Summary of the Insurance Quotation

In this step, on behalf of their customers and upon their agreement, you can perform the following actions:

-

Generate a quotation document, based on the Final Quotation record;

-

Insert bank details;

-

Start the application process;

-

Launch the application for term life cover;

-

Issue a term life policy;

-

Close the business process - either by quitting or establishing a term life policy.

The quote details presented in this section are not editable.

The following sections are displayed in the Summary screen.

The Personal Information grid presents the following read-only fields.

|

Field |

Description |

|---|---|

| Role | The possible values of this field are: Agent, Policyholder, Policyholder / Insured, Insured. |

| Name | This field holds the full name for the above role, the last name being capitalized. This data is taken from the previous steps where the user inputs their personal information. |

| Personal ID Number | This field holds the personal identification number for the above roles, which is taken from the data that has been input in the previous steps. |

The top of this section displays the Currency, Payment Frequency and Policy Term read-only fields. The values are taken according to the chosen quotation from the previous Quotation step.

Below these fields, a grid similar to the one in the Quotation step is displayed, containing the following columns: Coverage, Sum Insured, Regular Premium, Annualized Premium. In the last column, the annual premium amount is calculated and displayed for each coverage. The values in this grid are not editable.

This section includes mentions regarding the policy fee, agent indemnity commission and the quotation expiry date. These fields are read-only.

Regarding the policy fee, the following message is displayed: "The total premium includes a policy fee of X EURO".

If the payment frequency is annually, this message is not displayed.

If the payment frequency is other than annual:

-

the total annualized premium in the ‘'Policy quotation details’' should also include the policy fee in the calculation (not only the total regular premium)

-

The values of the policy fee that are added to the total regular premium are, depending on the frequency: Half-yearly - €1.00, Quarterly - €1.25 and Monthly - €1.50

-

The values of the policy fee that are added to the total annualized premium must be, depending on the frequency:

-

Half-yearly - €2.00 (1X2)

-

Quarterly - €5.00 (1,25X4)

-

Monthly - €18.00 (1.50X12)

-

-

-

in the "Important notes concerning this quotation", the mention regarding the policy fee is modified as follows: "The total premiums include a policy fee of X EUR payable [Monthly/Quarterly/Half-Yearly]", when X = the policy fee added to the total regular premium and [Monthly/Quarterly/Half-Yearly] = the payment frequency (dynamic text).

-

the value for the total regular premium, the value for the total annualized premium and the mention regarding the fee has a * symbol displayed next to them.

-

Regarding the renewal commission, the following message is displayed: "On completion of the 24 months earnings period, renewal commission of Y per Z is paid to the Agent.", where Y is dynamic and represents the renewal commission and the quotation currency. It represents a renewal commission of 2% of each premium paid after the two years earnings period is completed. This commission is paid according to the frequency.

Y corresponds to the renewalCommission attribute of the Agent entity.

Once the 24 months earnings period expires, the commission resorts to “renewal” commission, which is paid as and when each premium is paid.

Example:

premium = 100 euro / month

Y = 2% of 100 euro = 2 euro

Z = dynamic, the frequency of the chosen quotation

Regarding the Expiry date, the following message is displayed: "This quotation is valid until W", where W is the expiry date of the quotation, representing the date when you click the Save Quote button for the first time, plus 30 days. For example, if you click the Save Quote button on 02.07.2021, the expiry date is 01.08.2021.

W corresponds to the expireDate attribute of the FTOS_INSQB_QuoteLife / FTOS_INSQB_QuoteVersion entities.

Guaranteed/Jet Issue

In the Summary section, it is also mentioned if the quotation qualifies for a guaranteed/jet issue. In order for the quotation to be qualified as such, the following conditions must be simultaneously met:

-

The BMI of the proposed life insured must not be below 18.5 or greater than 24.9.

-

The insured answered no to the tobacco use question, in the Personal Data step.

-

The insured has an occupation with no additional requirements by reference to the Occupation table, that they are an “A” for acceptable occupation, both for life cover and for the riders.

-

The insured has applied for a term of 10 years.

-

The insured's age next birthday is 31 or less.

-

The insured has applied for a cover equal or less than 100.000 Euro or equivalent.

If all the above conditions are met, the mention regarding the expiry date of the quotation is no longer displayed, and it is replaced with the following: "This quotation qualifies for Guaranteed Issue, provided an application is received before X.", where X is the expiry date of the quotation, as shown below.

If you click the Save Quote button for several times in different days, in all cases W is calculated in regards to the first time you click Save Quote in the Quotation step + 30 days.

When clicking the Generate Quotation button, a .pdf quotation document is generated, named "TermLifeInsuranceQuotation".

You can open, download and print this document, containing the date when the quotation was generated, corresponding to the quotationDocumentDate attribute, and the date when the quotation expires, corresponding to the expireDate attribute, W.

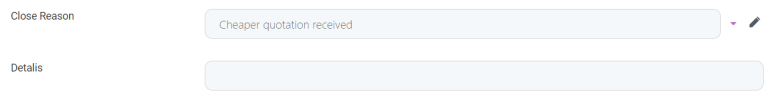

In this section, You can choose to quit and close the quotation. The following fields are displayed.

|

Field |

Description |

|---|---|

|

Close Reason |

Mandatory option set field, displaying the following values:

|

|

Details |

Optional free text field, where you can input any details regarding the decision to quit the quotation. |

After filling out the fields, you need to click the Quit button, and a confirmation pop-up is displayed, with the following message: "Are you sure you want to quit?". If you choose Yes, the quotation history list is displayed, and the status of the quotation is changed to Closed.

If you click the Quit button without choosing the Close Reason, the following blocking message is displayed: "Close reason required".

The Previous and Apply for cover buttons are present at the bottom of the page.

When you click the Previous button, you are taken to the previous Quotation step, and a pop-up is displayed, asking if you want to save the changes.

When you click the Apply for cover button, the application takes you to the next flow, the Application Form. If the button is clicked before the quotation was generated in the Generate Quotation section, the following blocking message is displayed: "Generate quotation required".