Loan Classification

Banks classify their existing loan contracts based upon the days past due (DPD), number of days passed since repayment due date without fully repaying the due amount.

In order to comply with the risk method calculation, the DPD (days past due) value is calculated as the number of days between the contract's due date and the current system date of Core Banking.

Banking being a highly regulated sector such requirements are usually enforced either with regional or local rules. The banks can apply different provision percentages for principal or for interest for each contract, based on this classification: the higher the delay period, the higher the provision percentage applicable and the risk classification. Since the provisions have an impact on the financial results of the bank, this is again driven by regulations and may vary in time or depending on country or region.

Core Banking enables you to define the desired loan risk classification by managing the records in the FintechOS Portal's dedicated menu, Loan Classification.

Loan classification works by risk contamination at the customer and the group levels. This means that if a loan contract belonging to a customer is classified as one of a higher risk due to delays in the repayment process, all the other loans of the customer and of the group where the customer is a member are further classified into that high-risk classification.

The

UseContaminationForDPDCategory Core Banking system parameter specifies whether Core Banking should use the risk contamination for loan classification or not.The risk classification of loan contracts is automatically performed by the

Update Loan Classification (CB) scheduled job based on the loan classification records' definition. To manage loan classification records:

-

Log into FintechOS Portal.

-

Click the main menu icon at the top left corner.

-

In the main menu, expand the Admin Configurations menu.

-

Click Loan Classification menu item to open the Loan Classifications List page.

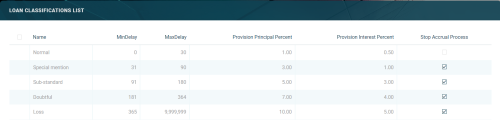

On the Loan Classifications List page, you can:

-

Create a new classification record by clicking the Insert button at the top right corner.

-

Edit an existing classification record from the list by double-clicking it and editing the existing values in the fields.

-

Delete a record by selecting it and clicking the Delete button at the top right corner

-

Search for a specific record by filling in any or all the column headers of the displayed records list.

-

Stop the accrual process for contracts that fall under a specific classification. Select the Stop Accrual Process checkbox next to a record to except all contracts within that category from the accrual calculation processes. All the following categories are automatically excepted from the accrual calculation processes.

-

Include the contracts within a loan category into the accrual processes calculation by deselecting the Stop Accrual Process checkbox next to a record. You can do this only after deselecting the Stop Accrual Process checkboxes next to each of the lower categories.

Only users with the attached Loan Admin Officer security role can select or deselect the Stop Accrual Process checkboxes.

Creating Loan Classification Records

Follow these steps to create new loan risk classification records:

-

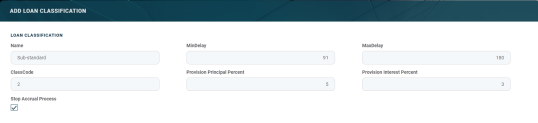

In the FintechOS Portal, click the Insert button on the top right side of the Loan Classifications List page. The Add Loan Classification page is displayed.

-

Fill in the following fields:

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| Name | No | Text | Enter the name of the risk classification record. |

| MinDelay | No | Whole Number | Enter the minimum number of days past since a repayment due date without performing the repayment for a loan contract in order for the contract to be classified in this risk classification. |

| MaxDelay | No | Whole Number | Enter the maximum number of days past since a repayment due date without performing the repayment for a loan contract in order for the contract to be classified in this risk classification. |

| ClassCode | No | Number | Enter a code for this risk classification. This code is used in automatic calculations for contracts classified in one of the risk categories. |

| Provision Principal Percent | No | Number | Enter the provision percentage applicable to the principal amount of contracts falling into this loan risk classification. |

| Provision Interest Percent | No | Number | Enter the provision percentage applicable to the interest amount of contracts falling into this loan risk classification. |

| Stop Accrual Process | No | Boolean | If the checkbox is selected, then the contracts that fall within this loan classification delay category are excluded from the accrual calculation processes. If a category is marked as true, all the following categories are automatically marked as true and excepted from the accrual calculation processes. You can include the contracts within a loan category into the accrual processes calculation by deselecting the Stop Accrual Process checkbox next to a record, within the Loan Classifications List page. You can do this only after deselecting the Stop Accrual Process checkboxes next to each of the lower categories. |

-

Click the Save and Close button at the top right corner of the page.