Personal Overdraft

An overdraft is an extension of credit from a lending institution that is granted when an account reaches zero. The overdraft allows the account holder to continue withdrawing money even when the account has no funds in it or has insufficient funds to cover the amount of the withdrawal.

In the title field, enter a name for the product. Optionally, you can click the ellipsis button (...) to also provide a description and/or an availability period. Below, fill in the following product configurations.

Main Info

This section determines the overdraft limit amount and term:

- up to - Sets the maximum amount that can be loaned in the specified currency.

- with a term up to - Sets a maximum term for the overdraft repayment in either days, months, or years.

E.g.: Overdraft limit amount up to 1000 EUR with a term up to 3 months.

Interest

Interest on a savings or current account is the amount of money a bank or financial institution pays a depositor for storing their money with the bank. The financial institution pays the depositor a percentage of their account balance, and makes regular interest payments across the statement![]() A bank statement summarizes all the account's monthly transactions and is typically sent by the bank to the account holder every month. cycle.

A bank statement summarizes all the account's monthly transactions and is typically sent by the bank to the account holder every month. cycle.

Click + Add saving interest or + Add sight interest to set up a long term or overnight interest rate respectively

- fixed - Sets an interest rate that is a fixed percentage of the statement's amount.

- for the first / and then - Applies different interest rates over defined periods of time, in months.

- until end - Applies the interest rate until account closure.

- based on formula - Allows you to set savings interest rates based on Product Formulas.

- credited - Occurrence of interest being credited to the customer (Daily, Maturity, Monthly, Quarterly, Yearly).

- capitalized - Determines if the interest is calculated and credited to the main account, based on the total amount accumulated at each statement.

E.g.: Savings Interest is fixed at 0.42% for the first 6 months and then fixed at 0.45% until end, credited Monthly, capitalized.

The overdraft interest is charged on the account's negative balance (when the account holder withdraws funds in excess of the money available in the account).

Click + Add overdraft interest to set up an interest for the overdraft amount based on the desired interest rate(s).

- fixed - Sets an interest rate that is a fixed percentage of the principal amount, regardless of changes in the market interest rates.

- variable - Sets an interest rate based on an underlying benchmark interest rate plus a specified percentage margin.

- based on formula - Allows you to set interest rates based on Product Formulas.

- for the first / for - Applies the interest rate for a specified number of installments

Regular payment that a borrower is required to make to the lender to repay a loan over time..

Regular payment that a borrower is required to make to the lender to repay a loan over time.. - until end - Applies the interest rate until the end of the loan term.

E.g.: Overdraft Interest is fixed at 5% for the first 3 installments and then variable indexed to EURIBOR 3M with a margin of 1% until end.

Fees

- Click +Add fee.

- Select a predefined type of fee from the list, or click Create new to define a new fee type (you can also rename an existing fee by clicking the fee name). The type of fee determines parameters such as the the conditions under which the fee is applied, how often the fee is charged, whether the fee is refundable or not, etc. For more information, see Fee Types.

- Enter the amount of the fee:

- value - a fixed value in the specified currency.

- percentage - a specified percentage of either the remaining value, financed value, payed value, unused amount, used amount, overdraft limit amount, or amount.

- based on formula - Allows you to set fees based on Product Formulas.

You can set up multiple fees that will be charged independently, based on their Fee Types. E.g.:

- Front-end fee is 25 $.

- Repayment fee is 4% over remaining value.

This will always charge the borrower a $25 fee on loan application. If, during the loan, the borrower decides to repay the loan in advance, a 4% fee is charged over the loan's remaining value.

Discounts

In the Discounts section, you can define discounts on any of the already configured interest items, commission items, or on all pricing elements.

There are three ways to create discounts:

- Follow the sentence-based interface to configure a condition based on a dictionary attribute (e.g., Age >18), for which you define a discount. Note that you can also create new attributes, extending your dictionary (+Add discount > Create New).

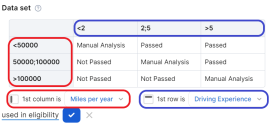

- Add a Dataset based on one, two, or more attributes for a pricing item. You can add more data sets, one for each pricing item. For more details on how to create Data Sets, see Product Data Sets.

- Add a formula to define discounts with more advanced conditions based on mathematical expressions, data sets, and other inputs. You can add more formulas, one for each pricing item. For more details on how to create formulas in Product Designer, see Product Formulas.

A discount does NOT override the previous value of a pricing item, but is applied to it, decreasing the pricing item's final value. For example:

- A discount of 10% applied to an existing 10€ commission results in a new value of 9€ for the commission;

- A discount of 2€ applied to an existing 10€ commission results in a new value of 8€ for the commission.

Underwriting

The underwriting rules determine an applicant's eligibility for the product and whether or not a manual approval process is required (available only for underwriting rules based on Product Data Sets).

There are three ways to add Underwriting rules:

- Add Rule - Follow the sentence-based interface to configure a condition based on a Lexicon Term (e.g. Property Condition is Good or Excellent).HINT

In the attributes' pop-up window, you can click +New Attribute to quickly add a new lexicon term or Product Settings to edit the current lexicon term. - Add Formula - Use Product Formulas that return a boolean result ("True" for approval and "False" for rejection);

- Add Data Set - Use Product Data Sets for the evaluation. This is mandatory if the rule can return an outcome where the application must go through a manual approval process. The data set can return only the Approved, Derrogation, or Rejected results (or an equivalent terminology defined in the Underwriting Data Set Values, e.g. Passed, Manual Analysis, or Not Passed).

For each rule, you can select the used in eligibility option to mark it as a knock-out rule, which automatically disqualifies the applicant if its condition is not met. Otherwise, the rule is submitted to the final approval review.

For the manual approval result, you need to configure the journey to direct the application to a back-office manual approval process. If you are using Multi-Dimensional Data Sets based on cascading data sets, the manual approval outcome must be defined in the top-level data set.

Documents

Specify the document types required from the applicants (and/or others involved in the origination process, e.g. codebtors![]() Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt.), as well as the document types provided to the applicants.

Individual who assumes joint responsibility for repaying a loan alongside the primary borrower. If the primary borrower defaults on the loan, the codebtor becomes liable for the remaining debt.), as well as the document types provided to the applicants.

| Parameter | Description |

|---|---|

| Required from customer |

Documents that the applicant must provide in order to verify identity, income, product eligibility, etc. To add a required document:

E.g.: Income statement mandatory for debtor and mandatory for co-debtor. |

| Provided to customer |

Documents that must be provided to the applicant typically in order to obtain an agreement and/or signature. To add a provided document:

E.g.: Terms and conditions is static requires accord and requires signature. |

Once you’ve configured all the fields, change the status from Draft to Approved to save your Personal Overdraft product. For details on versions, see Product Life Cycle.