Third-Party Commission

Third-party commissions are the fees paid by the bank or the financial institution to third-party entities (agents, brokers, etc.) for intermediating the selling of a product or service to a customer. There may also be commissions paid by the third-party entity to the financial institution, for example for accessing the financial institution's crediting platforms, or even agreement management commissions paid periodically to the financial institution. These third-party commissions vary from bank to bank, based on their policy.

To prevent losing profits, there may be situations when the financial institution claims back all or some of the commission already paid out to third-party entities, because the affected contracts were closed before their due date.

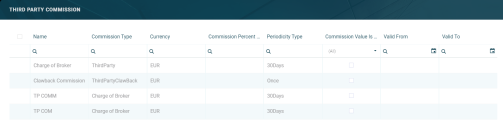

Core Banking has a dedicated menu for managing third-party commissions. These third-party commissions are attached to agreements with third-party entities.

Third-party commissions cannot be used in contracts for customer.

They are not displayed in Banking Product Factory's Commissions menu and they can't be selected in Commission Lists.

Third-party commissions and third-party commission types can't be used in Payment Schedule Type Details.

To manage third-party commissions:

-

In FintechOS Portal, click the main menu icon and expand the Admin Configurations menu.

- Click the Third-Party Commission menu item to open the Third-Party Commission page.

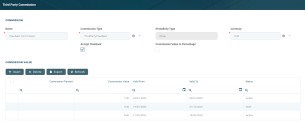

On the Third-Party Commission page, you can create a new third-party commission, search, edit, or delete an existing one. You can't delete commissions already used by other records.

The value of a third-party commission used in active contracts can't be edited. Instead, you can modify the value's validity and add a new value with a future validity period. For details, see the Editing The Value Of A Commission Already In Use section.

Users with the associated role of Loan Admin Officer or Retail Credit Officer can insert, update, or delete third-party commission records. Users with the other associated Core Banking security roles can only view such records.

Creating Third-Party Commissions

Follow these steps to create new third-party commission records:

-

In the FintechOS Portal, click the Insert button on the top right side of the Third-Party Commission page. The Add Third-Party Commission page is displayed.

-

Fill in the following fields from the Commission section:

-

Name - Enter the name of the commission.

-

Commission Type - Choose one from the following third-party commission types:

ThirdParty(out-of-the-box third-party commission type)ThirdParty Clawback(out-of-the-box third-party commission type, defined for clawback commissions)- Other third-party commission types defined by your users.

- Currency - Select the currency of the commission from the drop-down.

- Accept Clawback - Select this checkbox if the commission accepts a clawback commission during agreement pricing definition.

-

Is For Transaction - Select this checkbox if the commission is applicable when approving a transaction at the contract level, for example when approving a disbursement. If left unselected, then the commission is applicable when approving the contract. Depending on this setting, the system automatically triggers the calculation of the commission value in the moment when a contract or a contract event that falls under a third-party agreement is approved.

NOTE

If a clawback commission hasIs For Transaction = True, the clawback commission is calculated/ queued for calculation for each transaction type set in theClawback Transaction Typesfield at the agreement pricing level.

If a clawback commission hasIs For Transaction = False, the clawback commission is calculated/ queued for calculation only for the first occurring transaction type from the ones set in theClawback Transaction Typesfield at the agreement pricing level. - Commission Value Is Percentage - Select this checkbox if the commission is measured by percentage, not as a fixed value

- Commission Percent Applied To - Only displayed if you select the checkbox next to the

Commission Value Is Percentagefield. Choose one of the following:Remaining value- the percentage applies to the contract's remaining to be repaid value .Financed value- the percentage applies to the contract's financed value.Amount- the percentage applies to the contract's amount.Interest- the percentage applies to the contract's interest.

For Term Loan, Mortgage or Overdraft banking products the calculation method is as follows: Use Banking Formula - Select this checkbox to calculate the commission using the banking product formulas.

When using banking formulas to calculate the commission, you can't define actual values for the commission, so the Commission Value section is not displayed.

Commission Formula - Only displayed if you select the Use Banking Formula checkbox. Select the commission formula that you want to use for the commission calculation.

NOTE

You can build your own commission calculation business formulas, or you can use one of the pre-built formulas coming with the Third-Party Management package:

-OnePercentLoanAmountBPFormula- When using this demo formula, the commission is calculated as1% from the loan amount. For example, when loan amount is 10000, the calculated commission is 100.

-ClawbackCommissionEventValueLoanAmount- When using this demo formula, the clawback commission is calculated asinitially granted commission*[(transaction amount of clawback trigger)/(loan amount)]. This formula is not based on formula mapping, but on an input json file, provided as a sample. This can be customized in projects by changing the functiongetFormulaInputJSONfrom theFTOS_TPM_InvoiceHelperserver script library.Formula Mapping - Only displayed if you select the Use Banking Formula checkbox. Select the formula mapping to be used when calculating the commission.

NOTE

You can build your own formula mappings, or you can use one of the pre-built formula mappings coming with the Third-Party Management package:

-OnePercentLoanAmountFormula_formula_FTOS_CB_Contract- When using this demo data mapping, the formula is mapped to the Contract master entity.

If you are not selecting the formula mapping, it is calculated from theformulaInputJSONparameter, which in its turn is calculated based on the event.

NOTE

The types have a periodicity already set: once/ monthly/ trimester etc.

ForThirdParty Clawbackcommission type,Periodicity Type = Once.

IfpercentAppliedTo = financedAmount, thenfinancedAmount = amountDue - advanceAmount;

IfpercentAppliedTo = amount, thenfinancedAmount = amountDue;

IfpercentAppliedTo = remainingValue, then, ifContract Status = ContractVersionDraft, thenfinancedAmount = (-1) * mainBankAccountBalance. No negative values are allowed, so if the result is negative, thenfinancedAmount = null.

Default valuefinancedAmount = null.For Current Account with Overdraft banking products the calculation method is as follows:

IfpercentAppliedTo = overdraftLimitAmount, thenfinancedAmount = overdraftLimitAmount;

IfpercentAppliedTo = usedAmount, then if (periodType == Once),financedAmount = overdraftLimitAmount - availableAmountForOverdraft, elsefinancedAmount = null.

Default valuefinancedAmount = null. -

-

Optionally, view or edit the following fields:

-

Periodicity type - Automatically filled-in when you choose the commission type. You can't change this value.

-

-

(missing or bad snippet)

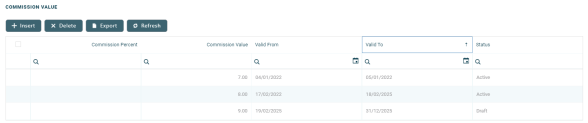

After saving the commission record, you should define the actual values of the third-party commission. These values are later displayed on the Edit Third-Party Commission page's Commission Value section.

When using banking formulas to calculate the commission, you can't define actual values for the commission, so the Commission Value section is not displayed.

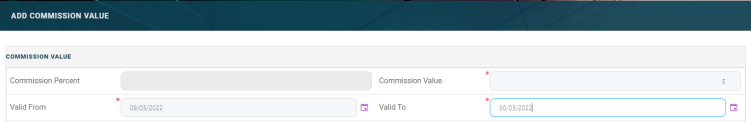

To add a new commission value, follow these steps:

-

Click the Insert button above the Commission Value section within the Add Third-Party Commission page.

-

Fill in the following fields in the newly opened Add Commission Value page:

-

Commission Value - Enter the value of the commission.

-

Valid From and Valid To - Select the interval during which the commission value is applicable.

-

Commission Percent - This is the percent representing the commission. If the commission percentage > 100, Core Banking displays a warning message.

-

-

Click the Save and Close button.