Overview

FintechOS Core Banking aims to help banks and/ or financial institutions with the management of records and processes during the life of the business relation with a customer, may it be on lending with underlying limits and collaterals, deposits, minimum current accounts capabilities, third-party management, or credit facilities. Its automated processes scheduled to happen during close of day or start of day calculate cost elements and keep up the correct figures driven by the contracts inserted.

All the features in Core Banking are built using the capabilities of FintechOS Studio, and you can access its menus and dashboards when logged in FintechOS Portal.

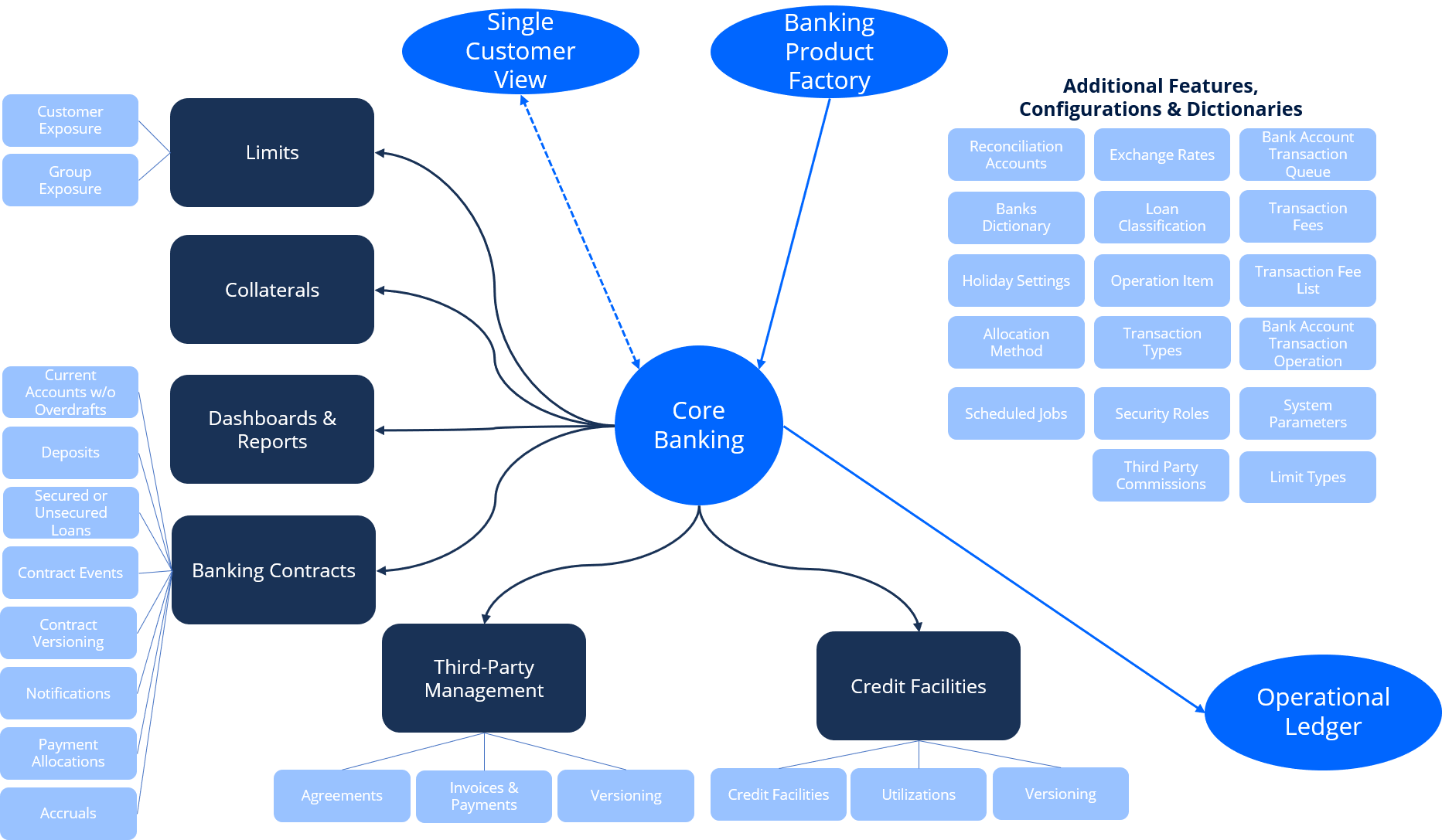

The diagram below exhibits the main features of Core Banking, along with a series of configurations and dictionaries used to automate the complex banking processes performed by the system. Core Banking uses the banking products records defined within Banking Product Factory, and the customer records managed by Single Customer View. Core Banking records are further used by Operational Ledger to generate ledger entries.

Banking Product Factory

This is a powerful automation processor accessible in the FintechOS Studio that builds the products to be used in a customer journey, configures the interest, commissions and the life cycle of a product. Those products are later introduced into a customer journey or, when used in conjunction with Core Banking, they associate the products with transaction types. For more information, see Banking Product Factory.

Single Customer View

Single Customer View is the central hub for collecting, aggregating, and processing banking customers’ data for customers representing legal entities or individuals.

Operational Ledger

Based on the transactions performed in Core Banking, Operational Ledger logs, along with a company’s financial transactions, details that enable the system to build ledger entries. For more information, see Operational Ledger.