Third-Party Invoices

Third-party invoices are the invoices that track the incomes and expenses resulted from contracts based on the bank or financial institution's agreements with third-party entities (agents, brokers, etc.) . Core Banking has a dedicated menu for managing third-party invoices. These third-party invoices are attached to agreements with third-party entities. You can create invoices manually, using the Invoice menu, or allow Core Banking to create the invoices automatically, using a dedicated scheduled job.

Third-Party Invoice Statuses

The four-eyes principle is applicable for status transitions of an invoice, meaning that a record should be approved by a second financial institution employee, with higher authorization rights. This is enabled via approval task High Productivity Fintech Infrastructure capabilities and thus it is also a financial institution's responsibility to set proper security roles and access rights to its users, in order to make sure that the same user can't insert and also authorize the same record.

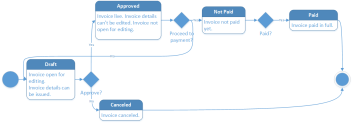

A third-party invoice record has the following business workflow statuses:

-

Draft - the status of a newly created invoice record that was not yet sent for approval. While in this status, you can edit the fields from the record's Invoice and Invoice Details tabs, but no payments can be processed yet. Send the record to approval after editing all the necessary information and adding at least one invoice detail record.

-

Approved - the status of an invoice record after being authorized by a user with approval competencies. While in this status, you cannot edit the record's details. If you need to alter the record's details, change its status back to Draft.

-

Not Paid - the status of an invoice record after approval and before actually performing the bank account transactions for the due payments.

-

Paid - the last status of an invoice record after performing the bank account transactions for the due payments. No other transitions are allowed from this status.

-

Canceled - the last status of a record after manually canceling it straight from the Draft status. No updates are allowed on the record. No other transitions are allowed from this status.

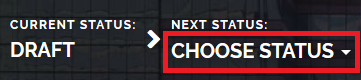

Changing Third-Party Invoice Statuses

You can manage a third-party invoice's life-cycle by changing its status from the top left corner of the screen.

The third-party invoice status transitions are illustrated below:

Managing Invoices For Third-Parties

To manage third-party invoices:

-

Log into FintechOS Portal.

-

Click the main menu icon at the top left corner.

-

In the main menu, expand the Core Banking Operational menu.

- Click the Invoice menu item to open the Invoices page.

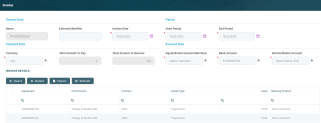

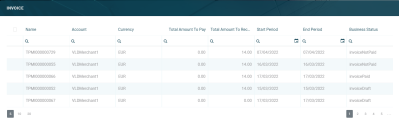

On the Invoices page, you can:

- Create a new invoice manually by clicking the Insert button at the top right corner of the page.

Core Banking can also create the invoices automatically, using the TPM Invoices (TPM) scheduled job. This job runs once each night and creates third-party invoices and payments, for the combination of third-party entity/ agreements currency, during the validity of the agreement, on the Payment Day of each agreement, as defined in the third-party agreement's

Payment Periodicity (daily, monthly, or weekly)- Edit an invoice in Draft status by double-clicking it.

- Delete a Draft invoice by selecting it and clicking the Delete button at the top right corner of the page. You can't delete invoices already used by other records.

-

Search for a specific record by filling in any or all of the column headers of the displayed agreements records list.

Users with the associated role of Loan Admin Officer or Retail Credit Officer can insert, update, or delete third-party invoice records. Users with the other associated Core Banking security roles can only view such records.

You can also add an invoice to the third-party agreement directly from the Agreement page, following the instructions detailed here.

Follow these steps to create new third-party invoice records:

-

In the FintechOS Portal, click the Insert button on the top right side of the Invoices page. The Add Invoice page is displayed.

NOTE

To add an invoice to the third-party agreement directly from the Agreement page, follow the instructions detailed here. -

Fill in the following fields on the newly opened Invoice page:

Field Mandatory Data Type Details General Data Name No Text Automatically filled in with the name of the invoice record, after saving the record. You can't modify this field. External Identifier No Text Enter an external identifier for the invoice, if needed. Invoice Date Yes Invariant Date Automatically filled in with the current date of the system. You can modify this date. Period Start Period Yes Invariant Date Select the starting date of the interval during which Core Banking filters the contracts that are subject to invoicing. End Period Yes Invariant Date Select the ending date of the interval during which Core Banking filters the contracts that are subject to invoicing. The Start Periodmust be<= End Period.Payment Data Currency Yes Lookup Select the currency in which the invoice is to be paid. Total Amount To Pay No Numeric The total amount to pay to the third-party, expressed in the selected currency. You can't modify this field. It is automatically calculated by Core Banking based on the invoice details entered later, after saving the invoice record. Total Amount To Recover No Numeric The total amount to recover from the third-party, expressed in the selected currency. You can't modify this field. It is automatically calculated by Core Banking based on the invoice details entered later, after saving the invoice record. Account Data Agent/ Broker/ Insurer/ Merchant Yes Lookup Select the third-party entity for whom you are creating the invoice. Bank Account Yes Lookup Select the third-party entity's settlement account. You can only choose from the list of the entity's accounts opened in the selected currency. Reconciliation Account Yes Lookup Select the financial institution's reconciliation account. You can only choose from the list of the accounts opened in the selected currency. -

Click the Save and Reload button at the top right corner of the page.

After saving the invoice record, the Invoice page also displays the Invoice Details section, containing a list with all the invoice details attached to the invoice, and the Payments section, containing information about the payments performed by Core Banking.

-

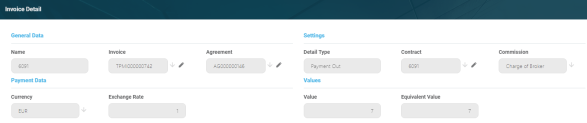

To add an invoice detail to an invoice in Draft status, click Insert within the Invoice Details section in the Invoice page. The Invoice Detail page is displayed.

-

Field Mandatory Data Type Details General Data Name Yes Text Automatically filled in with the name of the invoice detail record, after saving the record. You can't modify this field. This is the contract number. Invoice Yes Text Automatically filled in with the name of the invoice record. You can't modify this field. Agreement Yes Lookup Select the agreement for which you are inserting the invoice detail. You can only choose from the list of agreements with Approved status created for the third-party mentioned in the invoice record. Settings Detail Type Yes Option Set Select the type of payment to be performed for the invoice detail: Payment In- for payments from the third-party's settlement account into the financial institution's reconciliation account;Payment Out- for payments from the financial institution's reconciliation account into the third-party's settlement account.

Contract Yes Lookup Select the contract that is the object of the invoice detail.

You can only choose from the list of contracts with the third-party having the role specified in the selected agreement, and having the activation date during the period of the invoice, for commissions withOnceperiodicity type.

If the commission is applied to contract installments, than the due date of the installment must be within the period of the invoice.NOTE

For commissions withOnceperiodicity type, the contract can't be attached to an invoice detail more than once.Commission Yes Lookup Select the commission to be applied for this invoice detail. You can only choose from the list of commissions mentioned in the selected agreement, that have a valid value during the invoice's period. NOTE

If the selected commission is ofThird-Party Clawbackcommission type, thenDetail Type = Payment In.Payment Data Currency Yes Lookup Automatically filled in with the currency selected at the commission level. You can't modify this field. Exchange Rate Yes Lookup Automatically filled in with the exchange rate for Commission Currency to Invoice Currency valid on the date of the invoice, or the latest exchange rate recorded for Commission Currency to Invoice Currency. You can't modify this field. Values Value Yes Numeric Automatically filled in with the commission value for the selected contract at the current date, calculated by Core Banking. You can't modify this field. Equivalent Value Yes Numeric Automatically filled in with the commission's equivalent value in the invoice's currency, calculated by Core Banking as ( Exchange Rate * Value). You can't modify this field.NOTEEquivalent Valueis summed up toTotal Amount To PayifDetail Type = Payment Out.Equivalent Valueis summed up toTotal Amount To RecoverifDetail Type = Payment In. -

Click the Save and Close button at the top right corner of the page.

You can create only one invoice detail for the combination between a contract, a commission and a detail type. An error message prevents you to create duplicate invoice detail records containing the same combination of

Contract, Commission, and Detail Type values.You can create as many invoice details as needed for an invoice.

Automatic Invoice Payments

Core Banking identifies the invoices that are not paid on the day of payment specified in the agreement, using the Charge Not Paid Invoices service within the TPM Invoices (TPM) scheduled job. The system can automatically generate and process the payments for the invoices. The method of operating these payments depends on the setting of the ThirdPartyPaymentIsNet system parameter. The value of the parameter specifies whether Core Banking should generate one or two bank account transactions and payments for a third-party agreement invoice when the invoice's status is changed from Approved to Unpaid.

Depending on the

Third Party Invoice transaction type's Real Time Process field's value, the transactions made on bank accounts are processed in real-time, when the transaction is approved, or at a later time, after being placed in a queue and taken for processing by a specialized scheduled job.If ThirdPartyPaymentIsNet = False, when the invoice's status is changed from Approved to Unpaid, one or two bank account transactions are generated with the corresponding payments, as follows:

-

If

Total Amount To Recover > 0, one bank account transaction is generated, with source account =Settlement Accountand destination account =Reconciliation Accountwith the value ofTotal Amount To Recover, and with statusApproved. A payment is generated. -

If

Total Amount To Pay > 0, another bank account transaction with source account =Reconciliation Accountand destination account =Settlement Accountwith the value ofTotal Amount To Pay, and with statusApproved. A second payment is generated.

When

Total Amount To Pay > 0 , Total Amount To Recover > 0 , and both payments' statuses become Allocated, the invoice's status becomes Paid.If ThirdPartyPaymentIsNet =True, when the invoice's status is changed from Approved to Unpaid, Core Banking calculates the difference between Total Amount To Recover and Total Amount To Pay. Only one bank account transaction is generated and only one payment, representing the non-zero value between the Total Amount To Recover and the Total Amount To Pay, as follows:

-

If

Total Amount To Recover - Total Amount To Pay > 0, a new bank account transaction is generated with source account =Settlement Accountand destination account =Reconciliation Account, and a payment is generated for the invoice. -

If

Total Amount To Recover - Total Amount To Pay = 0, a bank account transaction is generated, and the transaction's status changes to Paid. -

If

Total Amount To Recover - Total Amount To Pay < 0, a new bank account transaction is generated with source account =Reconciliation Accountand destination account =Settlement Account, and a payment is generated for the invoice.

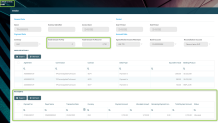

After creating the payment records, Core Banking displays them for each invoice in the Invoice page's Payments section:

Each payment record in the list displays information about the payment number, payer bank account name, transaction date, currency, payment amount, allocated amount, remaining payment amount, total payment amount, and status.

In the Payments section, you can:

-

Search for a specific record by filling in any or all the column headers of the displayed records list.

-

Open a specific a payment from the list by double-clicking it. The payment record itself can only be viewed, and not edited.

-

Delete a payment in Draft status by selecting it and clicking the Delete button at the top right corner. Any payment with a status different than Draft cannot be deleted.

You cannot edit any of the fields of a payment.

-

To view a record, double-click the desired payment on the Invoice page. The Payment page is displayed.

-

View the following information about the selected payment:

| Field | Details |

|---|---|

| Payment No | The number of the payment. |

| Customer | The name of the third-party entity associated with the payment. |

| Payer Name | The number of the payer bank account. |

| IBAN | The IBAN of the account where the money is being paid. |

| Transaction Date | The date of the payment transaction. |

| Currency | The currency of the payment. |

| Bank Reference | The bank reference for the payment. |

| Bank Charge | The amount charged by the bank for performing this transaction. |

| Total Payment Amount | The sum of the payment amount and the bank charge value. |

| Payment Amount | The amount of the payment. |

| Allocated Amount | The amount that was already allocated as a contract's repayment for a notification for the selected customer. |

| Unallocated Amount | The amount that remains to be allocated as a contract's repayment for a notification for the selected customer. |

| Comments | Any comments referring to the payment. |