Creating Agreements For Third-Parties

Third-party agreements are complex agreements between a financial institution and third-party entities such as agents or brokers, who intermediate the creation of contracts with customers, in exchange of a payment previously negotiated with the financial institution.

Before creating an agreement for a third-party entity, make sure that:

-

the third-party roles and the role-based limits are set up according to your financial institution's needs,

-

the third-party entity is recorded as a customer in Core Banking,

-

the third-party has the desired role associated within its customer record,

-

a settlement account (a current account contract for the same third-party entity) is set up for the desired currency.

To create a new third-party agreement:

-

Open the Agreements page as described in the Managing Third-Party Agreements section.

-

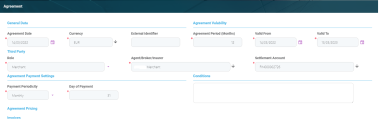

Click the Insert button to open the Agreement page, with the first tab displayed, the Agreement tab.

The fields displayed here are also available for completion when updating a record in Draft status.

-

Fill in the following fields in the General Data section:

-

Agreement Date - This is the date of the agreement, automatically filled-in with the system's date. You can change this value.

-

Currency - Select from the list the currency of the agreement. This is the currency for settling the included commissions. Make sure the third-party has a current account in the selected currency.

-

External Identifier - Enter an external identifier of the agreement record, if available.

-

-

In the Agreement Validity section, fill in the following fields:

-

Agreement Period (Months) - Enter the number of months for the agreement's validity.

If you modify theValid Todate, then the value ofAgreement Period (Months)is recalculated, rounding up the fractions of a month to 1 whole month. -

Valid From - Select the date when the agreement becomes active. This field is automatically completed with the system's current date. You can modify this date from the attached calendar, if needed.

The maturity date is automatically calculated following the formula:Facility Date+ (Period*Period Type). -

Valid To - The date until when the agreement is valid. This field is automatically completed with the date calculated as the system's current date + the number of months entered in the

Agreement Period Monthsfield. You can modify this date from the attached calendar, if needed, but it must be greater than or equal withValid From. If you modify this date, then the value ofAgreement Period (Months)is recalculated, rounding up the fractions of a month to 1 whole month.

-

-

In the Third-Party section, fill in the following fields:

-

Role - Select from the drop-down the role of the entity with whom the agreement is created. The roles are listed in the

ThirdPartyRoleCore Banking system parameter. The default roles are: Agent, Broker, Insurer, and Merchant. -

Agent/ Broker/ Insurer/ Merchant - Select from the list the name of the customer with whom the agreement is created. This is the entity who should be mentioned in contracts as contract participant with the specified role in order to qualify for the commissions stated in the agreement pricing records added to this agreement. The list is already filtered, displaying only the customers that have the same role as the one selected in the

Rolefield.NOTE

Once an agreement is saved, you can only change the Role and Agent/ Broker/ Insurer/ Merchant fields if you create a new version for the agreement. -

Settlement Account - Select the entity's bank account that acts as settlement account, where the commissions payable based on this agreement should be disbursed and/ or from where the financial institution should subtract the amounts to recover. The list is already filtered to display only the selected customer's current accounts in

Openstatus, in the currency selected previously for the agreement.

-

-

In the Agreement Payment Settings section, fill in the following fields:

-

Payment Periodicity - Select from the list the periodicity for processing the payments calculated based on this agreement. The possible values are:

Daily- the payments are performed each day. If you select this option, thePayment is in Real Timefield is displayed.Weekly- the payments are performed once a week. If you select this option, theWeek Dayfield is displayed.Monthly -the payments are performed once a month. If you select this option, theDay of Paymentfield is displayed.

- Payment is in Real Time - Only displayed if

Payment Periodicity = Daily. If you select the checkbox, then the payment is processed in real-time. - Week Day - Only displayed if

Payment Periodicity = Weekly. Select the day of the week when the payment should be processed. - Day of Payment - Only displayed if

Payment Periodicity = Monthly. Enter the day of the month when the payment should be processed, with values between 1 and 31. The default value is 31, the last day of the month. - Conditions - Enter any other conditions applicable to the agreement.

-

-

Click the Save and Reload button.

After saving the agreement, a unique identifier is generated based on the increment number and is displayed as the name of the agreement at the top of the page, along with the versioning information. All the other sections of the Agreement page (Agreement Pricing and Invoices) become visible after saving the record, so that you can fill them in.

The record is still in Draft status and you should define at least one pricing record before you change its status to Approved. You or Core Banking's automatic process can create invoices only for agreement records with Approved status.

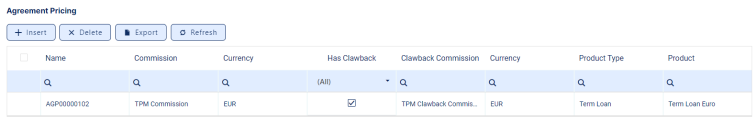

You can insert, update, delete or export pricing records for an agreement in Draft status in the Agreement Pricing section, displayed after saving the agreement,

The section displays information about the pricing's commission and its currency, the clawback commission, if applicable, and the products for which the pricing was set up. You can add as many pricing records as you need for an agreement.

To add a pricing record, follow these steps:

-

Click the Insert button to display the Agreement Pricing page.

-

Fill in or view the following fields in the Commission Settings section within the newly opened page:

-

Commission - Select from the list the third-party commission to be applied for the agreement pricing. The list is filtered to display only commissions with

ThirdPartycommission schema. -

Commission Currency - This field is automatically completed with the selected commission's currency. You can't change this value.

-

Commission Payment Type - Select the type of payment to be performed for the commission:

Payment In- for payments from the third-party's settlement account into the financial institution's reconciliation accountPayment Out- for payments from the financial institution's reconciliation account into the third-party's settlement account.

-

-

In the Agreement Pricing Object section, fill in the following fields:

-

Product Type or Product - Select the product type or the product that must be present in a contract in order for the agreement pricing to be applicable.

NOTE

If you are planning to use the clawback settings, make sure that you mark the desired transaction types withIs Clawback Transaction = True, and those transaction types are selected at the banking product type level. -

Has Clawback - This checkbox is displayed only if the selected commission was defined with

Accept Clawback = True.

If you select this checkbox, then the pricing has a clawback commission attached to it. The fields within the Clawback Settings section are displayed only ifHas Clawback = True.Default value:False. -

For Disburse - Select this checkbox if the pricing is applicable only when the contract subject to the agreement is disbursed, and not at the contract approval. This means that the commission applicable to this pricing is automatically calculated by the system as a pre-invoice detail when a disbursement event is approved at the contract level.

-

-

To prevent losing profits, there may be situations when the financial institution claims back all or some of the commission already paid out to third-party entities, due to the fact that the affected contracts were closed before their due date through certain contract events that determine the clawback (for example, Early Repayment or Returned Amount or Goods events).

In the Clawback Settings section, fill in or view the following fields:-

Clawback Commission - If displayed, select from the list the third-party clawback commission to be applied for the agreement pricing. The list is filtered to display only commissions with

ThirdParty Clawbackcommission schema. -

Clawback Commission Currency - If displayed, this field is automatically completed with the selected clawback commission's currency. You can't change this value.

-

Clawback Payment Type - If displayed, select the type of payment to be performed for the clawback commission:

Payment In- for payments from the third-party's settlement account into the financial institution's reconciliation account;Payment Out- for payments from the financial institution's reconciliation account into the third-party's settlement account.

- Clawback Period Type - If displayed, select from the list the period type for the clawback commission.

- Clawback Period - If displayed, enter the number of periods during which the clawback commission can be reclaimed by the financial institution in case a contract subject to the agreement pricing was closed earlier or a transaction type marked as clawback transaction type was performed on such a contract.

- Clawback Transaction Types - Select the transaction types for which the clawback commission should be applied.

You can choose from the list of transaction types withIs Clawback Transaction = True, and are listed at the banking product type level, if theProduct Typefield is selected, or are listed at the banking product level, if theProductfield is selected. - Block After Clawback - Select the checkbox to mark the contract as blocked for further agreements after performing a clawback payment. If

True, which is the default value, when a clawback commission is paid for this contract, no other commission found on the contract can be invoiced by Core Banking.

-

-

Click the Save and Close button.

After defining the relevant details of the agreement and at least one pricing record, proceed to agreement approval.

You or Core Banking's automatic process can create invoices only for agreement records with Approved status. These invoices are later used for paying out the commissions to the third-party entity and/ or the financial institution.