Manage Policy Claim Data

Claim data is used in decision process when writing a new risk or when modifying existing risks during underwriting, adjusting indemnity limits if no automatic reinstatements are in place, or renewing a policy. It can determine a set of KPIs at policy level that can be further aggregated at portfolio levels.

The system is able to get claims data from an external source in order to be used in the views for Policy Claims data and other processes (e.g. Update Sum Insured after a claim is settled).

The Policy Claim Data API is used to log the policy claim data. The API is called each time an update is made at reserve level and/or payment level. Find out more about the API by accessing the Policy Claim Data API page.

View the Loss Ratio

The loss ratio (LR) is calculated at coverage level, and takes into account the gross written premium (GWP).

In order to view the loss ratio, access a policy and click on the Claims Data tab.

The tab displays three sections:

-

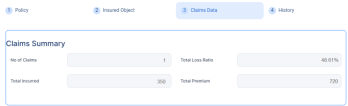

Claims Summary: This section contains a grid with the following fields:

-

No of Claims: All claim files opened on the coverage;

-

Total Loss Ratio: Calculated as Incurred Total/Premium Amount Total * 100. It is displayed in percentages.

-

Total Incurred: Calculated as the sum of all incurred values for all coverages. The incurred is calculated as: SUM (all resevres on the coverage) + SUM (all indemnities paid on that coverage).

-

Total Premium: Calculated as the sum of all the premium values for all coverages.

-

Currency.

-

-

Affected Coverage: Keeps and reflects the tabular view for claims recorded at coverage level.

-

Claim Files: This section displays a list with all the claim files recorded to that policy. The claim file data is updated after each API call for said claim file with the latest data. The values are updated each time the API is received.

View the Indemnity Limits Updates After a Claim

After a claim, the Sum Insured of the policy diminishes with a value corresponding to the amount paid for that loss, when the policy is not subject to an automated reinstatement of Sum Insured. In the Coverage view, the Available Indemnity Limit contains the updated Sum Insured after a loss is paid partially or final. The Update Indemnity Limit field is introduced to state if the indemnity limit needs to be updated from a policy after each paid claim. The default value is No. The first time a policy is saved, unless otherwise modified by the Formula Engine or an API, the Available Indemnity Limit is equal to the Sum Insured/Indemnity Limit. The update of the Available Indemnity Limit is triggered when at the Policy Claim Data level the following two rules apply at the same time, for a single claim:

-

The claim reserve value is 0;

-

The claim payment's value is greater than 0.

The source for this data is always FTOS_INSPA_ClaimFiles if the initial rule is validated updateSumInsuredafterClaim = True.

The Available Indemnity Limit in Policy Administration is equal to the Indemnity Limit in Core Claims Admin.

The Indemnity Limit consumes the recorded value limit and the risk level for the peril that has the claim file attached to it.

Indemnity Limit = MIN (Value Limit, Available Indemnity Limit).

The Available Indemnity Limit is calculated as per below:

Available Indemnity limit = Previous value for the Available Indemnity Limit - Current Indemnity Paid for the coverage.

In the remote case in which the result has a negative value, the updated Available Indemnity Limit becomes 0. In case the claims settles a total loss, the Available Indemnity Limit becomes 0. The values of the claims fees (e.g. legal expenses, handling costs, experts costa) are not included in the process of updating the Sum Insured.

At 01.01. 2021 a policy is issued with the Sum Insured for the building being 100.000 EUR, so all the coverages and the perils for the building have a sum insured of 100.000 EUR.

The content is insured at 20.000 EUR, so all the coverages and the perils for the content have a sum insured of 20.000 EUR.

TPL is covered for 10.000 EUR. So the coverages and the perils for TPL have an Indemnity limit of 20.000 EUR.

On the 27th of February a fire ensues that affects both the building and the content. The fire does not spread or affect any neighboring areas and no individuals other than the insured’s family is affected.

One month later, the file is settled and a claim of 30.000 EUR is paid, 25.000 EUR for the building and 5.000 EUR for the content.

If an agent searches for this policy on the 28th of March, the system displays the following values :

-

Available Indemnity Limit for the Building and all subsequent coverages = 75.000 Eur;

-

Available Indemnity limit for the Content and all subsequent coverages = 15.000 Eur;

-

Available Indemnity Limit for TPL = 10.000 Eur.