Core Banking System Parameters

The system parameters used by Core Banking determine the behavior of all the contracts, transactions, limits and other parts that make up your Core Banking system.

The Core Banking system parameters are not to be confused with the FintechOS system parameters, stored in the

systemparameter and systemParameterOnPortalProfile entities.|

|

|

Here's the list of system parameters used by Core Banking, along with their description:

| System Parameter | Description | Module | Parameter Type | Entity | Option Set | Default Value |

AccountingAnalyticChar

|

The analytic character used when displaying decimal numbers. | Loan Admin | Text | N/A | N/A | .

|

AccountingRealTime

|

Specifies if all accounting entries are generated real-time (for True value) or on demand (for False value). |

Loan Admin | Boolean | N/A | N/A | False

|

AdvanceNotification

|

Specifies if the advance to be paid in a contract is displayed in a new repayment notification record (for False value) or included in the front-end fee repayment notification (for True value). |

Loan Admin | Boolean | N/A | N/A | False

|

BankAccountTransactionFeeMarkDown

|

This parameter instructs the system how to process bank account transaction operations. Possible values:

|

Loan Admin | Text | N/A | N/A | Total

|

CalendarYearEnd

|

The maximum year in the calendar to be used when generating holidays for calendars. Format: YYYY |

Loan Admin | Whole Number | N/A | N/A | 2100

|

CalendarYearStart

|

The minimum year in the calendar to be used when generating holidays for calendars. Format: YYYY |

Loan Admin | Whole Number | N/A | N/A | 2019

|

CreditFacilityLimitPercent

|

Represents the default limit of credit facility records. | Loan Admin | Whole Number | N/A | N/A | 30

|

CurrentAccount_WithOverdraft_DaysBeforeExpire

|

Represents the number of days before the overdraft feature's expiration date of a current account when the contract based on that banking product gets displayed in the Soon to Expire Ovedrafts dashboard. | Loan Admin | Whole Number | N/A | N/A | 30

|

DaysBeforePurge

|

Represents the default number of calendar days that a record will be kept in Draft status before it is purged. The records that are due to be purged on the current day and have their transaction type's To Be Purged field marked as True are displayed in the Records To Be Purged Dashboard, within the section specific to the record's transaction type. The job performing the deletion is Delete Purged Entries and it should be scheduled at the bank's level.The custom job error records are also purged at the interval given by this parameter. |

Loan Admin | Whole Number | N/A | N/A | Set it according to the bank's policy. |

DaysFutureInstallmentsReport

|

Represents the default number of days before an installment's due date in order for that installment to be included in the Future Installments report within the Reports Dashboard. | Loan Admin | Whole Number | N/A | N/A | 15

|

DaysPastDueInstallmentsReport

|

Represents the default number of days after an unpaid installment's due date in order for that installment to be included in the Past Due Installments report within the Reports Dashboard. | Loan Admin | Whole Number | N/A | N/A | 25

|

DefaultIntervalLimitsReport

|

Represents the default number of months considered when running the reports within the Limit Report dashboard. | Loan Admin | Whole Number | N/A | N/A | 12

|

DelayDaysForBlockNewContractApproval

|

Represents the default number of delay days for blocking the approval of new loan contracts for customers who have overdue payments. New contract approval is blocked by Core Banking if the customer has overdue days >= the value of the DelayDaysForBlockNewContractApproval parameter. |

Collection | Whole Number | N/A | N/A | 0

|

DepositAggregateItemValues

|

Specifies if the deposit interest is split in two lines or displayed in one line.

|

Loan Admin | Boolean | N/A | N/A | False

|

EarlyRepaymentFee_IndividualNotification

|

Specifies whether to generate a separate repayment notification for the early repayment fee of a contract (for True value) or include the fee into the repayment notification containing the actual early repayment amount (for False value). |

Loan Admin | Boolean | N/A | N/A | False

|

FrontEndFee

|

The commission type used for automatic notification on contract approval (Inclusion)/ or notification daily process (Exclusion). | Loan Admin | Lookup | FTOS_BP_CommissionType

|

N/A | Front-end Fee

|

FTOS_CB_CalculatedProvisions

|

Loan Admin | Boolean | N/A | N/A | False

|

|

FTOS_CB_ExchangeRate_UseLatest

|

Loan Admin | Boolean | N/A | N/A | True

|

|

LimitMandatoryForIndividuals

|

Specifies whether Core Banking should validate the limits for individual customers or only validate them for legal entity customers.

|

Loan Admin | Boolean | N/A | N/A | True

|

LogScheduleJobError

|

Specifies whether job errors should be logged (for |

Loan Admin | Boolean | N/A | N/A | False

|

ManualRepaymentFee

|

Specifies whether a banking product can have only one Repayment Fee type commission on its Commission List or more. This parameter affects the Contract Event page.

Read more information about the effects of this parameter's value in the Transaction Fees section. |

Loan Admin | Boolean | N/A | N/A | True

|

PurgeScheduleJobLogDays

|

Specifies the number of days used to select the old data from the schedule job log to be purged. | Loan Admin | Whole Number | N/A | N/A | 1 |

ReconciliationAccountTreatment

|

Specifies how Core Banking treats situations when the funds of the reconciliation account associated with the banking product used in the contract would go below zero if a disbursement event would be approved.

Negative balance treatment value. Core Banking also takes into consideration the settings used at the banking product level (the Negative balance treatment field's value next to Reconciliation Account). Thus, if the value is specified at the banking product level, then that value takes precedence over the system parameter's setting. |

Banking Product | Option Set | N/A | FTOS_BP_WarningErrorTreatment

|

Warning

|

RepaymentFee

|

The commission type used for notification daily process (Exclusion). | Loan Admin | Lookup | FTOS_BP_CommissionType

|

N/A | Repayment Fee

|

ThirdPartyPaymentIsNet

|

Specifies whether Core Banking should generate one or two bank account transactions and payments for a third-party agreement invoice when the invoice's status is changed from Approved to Unpaid. For

For

When the payments are approved, the invoice's status becomes Paid. |

Loan Admin | Boolean | N/A | N/A | False

|

ThirdPartyRole

|

The list of allowed roles to choose from in the third-party agreement form. | Banking Product | Text | N/A | N/A | Merchant,Insurer,Broker,Agent

|

Unusage

|

Commission for not using the funds. The commission type used for Credit Facility accrual daily process. | Loan Admin | Lookup | FTOS_BP_CommissionType

|

N/A | Commission Unusage Monthly

|

Usage

|

Commission for usage of funds. The commission type used for Credit Facility accrual daily process. | Loan Admin | Lookup | FTOS_BP_CommissionType

|

N/A | Commission Usage Monthly

|

UseCF

|

Specifies whether your installation uses the Credit Facility module for Core Banking Corporate or not.

|

Loan Admin | Boolean | N/A | N/A | True

|

UseContaminationForDPDCategory

|

Loan classification works by risk contamination at the customer and the group levels. This means that if a loan contract belonging to a customer is classified as one of a higher risk due to delays in the repayment process, all the other loans of the customer and of the group where the customer is a member are further classified into that high-risk classification. Read more about loan classification in this dedicated page. This parameter specifies whether Core Banking should use the risk contamination for loan classification or not.

|

Loan Admin | Boolean | N/A | N/A | True

|

UseGLModule

|

Specifies whether your installation uses the General Ledger module or not. The GL module comes within a different digital asset than Core Banking, thus its use is optional.

|

Loan Admin | Boolean | N/A | N/A | True

|

Managing Core Banking System Parameters

Only users with associated

system administrator user rights can view and manage the Core Banking system parameters.In order to manage the system parameters used by your FintechOS Core Banking installation, follow these steps:

-

Log into FintechOS Portal with a user with administrative rights.

-

Click the main menu icon at the top left corner.

-

In the main menu, expand the Admin Configurations menu.

-

Click Core Banking System Parameter menu item to open the Core Banking System Parameters List page.

On the Core Banking System Parameters List page, you can:

-

Create a new Core Banking system parameter by clicking the Insert button at the top right corner.

-

Edit a parameter from the list by double-clicking it.

-

Delete a parameter by selecting it and clicking the Delete button at the top right corner

-

Search for a specific record by filling in any or all the column headers of the displayed parameters list.

Parameters marked as Is System cannot be deleted. When edited, only their value can be changed.

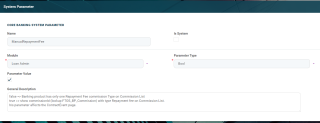

Creating Core Banking System Parameters

To create a new system parameter to be used with Core Banking, fill in the following fields on the System Parameter page displayed after clicking the Insert button:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Name | No | Text | Enter a suggestive name for the parameter. |

| Is System | Yes | Boolean | Select the checkbox to specify that the parameter cannot deleted or edited, except its value. Leave the checkbox empty if this parameter can be changed or deleted. |

| Module | Yes | Option Set | Select the Core Banking module that uses the system parameter. |

| General Description | No | Text Area | Enter a detailed description for the system parameter. |

| Parameter Type | Yes | Option Set | Select the data type of the parameter. Possible values: Text, Date, Date Time, Invariant Date, Whole Number, Numeric, Option Set and Entity.The rest of the fields that need to be completed depend on the selected data type. |

| Entity | Yes | Lookup | Displayed for Lookup parameter type. Select the entity from where you need to pick a record as parameter value. |

| Option Set | Yes | Lookup | Displayed for Option Set parameter type. Select the option set from where you need to pick a value as parameter value. |

| Parameter Value | Yes | Depends on the selected parameter type | Holds the value of the default parameter. Depending on the selected parameter type, you can either enter a value, select the checkbox or select record.

|

Click the Save and Reload button at the top right corner of the page.