Managing Commissions

Commissions are set up independently from the banking products. They are available in banking products in the form of commission lists, after they have been grouped together based on their use.

Commissions

Commissions are the fees taken by the bank for offering a product or service such as opening an account, for cash withdrawals, for transfers, for making payments in certain countries, for exchanging currencies, for emitting debit cards, for handling documents etc. These commissions vary from bank to bank, based on their policy.

You can manage commissions using Banking Product Dimensions. They are grouped into lists and attached to banking products, so they reach the contracts.

To manage commissions, follow the steps below:

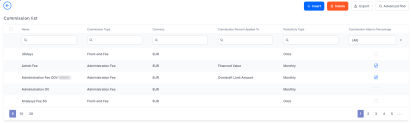

- In the main menu, click Product Factory > Banking Product Dimensions > Commissions, and the Commission List page opens.

- On the Commission List page, you can add new interests or search, edit, and delete existing ones.

The value of a commission used in active contracts cannot be edited. Instead, you can modify the value's validity and add a new value with a future validity period. For details, see the Editing The Value Of A Commission Already In Use section.

Read about how and when to use commissions based on their periodicity type on the dedicated Commission Definition Best Practices page.

-

To create a new commission, click the Insert button.

-

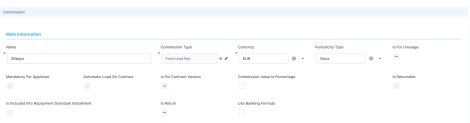

In the newly opened Add Commission page, fill in the following fields:

-

Name: Enter the name of the commission.

-

Commission type: Choose one from the following: Administration Fee, Commission Undrawn Amount (overdraft) Monthly, Commission Undrawn Amount (overdraft) Once, Commission Unusage Monthly, Commission Unusage Once, Commission Usage Monthly, Commission Usage Once, Front-end Fee, Management Fee, Payment Holiday Fee, Repayment Fee or Return Fee.

NOTE The types have a periodicity already set: once/ monthly/ trimester etc.

-

Periodicity type: Automatically filled-in when you choose the commission type.

-

Status: Select either

ActiveorDraftto enable or disable the commission. -

Currency: Select the currency of the commission from the drop-down.

-

Is For Unusage: Select this checkbox if the commission is applied for amount unused from the contract's amount. Usually this commission is applied for unused overdraft amounts.

-

Commission value is percentage: Select this checkbox if the commission is measured by percentage, not as a fixed value.

-

Commission percent applied to: Only displayed if you select the checkbox next to the Commission value is percentage field. Choose one of the following:

- Remaining value - the percentage applies to the contract's remaining to be repaid value .

- Financed value - the percentage applies to the contract's financed value.

- Paid value - the percentage applies to the anticipated payment performed on the contract.

- Unused amount - the percentage applies to the contract's unused amount from the granted value.

- Used amount - the percentage applies to the contract's used amount from the granted value.

- Overdraft limit amount - the percentage applies to the contract's overdraft limit amount.

- Amount - the percentage applies to the contract's amount.

For Term Loan, Mortgage or Overdraft banking products the calculation method is as follows:

IfpercentAppliedTo = financedAmount, thenfinancedAmount = amountDue - advanceAmount;

IfpercentAppliedTo = amount, thenfinancedAmount = amountDue;

IfpercentAppliedTo = remainingValue, then, ifContract Status = ContractVersionDraft, thenfinancedAmount = (-1) * mainBankAccountBalance. No negative values are allowed, so if the result is negative, thenfinancedAmount = null.

Default valuefinancedAmount = null.For Current Account with Overdraft banking products the calculation method is as follows:

IfpercentAppliedTo = overdraftLimitAmount, thenfinancedAmount = overdraftLimitAmount;

IfpercentAppliedTo = usedAmount, then if (periodType == Once),financedAmount = overdraftLimitAmount - availableAmountForOverdraft, elsefinancedAmount = null.

Default valuefinancedAmount = null.

-

Is included in repayment schedule installment: If this checkbox is selected and the Periodicity Type is not Once, then the commission is included in the Repayment Schedule (should be provided with a column where to put this Commission).

-

Automatically load on contract: Select this checkbox if the commission should be automatically loaded on the contracts based on banking products using this commission.

-

Mandatory for applicant: If you select this checkbox, then the commission is mandatory to be paid by the customer. If the bank has negotiated with the customer not to pay this commission, then do not select this checkbox.

-

Use Banking Formula: Select the checkbox if the commission is to be defined with an attached business formula for value.

-

Is For Contract Version: Select the checkbox if the commission is applied when a new version of the contract is created.

NOTE

If a version for a contract is created In Core Banking more than once on the same day, then all commissions withIs For Contract Version = Truethat were not notified yet for each previous version are deleted. At the end of the day, there is only one commission for the latest version. -

Is Return: This field is only visible and true if

Commission Type = Return Fee. Automatically filled-in when you chooseCommission Type = Return Fee, read-only. The selected checkbox means that the commission is a return fee, a commission to be paid back to the borrower following aReturned Amount or Goodsevent on a loan or mortgage contract. Read more information about return fees. -

Is Returnable: This field is only visible if

Commission Type = Front-End Fee. Select this checkbox if the commission can be paid back to the borrower following aReturned Amount or Goodsevent on a loan or mortgage contract. -

Banking Formula Type: Select the banking formula type to be used for commission calculation. This field is visible and mandatory to be filled in when

Use Banking Formula = True.IMPORTANT!

SelectCommissionFormulabanking formula type for theReturn Feecommission type. Thus, at banking product definition level, you can selectReturnCommissionFormulain the Banking Product Formulas section of the Risk Formulas tab.

Used inReturned Amount or Goodsevents on a loan or mortgage contract, this dedicated formula's result = (SUM of allFront-End Feetype commissions withIs Returnable = True)*[(Returned amount)/(Loan amount)].

-

-

Click the Save and Reload button.

-

In the Commission value section, insert or delete the values of the commission.

-

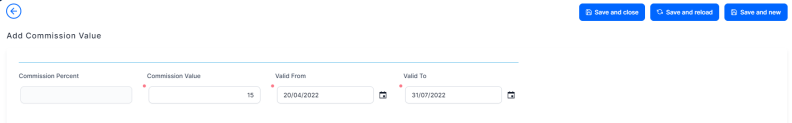

To add a new commission value, click Insert and fill in the following fields in the newly opened Commission page:

-

Commission percent: The percent representing the commission. If the commission percentage > 100, Banking Product Factory displays a warning message: "

Make sure percent value is accurate." -

Commission value: The value of the commission.

-

Valid from: Select the day when the commission value becomes applicable.

-

Valid to: Select the last day when the commission value is applicable.

-

-

Click the Save and Close button.

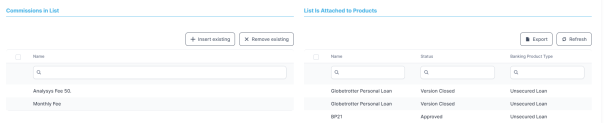

Commission Lists

A commission list allows you to group multiple commissions into a collection of commissions that you can use in a banking product. It is possible to group under the same umbrella the following types of commissions created individually in the Commissions menu: Front-end fee& Management fee & Repayment fee.

To manage commission lists:

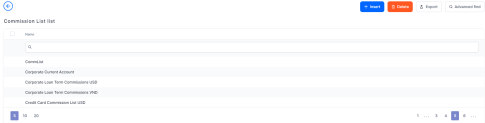

- In the main menu, click Product Factory > Banking Product Dimensions > Commissions List, and the Commission List list page opens.

-

On the Commission List list page, you can add new interests or search, edit, and delete existing ones.

Filter Interest

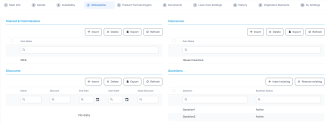

You can define filtering criteria for your interests and commissions which you can later on call in your banking products.

To manage filtering criteria, follow the steps below:

- In the main menu, click Product Factory > Banking Product, and the Product List page opens.

-

Select the product where you want to add the filter.

- In the Dimensions tab, insert or edit an interest or a commission.

- In the Interest & Commission Item Filters section, click Insert, and fill in the following fields:

Filter: Select a filter created in the Product Filter.

Value/ Date: Select the beginning value/ date for the filter.

Until Value/ Until Date: Select the maximum value/ date for the filter.

Description: This field is automatically filled in after the Save and Reload button is clicked. The values/ dates inserted above are turned into an expression.

For Lookup attributes, the following fields are available:

Filter: Select a filter created in the Product Filter.

Option set: Automatically filled in with the option set name created for the attribute.

Description: Add a description if needed.

grid of options: This field is automatically filled in after the Save and Reload button is clicked. The values of the option set are displayed. Select the checkbox for the values you wish to include in the filter.

- Click the Save and Close button.