Third-Party Management

The third-party management functionality of Core Banking refers to third-party entities (agents, brokers, insurers, etc.) which are registered with the financial institution to intermediate the selling of various banking products to customers. For their work, the third-party entities are compensated with fees payable for each new contract, based on a pricing agreement with the financial institution. Core Banking facilitates the management of third-party agreements, the linkage of contracts to third-parties, and the configuration of the commissioning processes through dedicated menus. A third-party invoicing process also takes care of the transfer part of the payments related with these third-party entities.

FintechOS Core Banking allows banks to create third-party agreements based on approvals.

Business Logic

Let's say a third-party entity (an agent, a broker, an insurer, or a merchant) agrees with a financial institution to intermediate the selling of various banking products to customers, for a fee. Thus, an agreement is recorded into the system, containing all the pricing information needed to compensate the third-party. Specific commissioning configurations must be in place to be then applied to the agreements. Whenever the third-party entity intermediates the selling of a contract to a customer, specifying in the contract the entity and their role, the entity should be compensated with the commissions mentioned in the agreement. The payments are performed based on automatic or manual invoicing processes. Agreement records must be approved before being used for invoice generation. You can create invoices and attach invoice details for an agreement for each currency mentioned in the pricing details, that are automatically processed for payment by Core Banking. An automated process running once each night creates third-party invoices and payments for the combination of third-party entity/ agreements currency, during the validity of the agreement, on the Payment Day of each agreement, excluding any invoice details already created on a manual invoice. The payments for the invoices are performed for unallocated or partially allocated payments.

Third-Party Agreements Statuses

Third-party agreements are complex agreements between a financial institution and third-party entities such as agents or brokers, who intermediate the creation of contracts with customers, in exchange of a payment previously negotiated with the financial institution. Therefore the four-eyes principle is applicable here, meaning that a record should be approved by a second financial institution employee, with higher authorization rights. This is enabled via approval task High Productivity Fintech Infrastructure capabilities and thus it is also a financial institution's responsibility to set proper security roles and access rights to its users, in order to make sure that the same user can't insert and also authorize the same record.

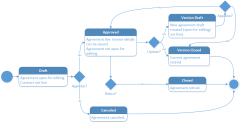

A third-party agreement record has the following business workflow statuses:

-

Draft - the status of a newly created third-party agreement record that was not yet sent for approval. While in this status, you can edit the fields from the record's Agreement tab, but no invoice details are attached to it by Core Banking. Send the record to approval after editing all the necessary details and adding at least one agreement pricing record.

-

Pending - this is a system status applied to records sent for approval, but not yet approved (when the four-eyes approval process is implemented). No updates are available in this system status.

-

Approved - the status of a third-party agreement record after being authorized by a user with approval competencies. While in this status, you cannot edit the record's details, but the invoice details are automatically added through the Core Banking invoicing processes. If you need to alter the record's details, create a new version based on the current agreement.

-

Closed - the last status of a third-party agreement, after manually closing it or after creating a new version based on the current version. No updates are allowed on the record.

-

Canceled - the status of a record after manually canceling it straight from the Draft status. No updates are allowed on the record.

Third-Party Agreements Versioning

Core Banking allows you to create new versions for an existing agreement if you need to modify an existing approved record.

A third-party agreement version can have the following statuses:

-

Version Draft - the status of a newly created agreement version record that was not yet sent for approval. While in this status, you can edit some fields. Send the record to approval after editing all the necessary details.

-

Approved - the status of an agreement version record after being authorized by a user with approval competencies. While in this status, you cannot edit the record's details.

-

Version Closed - the last status of an agreement version, after manually closing it or after creating another new version based on the current version. No updates are allowed on the record.

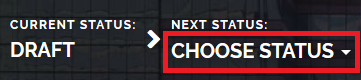

Changing Third-Party Agreement Statuses

You can manage a third-party agreements's life-cycle by changing its status from the top right corner of the screen.

The third-party agreement status transitions are illustrated below:

Note that:

- Once a record is live, its settings can no longer be modified.

- If you want to update the details of a live agreement, you must create a new agreement version.

- When you create a new agreement version, the current version is retired; no updates are allowed on the retired version.

- Every agreement version starts in a Draft state and must go through an approval process before going live.

- Only one version of an agreement can be live at one time.

As a best practice, new records or new versions of existing records created on a specific day should be approved on the same day.

Managing Third-Party Agreements

To manage third-party agreements:

-

Log into FintechOS Portal.

-

Click the main menu icon at the top left corner.

-

In the main menu, expand the Core Banking Operational > Third-Party Agreements menu.

-

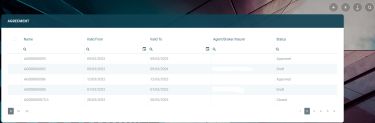

Click the Agreements menu item to open the Agreements page.

On the Agreements page, you can:

-

Create a new agreement by clicking the Insert button at the top right corner.

-

Edit a Draft agreement from the list by double-clicking it.

-

Delete an agreement in Draft status by selecting it and clicking the Delete button at the top right corner

-

Search for a specific record by filling in any or all of the column headers of the displayed agreements records list.

Users with the associated role of Loan Admin Officer or Retail Credit Officer can view, insert, update, or delete third-party agreement records. Users with the other associated Core Banking security roles can only view such records.

You can also manage agreements in the Third-Party Agreements dashboard. Agreements that remain in

Draft status for a predefined number of days can be purged within the Records To Be Purged dashboard's Agreements tab.