Commission Definition Best Practices

This page presents a series of recommendations about defining commissions to be used in conjunction with banking products and contracts based on these banking products. For step by step instructions on how to add commissions and how to fill in each field on the page, please read the dedicated Commissions page.

General Notes

-

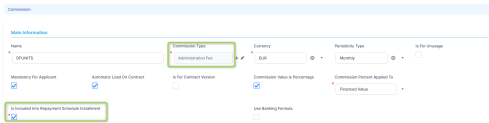

Each commission type has a specific periodicity. Some commissions are taken once within a contract, others can occur monthly, and others when a specific contract event occurs. When you select the

Commission Type, thePeriodicity Typeis automatically filled in by the system. -

If you select the

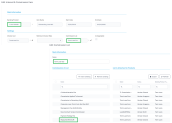

Is Included Into Repayment Schedule Installmentcheckbox for a commission and thePeriodicity Typeis different thanOnce, then the commission is included into the repayment schedule. Note that the repayment schedule should be provided with a column to place the commission.Let's say you define an Administration Fee or a Management Fee with the

Is Included Into Repayment Schedule Installmentcheckbox selected:

When defining the payment schedule type detail, you only need to select the fee type and not the actual fee:

-

Please only define maximum one commission of each type with the

Is Included Into Repayment Schedule Installmentcheckbox selected for every banking product. -

If you select the

Mandatory for Applicantcheckbox for a commission, then, at contract level, the commission cannot be deleted, but its value can be edited. -

If you select the

Is For Unusagecheckbox for a commission, then you are defining a commission for the unused amount of a contract and theCommission Percent Applied Tofield is automatically completed with theUnused Amountvalue. -

If you select the

Commission Value Is Percentagecheckbox for a commission, then the values of the commission can only be percentages. In this case, you must select the contract's operation item to which the commission's percent must be applied. The operation item must be selected from theCommission Percent Applied Todrop-down.

If you deselect theCommission Value Is Percentagecheckbox, then the values of the commission can only be numeric values. -

The validity period of a commission (the period between the values entered in the

Valid fromandValid tofields) is taken into consideration when searching for the values of each commission type. -

The system performs validations to ensure that the time intervals for the same commission's validity do not overlap. It also ensures that the commission has a valid value at any given time of a contract's life cycle.

The system does not allow you to modify the value of a commission already in use in active contracts. However, the bank may decide to alter its commission values starting next month, so the new values must be entered into the system.

The following instructions show how to edit the value of a commission attached to a banking product with Approved status and having contracts based on that banking product.

-

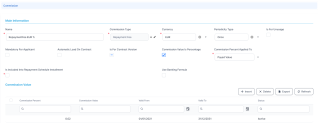

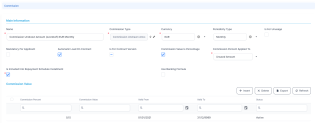

On the Commission List page, double-click the commission whose value has to be changed. The Edit Commission page is displayed.

-

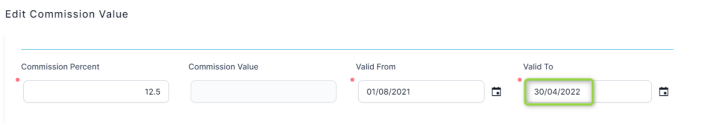

In the Commission Value section, select the value that is in its validity period and double-click it.

-

On the newly displayed Edit Commission Value page, change the date from the Valid To field into the last day when this commission value should be used in contracts.

-

Click the Save and Close button.

-

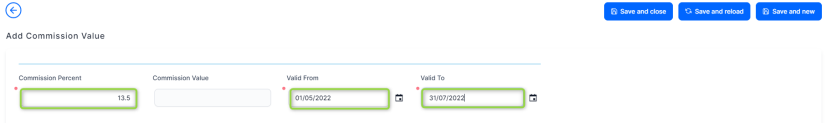

Back in the Commission List page, in the Commission Value section, click the Insert button. The Add Commission Value page is displayed.

-

Complete the fields for the new commission value record, filling in the new

Commission PercentorValue. Make sure the date entered in theValid Fromfield is the next day after the previous commission value is not active anymore. Enter a date further in the future for theValid Tofield. Select the Active status for the new commission value record. -

Click the Save and Close button.

-

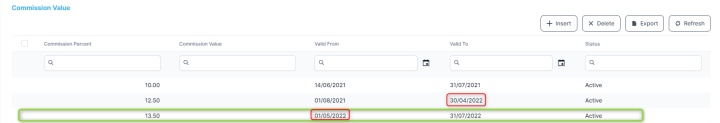

Back in the Commission List page, in the Commission Value section, observe the newly added commission value, valid starting the next day after the previously existent commission value ends its validity.

Contracts created after the new commission value's

Valid Fromdate automatically use the new commission value.

The following sections display examples of the typical definition commissions grouped on their periodicity:

One-time fees are commissions that the bank requires to be paid once and not on a regular basis during the contract's life cycle.

For

Once periodicity type commissions applied to loan contracts, the Percentage commission values should not be applied to Used or Unused Amount.For

Front-End Fee commission types with default Once periodicity type, the Percentage commission values should not be applied to Remaining Value.For

Once periodicity type commissions with the Is For Contract Version checkbox selected, the commission is posted on new contract versions if the Automatic Load On Contract checkbox is also selected. For commissions thus defined, the Percentage commission values can be applied to Remaining Value, but not to Used Amount or Unused Amount. Other than the previously described situation, we advise against defining

Once periodicity type commissions with the Is For Contract Version checkbox selected.The following example illustrates a one-time fee of 0.02% applied to the paid value of early repayment on contracts. The commission is not included into the repayment schedule of installments, it is not automatically loaded on the contract or mandatory for the applicant:

All the

Front-End Fee commission types with Once periodicity type applied to a contract are notified and must be paid when the contract is approved. The Core Banking system parameter FrontEndFee defines the type of commission that is automatically notified at the contract approval.Periodical commissions are required to be paid on a regular basis during the contract's life cycle, monthly or every 3 months depending on the commission type's defined periodicity. For such commissions, the Is Included Into Repayment Schedule Installment checkbox is automatically selected and the commission is included into the repayment schedule. The repayment schedule template should be provided with a column to place this commission type.

For periodical type commissions, such as commissions with Periodicity Type = Monthly, if you leave the Commission Value Is Percentage checkbox unselected, then the commission values are defined as straight forward values. Make sure that the formula in the repayment schedule template has the following types defined: fixed value, linear, linear on year.

If you select the Commission Value Is Percentage checkbox, then you can select the contract's operation item to which the percentage must be applied. The possible options are those listed in the drop-box next to Commission Percent Applied To field:

Remaining value- the percentage applies to the contract's remaining to be repaid value .Financed value- the percentage applies to the contract's financed value.Paid value- the percentage applies to the anticipated payment performed on the contract.Unused amount- the percentage applies to the contract's unused amount from the granted value.Used amount- the percentage applies to the contract's used amount from the granted value.Overdraft limit amount- the percentage applies to the contract's overdraft limit amount.Amount- the percentage applies to the contract's amount.

For term loan, mortgage, current account and deposit contracts, do not define commissions with

Commission Percent Applied To = Overdraft limit amount.Define and use commissions with

Commission Percent Applied To = Overdraft limit amount for contracts based on current account with overdraft banking products.The following example illustrates a monthly 0.15% commission applied to the unused amount of contracts. The commission is included into the repayment schedule of the monthly installments and it is automatically loaded on the contract:

The banks can define commissions for performing certain transactions (events) on contracts.

These commissions can also be defined with straight forward values or as percentages.

For commissions attached to contract transactions, do not select the

Automatically load on contract checkbox.For such commissions, the

Percentage commission values should not be applied to Used Amount or Unused Amount.If the

Is Negotiable checkbox is selected at product level when adding an interest & commission item, then at transaction level the value or percentage of the commission brought from the banking product level can be edited, otherwise the commission cannot be changed.The following example illustrates a commission applied to an early repayment contract event. You can see the same commission mentioned as a repayment notification detail after approving the event:

As you see below, when performing an early repayment contract event and on the banking product's commissions list there is a commission with the same type as the commission placed in the event, then the event automatically retrieves the commission from the list defined at the banking product level:

The commission used within the example presented above is defined as follows:

The banks can define commissions to be paid back to the customer when performing Returned Amount or Goods transactions (events) on contracts. A part or the entire amount of Front-End Fees paid by a customer at the contract creation can be paid back to the customer if they choose to return the amount of the loan or the goods in the time frame defined at the banking product level. For term loan or mortgage products, you can specify during banking product definition whether the product accepts Return Amounts or Goods transaction types or not, along with specific conditions, such as the number of days during which this transaction type can be created at the contract level.

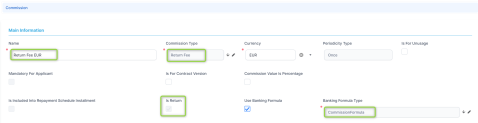

The Return Fee type commissions, calculated using the ReturnCommissionFormula banking product formula as sum of all Front-End Fee type commissions with Is Returnable = True)*[(Returned amount)/(Loan amount)], are paid back to the borrower if a Return of Goods transaction is performed.

To set up contracts that allow Return Amounts or Goods transaction, apart from configuring the Return Of Goods section within the banking product's Associated Transactions tab, make sure to define front-end fees with Is Returnable = True and return fees with Is Return = True. Attach the returnable front-end fees and the return fees to the commission list used within the product's Interests&Commissions tab, and select the ReturnCommissionFormula banking product formula within the product's Risk Formulas tab.

Return Fee commission definition example:

Returnable Front-End Fee commission definition example:

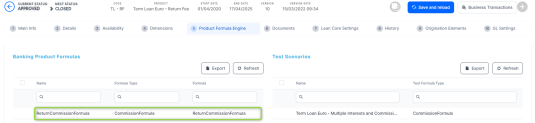

Return fee and returnable front-end fee used within a term loan banking product definition:

ReturnCommissionFormula banking product formula used within a term loan banking product definition:

The ReturnCommissionFormula banking product formula was already mapped to the entity holding contract records, thus no more actions are required for its definition. The picture below illustrates the mapping:

At the contract level, the Fees & Commissions section contains the returnable front-end fee, as it was defined with Automatically load on contract = True.

The following example illustrates the return fee commission automatically calculated for a Returned Amounts or Goods contract event.