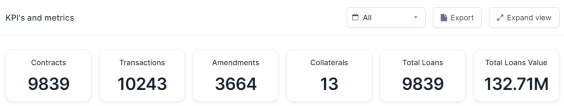

The dashboard contains the following sections dedicated to different processes:

-

KPI's and metrics - The section displays the total number of contracts, transactions, amendments (contract versions), collaterals, loans, and cumulative loan value (in millions, in the currency defined in the

FTOS_CB_DashboardCurrencyparameter) in the system for the selected time period.Select from the drop-down within the section the desired period for displaying the KPIs and metrics information:

Click Expand View to display more information in a slideable side-pane:

The side-pane allows you to select the desired period, then shows you the total number of contracts split on product types, and the total value of loans.

-

Search Customer - Click this section to open the Customer Core page in a new tab, where you can search for the desired customer.

-

Add Customer - click this section to open the Add Customer page in a new tab, where you can create new customer records.

-

Contracts - It displays the total number of contracts in the system, as well as a list of contracts with information about each contract's number, banking product, activation, status, and days past due. You can also create new contracts by clicking the Add button, or search for existing contracts by filling in any of the contract's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The side-pane displays a pie-chart that specifies the number of contracts in each status:

Contract Draft, Contract Closed, Contract Approved, andContract Canceled. Click any of the statuses to filter them out.The pane also displays the list of contracts in the selected statuses, with information about each contract's number, banking product and type, customer, activation and maturity dates, main bank account, balance, status, days past due, and category.

-

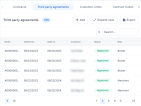

Third Party Agreements - This section is displayed if the

UseTPMLoan Management system parameter is set toTrue. It displays the total number of agreements in the system, as well as a list of agreements with information about each agreements's number, validity period, customer, their role, and record status. You can also create new agreements by clicking the Add button, or search for existing contracts by filling in any of the agreement's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The side-pane displays a pie-chart that specifies the number of agreement in each status:

Draft, Closed, andApproved. Click any of the statuses to filter them out.The pane also displays the list of agreements in the selected statuses, with information about each agreement's number, validity period, customer, their role, and record status.

-

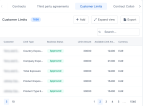

Customer Limits - It displays the total number of limits in the system, as well as a list of limits with information about each limit's customer, type, status, amount, available amount, and currency. You can also create new limits by clicking the Add button, or search for existing limits by filling in any of the limit's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The pane displays the list of limits, with information about each limit's customer, type, status, amount and available amount, currency, expire date, whether it is a secured limit, its underlying banking product and type, and its review date.

-

Contract Collateral - It displays a list of the collaterals used in contracts, with information about each collateral's customer, status, type, registered value, cover percent and value in the contract's currency, and the contract number. You can also search for existing collaterals by filling in any of the collateral's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The pane displays the list of the collaterals used in contracts, with information about each collateral's customer, status, type, registered value, cover percent and value in the contract's currency, and the contract number.

-

Credit Facility - This section is displayed if the

UseCFLoan Management system parameter is set toTrue. It displays the number of the credit facility records created in the system, as well as a list with information about each credit facility's name, customer, facility amount and currency, usage percentage, and status. You can also create new credit facilities by clicking the Add button, or search for existing ones by filling in any of the facility's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The side-pane displays a pie-chart that specifies the number of credit facilities in each status:

Credit Facility Draft, Credit Facility Closed, andCredit Facility Approved. Click any of the statuses to filter them out.The pane also displays the list of credit facilities, with information about each record's name, customer, facility amount and currency, usage percentage, status, allowed products, and allowed customers.

-

Credit Facility Usage - This section is displayed if the

UseCFLoan Management system parameter is set toTrue. It displays the number of the credit facility usage records created in the system, as well as a list with information about each record's name, contract id and number, utilization amount, credit facility number, currency, and customer. You can also search for existing records by filling in any of the facility usage's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The pane displays the list of credit facility usage records, with information about each record's name, contract id and number, utilization amount, credit facility number, currency, and customer.

-

Transactions - This section displays the number of the transaction records created in the system, as well as a list with information about each record's number, transaction type, contract number, value and currency, event date, and the user who created the transaction. You can also search for existing records by filling in any of the transaction's information in the Search box.

Click Expand View to view display more information in a slideable side-pane:

The pane displays the list of transactions, with information about each record's number, transaction type, contract number, value and currency, event date, and the user who created the transaction.

- Important Notices - The information displayed here is dependent on the Loan Management implementation. If the functionality was implemented, the section displays important notifications. This is where the financial institutions can set reminders to their employees.

-

Journal - This section allows you to add notes and/ or files related to your work. Simply type your notes in the Add information box, attach a file if relevant, click Save, and the system stores the data with the time stamp for future references.