Overview

The Banking Product Factory facilitates a wide range of business processes, including but not limited to digital onboarding, loan origination, product portfolio management, and approval flows. Financial institutions can create banking products such as bank accounts, term and mortgage loans, overdrafts, deposits, cards, and credit cards to offer the best service to their customers.

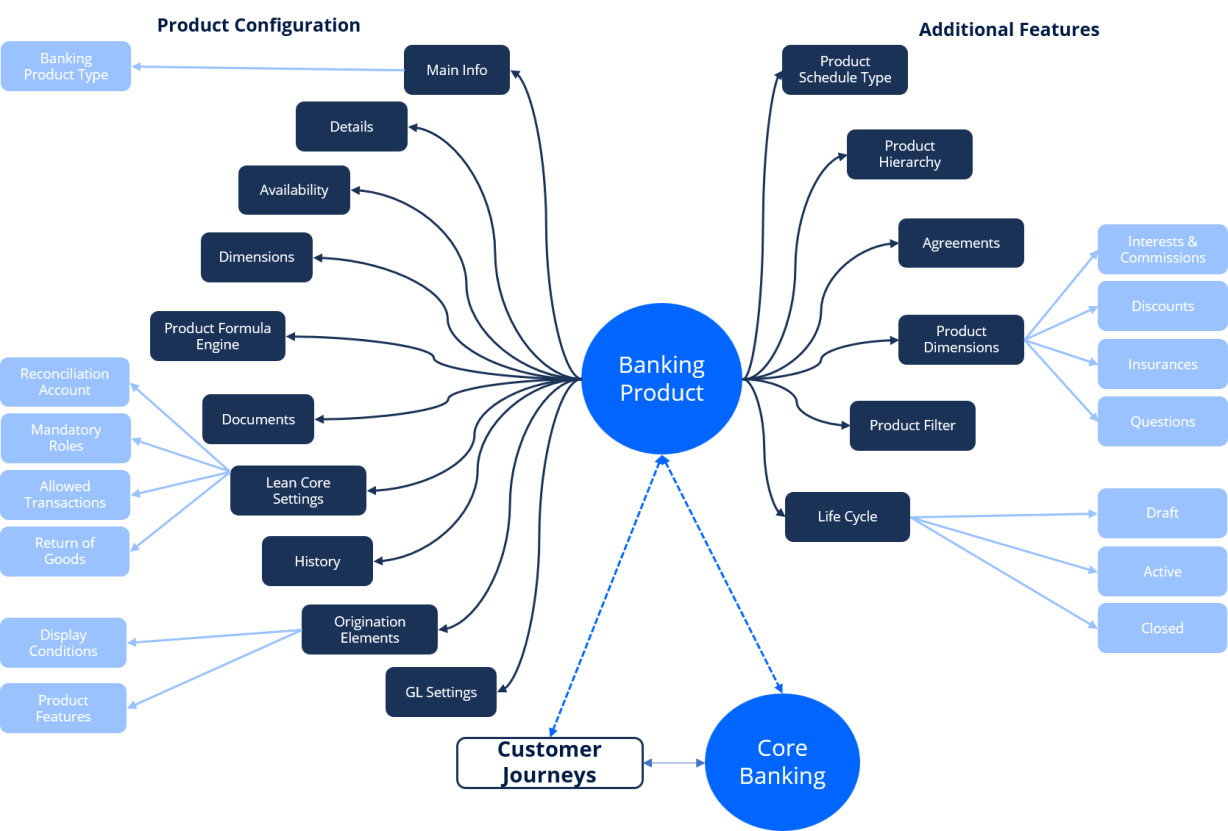

The diagram below shows the Banking Product Factory capabilities to create complex banking products to meet your business requirements.

Additional features are available when Banking Product Factory is implemented along with Core Banking, for example, transactions that can be performed on a banking product, reconciliation account associated with the product, mandatory roles for contract approval, payment allocation settings, or closing contract settings. Also, you can set the specific accounts to be used by Operational Ledger for transactions performed on contracts based on a banking product.

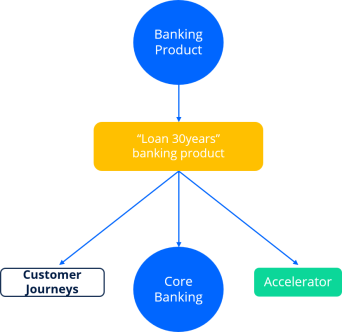

You can use Banking Product Factory to create a loan type with a specific amount interval, availability period, interest rate, commission, credit scoring criteria, etc. Then you can use this type of loan as one of the options that are available to the applicant in a loan application customer journey. Used in conjunction with Core Banking, you can create banking contracts for your customers based on the previously defined products.

Products defined with Banking Product Factory can be used in your customer journeys or you can edit existing customer journeys created in our accelerators such as Buy Now, Pay Later.

As your product portfolio evolves and you add new types of loans, modify some of the conditions for your products, or retire products, the options that show up (or no longer show up) in the loan application customer journey change automatically.

If you want to learn more about designing your banking product, check out the Banking Product Factory course, available through the FintechOS Academy.