Manage Outgoing Payment Requests

For some of your recurring outgoing payments scenarios, you can configure Billing & Collection to automatically approve and allocate those types of outgoing payments. For other scenarios, you have an outgoing payment request manual approval flow that lets you propose, approve or decline such requests, according to your needs.

With Billing & Collection you can effortlessly manage payment requests received from different sources or systems - such as Claim payments, Commission, Broker Balance (Credit), etc. See some examples below.

Payment requests are automatically registered into your system when you use the Bank Statements functionality to upload your bank statement files. Your import triggers the automatic parsing, sorting and matching of the Payment data - contained by the file, with the Outgoing Payments already configured or scheduled by you - such as broker commissions. For payment requests that respect some rules, such as providing the correct unique identifier for a broker or the number of the policy under brokerage, the allocation flow for the outgoing payment is completely automated. After import, you can find all the new outgoing payments into the Outgoing Payment Requests section. You can recognize the automatically allocated outgoing payments by their Paid business status. If necessary, you can open a record to see the paid amount. More details about how the system does the sorting of the received payment data, in the Import Bank Statements documentation.

The Outgoing Payment Requests section is also the place where you go to manually insert a request for an outgoing payment into the system, when needed.

Payment requests are automatically registered by your system - for example, when you use the Bank Statements functionality to upload your bank statement files or when you receive an API call, with some payment request details. The Outgoing Payment Requests list view is continuously updated, helping you understand the requests for payment you received, in real time. However, there are cases when you need to manually insert a new payment request. For example, for a one-time payment that goes towards a consultancy company.

Follow the steps below to insert a new payment request:

-

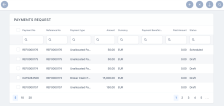

In FintechOS Portal, go to Main Menu > Billing & Collection > Outgoing Payments > Payments Requests. The Payments Request grid is displayed, displaying all the request records.

-

Click Insert. The Outgoing Payment Requests form opens.

-

Input the necessary details in the form, in the following sections:

-

The Payment Request section. For returning a payment, the details in this section are already filled in by the system and you only need to use the option sets to select the Payment Due Date and the Scheduled Date for payment.

-

The Payment Beneficiary section, where the Beneficiary Type can be: Payer, Insured, Contractor, Policy Beneficiary, Broker, Service Provider, or Other.

The Beneficiary Category can have one of the following values: Individual Person, Legal Person or Other.

-

The Payer Details section, to input the company's details. Insert any relevant information in the Comments field, to be considered when approving the payment request.

-

-

Click Propose payment return, so the record transitions from the Draft to the Proposed status. In this way you can further approve the payment request.

-

Click Save and Close to register the payment request. You can now find the record in the Payments Requests grid.

You can approve a payment request only when it is in Proposed status. Follow the steps below to approve an outgoing payment request:

-

Go to Main Menu > Billing & Collection > Outgoing Payments > Payment Requests. In the Payment Request grid, find the record of the Proposed outgoing payment record.

-

Open the payment request record and go to tab 2. Approval.

-

Click Approve. The record is now in Approved status, and in tab 3. Payment Confirmation, you can see the details.

The Billing & Collection solution automatically allocates an Outgoing Payment Request to an Outgoing Payment, based on the following rules:

-

Reference No of the payment request.

-

IBAN Account of the Payment Beneficiary and Payment Amount.

-

The allocation is done only if the payment has the same currency and the same IBAN as in the payment request.

-

The allocation is done only for the Payments Requests which are the Approved Status, with Updated Status as Scheduled.

As the first step of the allocation process, the system checks the details of the outgoing payments for the existence of Reference No.

If the user imports a Payment File (MT940 -D) using only the Reference No., the payment is allocated on that specific Request that matches the Ref No.

In case the Payment File contains a smaller payment amount than in the Outgoing Request, that specific payment amount is allocated on the Outgoing Payment Request, the Payment is Closed and the Outgoing request remains in Scheduled status, until the total sum is paid.

In case the Payment File contains a bigger payment amount than in the Outgoing Request, the rest of the amount remains in the Unallocated status (the payment is Partially Allocated).

First, if the Reference No is not identified, the system checks the IBAN Account, the currency, and the Payment Amount and allocates the Payment Request which has the same amount.

If the user imports a Payment File (MT940 -D) using the IBAN, Currency, and the correct Payment amount, then the amount is automatically allocated on the Outgoing Request identified by those criteria exactly.

If any of the criteria are not found/ filled in the MT490File, the automatic allocation does not take place. (E.g.: If the payment amount is different than the OutgoingRequest).

Also, when multiple outgoing requests are found (that have the same IBAN, Currency, and Payment Amount), the automatic allocation chooses the oldest record and allocates the amount on it (FIFO rule).

Note: All the automatic or manual allocation for Outgoing Payment Requests takes place only if the request is in status Scheduled.

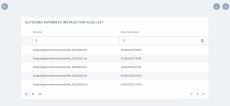

The Payments Instruction File is an important element of the automatic payment management featured by the Billing & Collection solution. This File contains instructions that trigger the payments from the insurer’s bank account, for a claim payment, for example.

A daily job automatically examines the outgoing payments requests registered into the system - irrespective of the source, process, or system it came from. Next, it prepares the File containing the payment instructions for the eligible requests - for example, for the outgoing payments in Scheduled status. The File is then transmitted to the bank and the amounts are disbursed from the insurer’s bank account, according to the instructions.

Follow the steps below to view a payment instruction file: