Working with Grace

You can apply a grace period to a loan contract, so that the customer starts repaying the loan later, effectively moving the due installments in the future with a number of months (or as per periodicity). You can set the grace period to apply for the loan's principal, the loan's interest, or both.

Core Banking uses the grace concept in two different contexts, at the loan level or the installment level. The grace period settings must be applied at the banking product definition level, as follows:

-

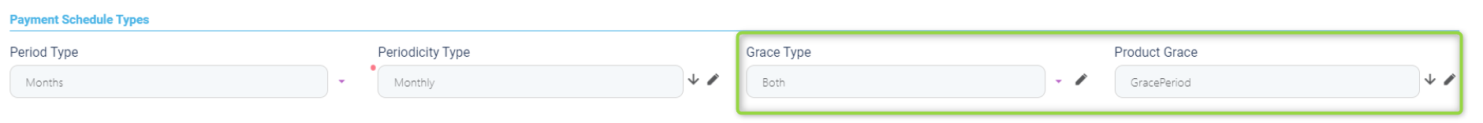

Loan grace - This is negotiated as part of the approval of a loan contract and is granted at the beginning of the loan, for a given number of installments during which the borrower pays only interest or nothing at all. This one has an impact on the schedule projection. Set the loan grace at the banking product definition level, in the Details tab's Payment Schedule Types section, as described in the Banking Product Factory user guide.

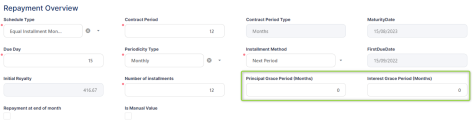

The loan grace setting are exposed at contract definition level for you to customize according to the customer's needs, within the Repayment Overview section:

-

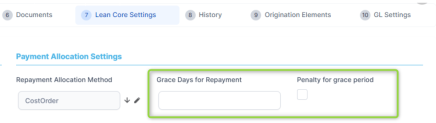

Installment grace - This is when you set a number of days allowed for the borrower to settle their notified amounts. Suppose the contract's schedule has its due date every month on the 15th and you want to allow for 5 days for the amounts to be recovered. If the amounts are not recovered in the 5 days, you also have the option to recalculate the penalty interest, if such interests exist on the contract, starting from the initial due date of 15th, or start applying it starting from 20th of the month. This one does not have an impact on the schedule projection, but on how and when to consider the amounts as overdue, and it relates to the notifications processing. These settings must be set at the banking product level, within the Lean Core Settings' tab Payment Allocation Settings section, as described in the in the Banking Product Factory user guide.