Working with Third-Party Invoices

Third-party invoices are the invoices that track the incomes and expenses resulted from contracts based on the bank or financial institution's agreements with third-party entities (agents, brokers, etc.) . Core Banking has a dedicated menu for managing third-party invoices. These third-party invoices are attached to agreements with third-party entities. You can create invoices manually, or allow Core Banking to create the invoices automatically, using a dedicated scheduled job.

The commissions applicable to agreement pricings are automatically calculated by the system as pre-invoice details. The calculation is triggered either when a disbursement event is approved at the contract level (for pricings with For Disburse = True), or when the contract itself is approved (for pricings with For Disburse = False). The commission is not calculated in that moment, instead, the event's information is recorded in a queue. From here, a specialized job processes each queue record and writes the results as pre-invoice details. These pre-invoice details are automatically added to the invoices when the system creates invoices, or you can add them manually to invoices.

Managing Invoices For Third-Parties

To manage third-party invoices:

-

In FintechOS Portal, click the main menu icon and expand the Core Banking Operational menu.

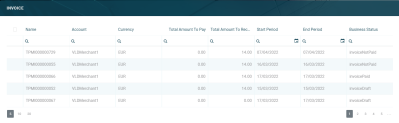

- Click the Invoice menu item to open the Invoices page.

On the Invoices page, you can create a new invoice manually, search, edit, or delete an existing third-party invoice in Draft status.

Core Banking can also create the invoices automatically, using the TPM Invoices (TPM) scheduled job. This job runs once each night and creates third-party invoices and payments, for the combination of third-party entity/ agreements currency, during the validity of the agreement, on the Payment Day of each agreement, as defined in the third-party agreement's

Payment Periodicity (daily, monthly, or weekly).Users with the associated role of Loan Admin Officer or Retail Credit Officer can insert, update, or delete third-party invoice records. Users with the other associated Core Banking security roles can only view such records.