Limits

The exposure is the risk a financial institution is taking on for writing the loan. Every time a financial institution grants any type of credit facility to a customer (a loan), the financial institution monitors its exposure to various financial indicators, which can negatively affect the customer and the institution itself. The financial institution uses various algorithms to calculate their exposure to the risks, but this calculation simply adds up to their exposure.

When referring to a loan, this page refers to all types of loans: unsecured loan, secured loan, overdraft, promissory note, working capital loan, and so on.

In FintechOSLoan Management an exposure can be related to a group or to a customer.

The approval of limits is subject to validation, depending on the type of customer. These validations are detailed below.

Group Exposure Types

- Total Exposure - the total amount of principal the lender is willing to allow the group to use in lending products at a certain moment in time.

- Country Exposure - the limit placed by a financial institution on the number of loans that can be given to borrowers in a particular country. They are used to control the financial institution' risk exposure to particular regions.

- Company Exposure - the exposure of a particular company in the group the lender is willing to allow for granting loans.

- Product Type Exposure - the maximum amount of credit an institution extends to the group for a specific type of product.

- Product Exposure - the maximum amount of credit an institution extends to the group for a specific product.

- Exchange Exposure - the risk a company undertakes when making financial transactions in foreign currencies. All currencies can experience periods of high volatility which can adversely affect profit margins, if suitable strategies are not in place to protect cash flow from sudden currency fluctuations.

Customer Exposure Types

- Total Exposure - the total amount of principal the lender is willing to allow the borrower to use in lending products at a certain moment in time.

- Product Type Exposure - the maximum amount of credit a financial institution extends to the customer for a specific type of product.

- Product Exposure - the maximum amount of credit a financial institution extends to the customer for a specific product.

- Exchange Exposure - the risk a company undertakes when making financial transactions in foreign currencies. All currencies can experience periods of high volatility which can adversely affect profit margins, if suitable strategies are not in place to protect cash flow from sudden currency fluctuations.

You can define new limit types that are based on roles associated to contract participants specific to your business, and use them throughout Loan Management with all the functionality of any other default limit type. Read the dedicated page to learn how to manage limit type records.

Validations

The

LimitMandatoryForIndividual Loan Management system parameter allows banks to specify whether their system should validate limits for individual customer, the same way it validates limits for legal entity customers. The limits for legal entities and groups are validated by Loan Management by default.-

Total Exposure is validated to be unique.

-

Product Type Exposure is validated against the approved and active total exposure set on the customer.

-

Product Exposure is validated against the Product Type Exposure if exists. If a Product Type Exposure does not exist, it is validated against the Total Exposure.

-

Exchange Exposure is validated against Total Exposure.

-

Total Exposure is validated to be unique and it is validated against the Total Exposure set on the group.

-

When a group defines a Company Exposure, a Total Exposure is automatically created for that company.

-

All the other limits are validated against their correspondent set on the customer’s group, if exists. If the correspondent does not exist, there are validated against Total Exposure from the group.

-

The account limit currency is automatically filled in with the group limit currency.

Both legal entity and individual customers can be added to groups. This can be helpful if you need to monitor group exposure for a household or a company and its shareholders together.

When

LimitMandatoryForIndividual = True, limit validations for a group containing individual customers happen the same way as for groups composed solely of legal persons.-

Total Exposure is validated to be unique.

-

Product Type Exposure is validated against the approved and active Total Exposure set on the group.

-

Product Exposure is validated against the Product Type Exposure if it exists. If a Product Type exposure does not exist, it is validated against the Total Exposure.

-

Company Exposure is validated against the approved and active total exposure set on the group.

-

Country Exposure is validated against the approved and active total exposure set on that group.

-

Exchange Exposure is validated against Total Exposure.

-

You can define as many limits with the same Type (on Group or on Customer) as long as only one Limit (Type) is in Approved status.

After setting the limits, the loan approval is validated against those limits, as detailed below:-

If there is not at least one limit set at the customer or group level, the approval of the loan is not possible and an explicit error is displayed.

-

Contract maturity date cannot exceed the limit’s expiry date and an explicit error is displayed.

-

The loan amount cannot exceed the corresponding limit amount. If not, an explicit error is displayed.

-

When a member is added to or deleted from a group, Loan Management automatically recalculates the limits of the group. The limits of the deleted member become as they were before entering the group.

If a member is moved from one group to another via API integration, the limits of both affected groups are automatically recalculated in real time.

Role-based limits have all the functionality of any other system limit type. The limits defined for participants at the contract level can be updated according to the contract's value. If a limit is set as revolving, it is replenished with capital repayments.

For contracts based on products with a product admin configuration with a mandatory role configured, Loan Management checks whether the contract contains a participant with the same role. For example, for a product admin configuration with Merchant mandatory role, if Loan Management doesn't find a participant with this Merchant role on the contract, then an error message informs you that "Contract participants are blocking disbursement (Merchant)!". In this case, add a participant with the Merchant role to the contract.

If the Search Limit checkbox was selected for the mandatory role at the product admin configuration level, then Loan Management checks whether there is a contract participant whose limit is of the limit type associated with the same role. In the example above, Loan Management checks the existence of a participant who has a Merchant Exposure type limit.

If the existing limit's available amount is smaller than the value of the contract, then Loan Management checks the limit's Is Mandatory field. If Is Mandatory = True, then an error is raised that the limit is reached and the contract cannot be approved, otherwise, a warning is presented but the contract can be approved.

The

Is Mandatory field's value cannot be changed from False to True when versioning a limit until Available Limit Amount >= 0.The way the system is configured by default, there are no validations at Contract Version approval for contract participants' limits. If this is desired, the version settings for

Contract Participants need to be changed from IsUpdate= true to IsUpdate = false.

Calculation of Available Limit Amount

After loan approval, the available amount for each corresponding limit is recalculated by subtracting the loan amount from the limit amount. When calculating the group limit available amount, the application takes into account all group members. If the limit currency and loan currency are different, the application automatically converts the loan amount using the current exchange rate.

All group and customer limits are updated daily in accordance with the exchange rate. This is done via a job called Daily Limit Recalculation.

If a limit is revolving (Is Revolving = True at the limit level), then the limit is a revolving limit, meaning that the Available Amount of the limit is replenished either on each repayment of the principal or on loan contract closure, depending on the On Repayment field's value. If Is Revolving = False, then the limit is not revolving in any circumstances.

At a revolving limit's level, if On Repayment = True, then the Available Amount of the limit is replenished on each repayment of the principal with the repayment value. If On Repayment = False, then the limit amount is replenished on loan contract closure with the amount of the contract.

If a customer that already has approved contracts becomes a member of a group, all its active limits are suspended. The same applies when excluding a customer from a group.

If a customer is a child company for more than one company which are part of different groups, it should have impact on the available limit amount on the group to which it was first added, unless if it was already part of a group.

Limit Statuses

The four-eyes principle is applicable for limits in FintechOSLoan Management, meaning that a record should be approved by a second bank employee, with higher authorization rights. This is enabled via approval task FintechOS Platform capabilities and thus it is also a bank's responsibility to set proper security roles and access rights to its users, in order to make sure that the same user can't insert and also authorize the same record.

A limit record has the following business workflow statuses:

- Draft - the status of a newly created limit record that was not yet sent for approval. While in this status, you can edit some fields, but you can't use it in contracts. Send the record to approval after editing all the necessary details.

-

Pending - this is a system status applied to limits or limit versions sent for approval, but not yet approved. No updates of the records are available in this system status.

- LimitApproved - the status of a limit record after being authorized for use throughout Loan Management by a user with customer limits approval competencies. While in this status, you cannot edit the record's details. If you need to alter the limit's details, create a new version based on the current limit.

- Closed - the last status of a limit, after manually closing it or after creating a new version based on the current version. No updates are allowed on the record. The limit record cannot be used anymore.

- Suspended - the status of limit records which are suspended at the moment and cannot be used. If a customer is introduced into a group, the customer's limits are all suspended automatically until the limit records are reviewed and new versions are created for them with updated information.

- Expired - the status of limits whose availability has expired, thus the record cannot be used anymore. You can edit a limit's expiration date to a future date by creating a new version.

For the limit to be applied, it must be in Approved status.

Limit Versioning

Loan Management allows you to create new versions for an existing limit if you need to modify an existing approved limit.

A limit version can have the following statuses:

-

Version Draft - the status of a newly created limit version record that was not yet sent for approval. While in this status, you can edit some fields. Send the record to approval after editing all the necessary details.

-

Approved - the status of a limit version record after being authorized by a user with customer limits approval competencies. While in this status, you cannot edit the record's details.

-

Version Closed - the last status of a limit version, after manually closing it or after creating another new version based on the current version. No updates are allowed on the record.

The way the system is configured by default, there are no validations at Contract Version approval for contract participants' limits. If this is desired, the version settings for

Contract Participants needs to be changed from IsUpdate= true to IsUpdate = false.

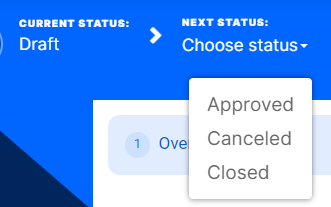

Changing Limit Statuses

You can manage a limit's life cycle by changing its status from the top right corner of the screen.

The limit status transitions are illustrated below:

Note that:

- Once a record is live, its settings can no longer be modified.

- If you want to update the details of a live limit, you must create a new limit version.

- When you create a new limit version, the current version is retired and moved to history; no updates are allowed on the retired version.

- Every limit version starts in a draft state and must go through an approval process before going live.

- Only one version of a limit can be live at one time.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.

Managing Limits

You must have the Corporate Credit Officer, Retail Credit Officer, or Risk Officer security roles to add and update limits. Other associated roles allow you only to read limits information.

To manage limit records:

-

In FintechOS Portal, click the main menu icon and expand the Loan Management Operational menu.

-

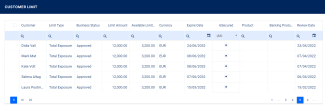

Click Customer Limit menu item to open the Customer Limits List page.

On the Customer Limits List page, you can create a new limit record for a customer, delete records in Draft status, and search for a specific record. You can also edit the information for limits in Draft or Version Draft status, or create new versions for approved limits to change their information.

Alternatively, you can also manage limits at a customer level from the Customer Core menu, by selecting a customer from the list and managing their limit records within the Groups & Limits tab.