Third-Party Management

The third-party management functionality of Core Banking refers to third-party entities (agents, brokers, insurers, etc.) registered with the financial institution to intermediate the selling of various banking products to customers. For their work, the third-party entities are compensated with fees payable for each new contract, based on a pricing agreement with the financial institution. Core Banking facilitates the management of third-party agreements, the linkage of contracts to third-parties, and the configuration of the commissioning processes through dedicated menus. A third-party invoicing process also takes care of the transfer part of the payments related with these third-party entities.

FintechOS Core Banking allows banks to create third-party agreements based on approvals.

The third-party management features are available via the Third-Party Management v4.0 package, which has to be installed on top of the Core Banking 4.0 package.

Business Logic

Let's say a third-party entity (an agent, a broker, an insurer, or a merchant) agrees with a financial institution to intermediate the selling of various banking products to customers, for a fee. Thus, an agreement is recorded in Core Banking, containing all the pricing information needed to compensate the third-party. Specific commissioning configurations must be in place to be then applied to the agreements. Whenever the third-party entity intermediates the selling of a contract to a customer, specifying in the contract the entity and their role, the entity should be compensated with the commissions mentioned in the agreement. The payments are performed based on automatic or manual invoicing processes. Agreement records must be approved before being used for invoice generation. You can create invoices and attach invoice details for an agreement for each currency mentioned in the pricing details, that are automatically processed for payment by Core Banking. An automated process running once each night creates third-party invoices and payments for the combination of third-party entity/ agreements currency, during the validity of the agreement, on the Payment Day of each agreement, excluding any invoice details already created on a manual invoice. The payments for the invoices are performed for unallocated or partially allocated payments.

Managing Third-Party Agreements

You can manage third-party agreements via the user interface or via integration through APIs.

For information about the available endpoints, please visit the Third-Party Management Endpoints page.

To manage third-party agreements through the user interface, follow these steps:

-

In FintechOS Portal, click the main menu icon and expand the Core Banking Operational > Third-Party Agreements menu.

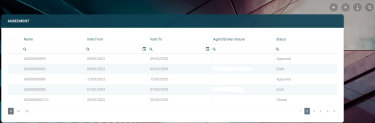

On the Agreements page, you can create a new agreement, search, edit, or delete agreements in Draft status.

Users with the associated role of Loan Admin Officer or Retail Credit Officer can view, insert, update, or delete third-party agreement records. Users with the other associated Core Banking security roles can only view such records.

You can also manage agreements in the Third-Party Agreements dashboard. Agreements that remain in

Draft status for a predefined number of days can be purged within the Records To Be Purged dashboard's Agreements tab.