FintechOS Platform 24.1

May 14th, 2024

This minor release of the FintechOS Platform brings security updates, improvements and user guidance for the Code Editor, enhanced Product Factory, and more.

What's New

Code Editor Improvements

Enhanced Security Posture

The Code Editor comes with additional security improvements. Network and extensions control were implemented, thus allowing users to install Visual Studio Code extensions from a pre-defined list.

Contextual Help and Tutorial

Code Editor's usability is improved with just-in-time guidance and documentation that ensures seamless and intuitive access to contextual help and guidance throughout your workflow. The contextual help comes with useful tips on how to enable and use the extension, together with an extended tutorial on how to set up and use the extension in a development environment.

Edit Digital Asset Import Orchestration Scripts

New JS attributes were added to the Code Editor: beforeImport and afterImport, BeforeSaveServer and AfterSaveServer.

Improved Developer Productivity

Manage Digital Identities with FintechOS Studio

As an admin, you can visualize identities based on different properties and can carry out actions which are integrated with the identity provider. For example, you can insert new users, activate or deactivate them or delete temporary identities. Read more in the documentation.

Current User Login Data

You can retrieve all login data, successful and unsuccessful, for the current user logged in to Studio by using the following Client SDK method: ebs.getCurrentUserSessionsHistory.

Extended Scope of Security Roles

Build cost has been reduced by having developers perform fewer manual actions to incorporate security configurations when relying on items outside their solution, like those part of system packages. For this, the new option, Include Extended Security Configuration, allows you to control if the digital solution package should include or not all security role items of the security roles referred by the configuration items in your package. Thus, you can choose to include security configurations that relate to items external to the package but are linked to the same security roles.

DB Objects Execute Before Import

Scripts and other database objects are now executed before importing each digital asset to a new environment. This action is done automatically, and it streamlines the import of digital solution packages to a new environment by executing db scripts first and limiting the number of possible entanglements. Read about this in the documentation.

New httpAction Method

A new httpAction method is available for running an HTTP Post request and returning the HTTP response from the server, while using the httpVerb method for CRUD operations.

New SDK to Delete Temporary Identities

Temporary identities can now be deleted from the FintechOS Identity Provider using a new SDK method, server.security.deleteTemporaryIdentity. The temporary system users are deleted only if they expired according to the configurations previously made in the B2C portal configuration.

Products Improvements

APIs

The insurance and banking product APIs have been enhanced as follows:

- Product Eligibility - New APIs allow you to retrieve the eligibility for a product application. The two APIs allow you to check underwriting based on either the product code or product ID only for the underwriting rules tagged as used in eligibility (as opposed to the underwriting APIs which check all underwriting rules, both general and used in eligibility).

- Offer Eligibility - A new offer eligibility API assesses eligibility for each product or product plan included in a particular offer. This involves evaluating individual product/plan eligibility criteria to produce a final consolidated eligibility status for the entire offer.

- Product Underwriting - The performance of product code and product ID based underwriting APIs has been improved. In the case of a formula error, a

500 Internal Server Errorstatus code response is returned, with the explicit error message from the formula engine. - Offer Pricing - When requesting pricing for a draft offer, the product offer pricing API now returns a

400 Bad Requestresponse, instead of the misleading404 Not Foundstatus code. The error message indicates that the operation cannot proceed due to the offer's draft status and the offer must be approved for pricing calculation. - Offer Underwriting - The offer underwriting API has been enhanced to validate the audience criteria before checking the underwriting rules and automatically stop the process if the audience criteria are not met. The Input request parameter has been extended to support audience criteria parameters (age, income brackets, etc.).

- Offer Details - The offer details API response now includes a section called

InputsMetadatawhich contains information about the input parameters required for audience , underwriting, and pricing evaluations. The section lists the name, data type, and acceptable values for each input parameter.

Dedicated Web API Client Library

Product APIs are now also available in the form of a Web API Client Library. This provides easy integration within the FintechOS Platform development environment complete with automatic authorization. You can find the library in the Web API Client Libraries list under the name PFAPI.

Banking Product Insurance Enhancements

Insurances required from loan applicants support new configurations:

- Insured amount based on product formulas - In addition to value and percentage based amounts, you can now set the insured amount based on a formula.

- Insurance payment periodicity - You can now set the frequency of insurance premium payments: once, 30 days, annual, etc.

- Bancassurance classes - Insurances are now classified in categories such as credit insurance, home insurance, or life insurance, which allows them to be displayed in the payment schedule (if the insurance has a recurrent periodicity and its bancassurance class is associated with a column in the loan's payment schedule).

Personal Overdraft Improvements

You can now configure the overdraft limit amount and term, as well as the overdraft interest.

Penalty Interests Consistency

Once you set up a penalty interest based on a reference value, you cannot reuse that reference value in another penalty interest. E.g.: If you set up a penalty interest as a percentage of the principal, you cannot create another penalty interest that is also based on the principal.

The General reference value is mutually exclusive with other penalty reference values. If you create a penalty interest based on the General reference value, you cannot create any other penalty interests. Likewise, if you create a penalty interest based on another reference value, you cannot create a penalty interest based on the General reference value.

Simplified Lexicon Terms Reuse

If you wish to use an existing lexicon term in a new context (in a product template that doesn't have the lexicon term associated yet), you no longer have to assign the product template to the lexicon context in advance.

When typing the name of an existing lexicon term in the Product Designer, if the lexicon term is not yet associated with the product template, you can now immediately use the term in your product (the lexicon context will be automatically updated with the product template).

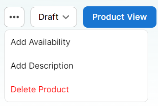

Delete Product Drafts

In the product designer, when editing a product in the draft state, the ellipsis menu (...) now includes an option to delete the draft.

You cannot delete approved or closed product versions.

Customizable Currencies

You can now customize the list of currencies available for your products from the selectedCurrencies key in the kv/<environment name>/mkexp-bff/appSettings Configuration Manager directory.

Required Documents Refinements

The mandatory for debtor marker has been replaced with the more generic mandatory for applicant. The mandatory for co-debtor marker now appears only when the product allows co-debtors.

Other Product Changes

The product codes have been limited to maximum 10 characters.

Journey Triggered Server-Side Scripts

The Advanced sections of form driven flows, app data forms, and form driven flow steps include two new tabs called Before Save Server Event and After Save Server Event that trigger server side scripts before and after saving form data.

This enables you to decouple business logic related to database CRUD operations into journey-specific and entity-specific (event triggered automation scripts) categories.

For detailed descriptions of the code execution sequence in various scenarios, see the related FintechOS Studio documentation.

Removed Audit Tab from Admin Settings

The Audit tab has been removed from the Admin > Settings menu in FintechOS Studio as user login information is now stored in the FintechOS Identity Provider.

Individualized Customizations at Form Step Level

You can now configure distinct settings on each form step for: Next/Previous button display and labeling, prompting for unsaved changes, or saving data on leave.

Deprecated Client-Side Data Updates

The ebs.insertEbs, ebs.insertAsync, ebs.updateEbs, ebs.updateAsync, ebs.deleteEbs, and ebs.deleteAsync Client SDK functions have been deprecated by default to enforce good coding practices. You can use the sys-do-not-allow-client-side-direct-data-updates system parameter to re-enable them.

Improved Selection Visibility in Grids

In the FintechOS Studio grids, the highlight color for the currently selected row(s) now has increased contrast for better visibility.

Breaking Changes

User login information such as date, hour, IP address and Studio environment, is no longer stored in the System Audit table in the database, as it was in v22. Instead, the data is now available in the FintechOS Identity Provider if the Save events toggle is enabled, as explained in the documentation.

Login data cu current user logged in Studio can be retrieved using the following Client SDK method: ebs.getCurrentUserSessionsHistory.

The ebs.insertEbs, ebs.insertAsync, ebs.updateEbs, ebs.updateAsync, ebs.deleteEbs, and ebs.deleteAsync Client SDK functions have been deprecated. Use the sys-do-not-allow-client-side-direct-data-updates system parameter to temporarily enable them while refactoring your code.

Fixed Issues

| No. | Summary |

|---|---|

| N/A | Success toast messages for record updates and record inserts erased their corresponding <div> elements from the document object model after expiration, making them difficult to detect by testing automation tools. |

| 50584 | In FintechOS Portal, users could not open .png files. |

| 51093 | In the UI designer, when adding a paragraph in the non-expanded view, the edit ribbon was covering the text. |

| 52655 | When in full screen mode, the FintechOS Studio code editor would become stuck in read-only mode, preventing editing. |

| 53245 | B2C portals did not work on Android devices. |

| 53359 | Symbols were not displayed correctly in digital documents. A new font package has been added to the platform to address the issue. |

| 53520 | Fixed an issue with httpPost and callPostMethod that caused a different datatype to be sent. |

| 53373 | Appending input parameters to B2C paths triggered a page unfound error. |

| 54298 | Fixed an issue with the httpPost method. |

Known Issues

The get offers API may cause memory issues when retrieving offers based on the product codes query parameter. If possible, use the product IDs query parameter instead.