Liquidating a Deposit

You can leave a deposit contract to reach its maturity and allow Core Banking to liquidate it automatically. In this case, the balance available on the deposit is transferred to the current account selected during contract creation and the contract is closed, along with its associated account.

You can also liquidate a deposit on request, either at maturity, with the full payment of interest, or before the deposit's term is up, with possible penalty applied to the accrued interest. This can be especially useful for deposit contracts with automatic roll-over setting at the banking product level. Core Banking offers you two predefined contract transactions that aid you in liquidating a deposit, as follows:

A Deposit Liquidation transaction represents the way of closing the deposit account, so the entire amount is transferred in the current account. If the liquidation occurs at the maturity date, the interest is also paid. If the liquidation occurs on any other day except the maturity date, the customer receives the sight interest, if a sight interest was configured.

You can add deposit liquidation transactions to an approved contract via Core Banking's user interface or through API calls, using the Core Banking endpoints. Read more about these endpoints in the Core Banking Developer Guide.

In order to add a deposit liquidation transaction to a deposit contract through the menus available in Core Banking, follow these steps:

-

In FintechOS Portal, select a contract with Approved status and double-click to open it.

-

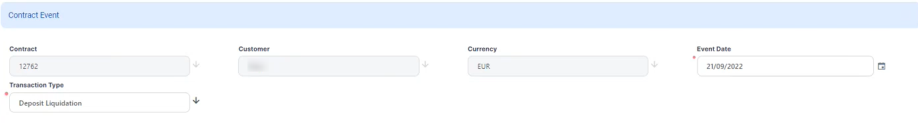

Navigate to the contract's Payments tab and click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields:

-

Event Date - This is pre-filled with the current date.

-

Transaction Type - Select from the list the Deposit Liquidation transaction type. If you can't find it, then the transaction type is not associated with the banking product which is at the base of the contract.

Other values are automatically completed: contract, customer, and currency.

-

-

Click the Save and Reload button.

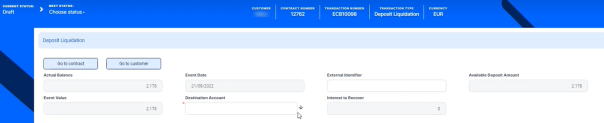

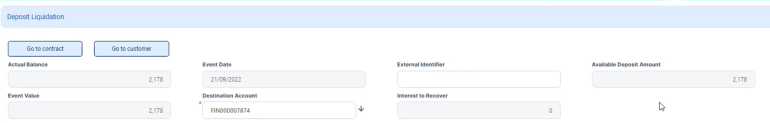

The event is saved in Draft status and a transaction number is automatically generated for it. The Edit Contract Event page corresponding to the selected transaction type is displayed. The account's actual balance, available deposit amount, the calculated interest to recover at the current date, event value, and event date are automatically calculated, and you can't edit them. -

Fill in the external identifier of the transaction, if available.

-

Select from the list the Destination Account for the respective amount, the account where the all the funds from the deposit should be moved by Core Banking after approving the liquidation transaction. The list contains all the active accounts in the system. You should select an account belonging to the same customer as the deposit, opened in the same currency.

-

Click the Save and Reload button.

If the event value meets the business requirements defined within Core Banking, the event is saved. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.

While the event is in Draft status, you can modify all the event's fields except Transaction Type. The event value is not applied to the contract while the event is still in this status. -

Approve the event by changing its status to Approved in the upper left corner of the Event page.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status and Core Banking applies the transaction to the contract, moving the funds calculated in the liquidation event value from the deposit account into the selected destination account.

The transaction is visible in the Transactions section, and you can also see the account operation in the Bank Account Operations section.

-

The deposit account's balance is now zero. View the balance of the account after approving the transaction, clicking the pencil icon next to the Main Bank Account field in the contract's Overview tab:

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.

The liquidated deposit contract, with zero available balance, is now ready to be closed. Depending on its closure settings, it is either picked up by Core Banking and automatically closed, or you can close it manually.

An Early Termination Deposit transaction represents the way of closing the deposit account before its maturity, so the entire amount is transferred in the current account. Because the liquidation occurs before maturity date, the customer receives the sight interest, if a sight interest was configured, or the interest accrued to the date with possible penalty applied.

In order to add an early termination transaction to a deposit contract, follow these steps:

-

In FintechOS Portal, select a contract with Approved status and double-click to open it.

-

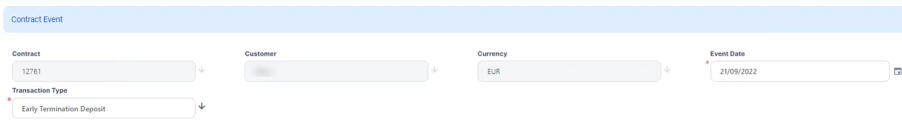

Navigate to the contract's Payments tab and click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields:

-

Event Date - This is pre-filled with the current date.

-

Transaction Type - Select from the list the Early Termination Deposit transaction type. If you can't find it, then the transaction type is not associated with the banking product which is at the base of the contract.

Other values are automatically completed: contract, customer, and currency.

-

-

Click the Save and Reload button.

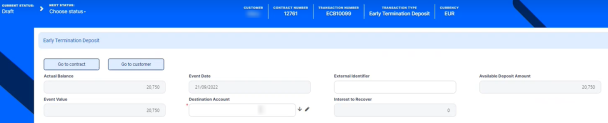

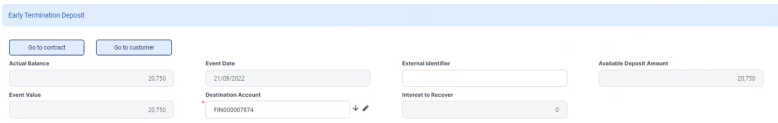

The event is saved in Draft status and a transaction number is automatically generated for it. The Edit Contract Event page corresponding to the selected transaction type is displayed. The account's actual balance, available deposit amount, the calculated interest to recover at the current date, event value, and event date are automatically calculated, and you can't edit them. -

Fill in the external identifier of the transaction, if available.

-

Select from the list the Destination Account for the respective amount, the account where the all the funds from the deposit should be moved by Core Banking after approving the liquidation transaction. The list contains all the active accounts in the system. You should select an account belonging to the same customer as the deposit, opened in the same currency.

-

Click the Save and Reload button.

If the event value meets the business requirements defined within Core Banking, the event is saved. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.

While the event is in Draft status, you can modify all the event's fields except Transaction Type. The event value is not applied to the contract while the event is still in this status. -

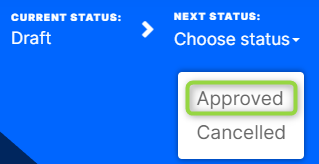

Approve the event by changing its status to Approved in the upper left corner of the Event page.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status and Core Banking applies the transaction to the contract, moving the funds calculated in the early termination event value from the deposit account into the selected destination account.

The transaction is visible in the Transactions section, and you can also see the account operation in the Bank Account Operations section.

-

The deposit account's balance is now zero, as you can see in the contract's Overview tab.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.

The terminated deposit contract, with zero available balance, is now ready to be closed. Depending on its closure settings, it is either picked up by Core Banking and automatically closed, or you can close it manually.