Configuring the Banking Product Factory

This processor creates and maintains products that are used in FintechOS form driven flows and later in digital journeys. The custom products are included in the solution with pre-loaded filters and ranking systems. They are a great place to start, but if for some reason you need further configurations, you have limitless possibilities to modify, extend or define new custom offerings for your customers. Based on your business requirements, create new products or clone the existing one to modify them.

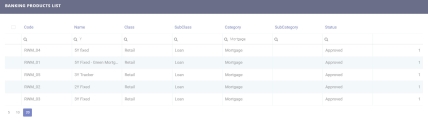

To visualize and to administer them, access the dedicated menu for Banking Product Factory within the Innovation Studio. The DIP for Mortgage journey has five products that are different between themselves with regard to the minimum-maximum period intervals, the minimum-maximum amount intervals and the minimum-maximum advance![]() The advance percentage from the contract's financed value applicable at the contract level., product destination types

The advance percentage from the contract's financed value applicable at the contract level., product destination types![]() The product purpose. This section allows for insertion or removal of existing destinations for a banking product., and interest

The product purpose. This section allows for insertion or removal of existing destinations for a banking product., and interest![]() It is the total amount paid for the entire loan duration as interest..

It is the total amount paid for the entire loan duration as interest..

| Product | Name | Class | Subclass | Category |

|---|---|---|---|---|

| RWM_01 | 5Y Fixed - Green Mortgage | Retail | Loan | Mortgage |

| RWM_02 | 2Y Fixed | Retail | Loan | Mortgage |

| RWM_03 | 3Y Fixed | Retail | Loan | Mortgage |

| RWM_04 | 5Y fixed | Retail | Loan | Mortgage |

| RWM_05 | 3Y Tracker | Retail | Loan | Mortgage |

To modify any of the five existing products, you must create a clone and modify the clone since the products are in

Active state.- Log into Innovation Studio in developer mode.

- Click the main menu icon at the top left-hand corner of the screen.

- In the main menu, click Product Factory.

- Click Banking Products to open the Banking Products List page.

For exemplification, here is one of the products presented in detail. The fields are available for the other products as well with slight variations between them.

Main Info

The first tab requires the basic elements for the creation of a product such as product type, name, code, hierarchy and features.

| Field | Required |

Description |

Default value |

|---|---|---|---|

| Product Type | Yes | The type of product. |

Mortgage |

| External Code | No | The code of the product imported from an external system, if applicable. It can have 10 characters and it is not used in the contract. | N/A |

| Banking Product Code | Yes | The code of the product. It can have 10 characters and it is used in the contract. It uses a sequencer and the code of the product type. | RWM_01 |

| Name | Yes | The name of the product. | 5Y Fixed - Green Mortgage |

| Class | No | This field is used to place the product in a hierarchy. | Retail |

| Subclass | No | This field is used to place the product in a hierarchy. | Loan |

| Category | No | This field is used to place the product in a hierarchy. | Mortgage |

| Start Date | Yes | The date when the product becomes available. | 19/01/2022 |

| End Date | Yes | The last date from when the product is available. From that date forward, the product is no longer available. | 29/11/2029 |

| Description | No | Write any description or additional text here. | Floating rates with low interest fees |

Details

The Details tab requires further elements such as interest, payment type, top-ups and withdrawals.

| Field | Required | Description | Default value |

|---|---|---|---|

| Bank Account Type | Yes | Select the type. | Loan Term Account |

| Is Revolving | No | Allows a business to borrow money as needed for funding working capital needs and continuing operations such as meeting payroll and playable. | null |

| Auto Disbursement | Yes | Specifies if the disbursement is automatically performed when the contract is approved. | true |

| Max No Disbursements | No | The maximum number of disbursements that can be configured for this product. | undefined |

| Is Guaranteed | Yes | This checkbox marks the product as secured or unsecured. | true |

| Allow Collateral Partial Release | No | A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. | null |

| Collateral Cover Percent | No | The percent that the collateral person on the contract pays. It usually is over 100%. | undefined |

| Allow CoDebtor | No | Select if another debtor exists for this product. | true |

| Allow Refinancing | No | Select if the account can be refinanced for this product. | false |

| Number of CoDebtors | No | Set the maximum number of debtors possible for this product. | 2 |

Payment Schedule Types grid

In the Payment Schedule Types section, the following fields are available:

| Field | Required |

Description |

Default value |

|---|---|---|---|

| Periodicity Type | Yes | Select the regularity of payments. | Monthly |

| Holiday Shift For Repayment Installments | Yes | This checkbox marks if the holidays are considered for the calculation of the maturity schedule. | undefined |

| Holiday Shift Method | No |

Select from the list the method to be used when calculating the due date if that date falls to a holiday. The due date can be shifted before or after the holiday. Possible values:

|

Forward |

| Defer Due Date | Yes | If you select the checkbox, the payment schedule calculates the next payment amount as if the due date has not changed even when the due date falls on a holiday. This checkbox is selected by default. | true |

| Grace Type | No | Select one from the list. | none |

| Product Grace | No | Select one from the list. | |

| Grace Days for Repayment | No | Select one from the list. Insert the number of days for which the grace applies. | undefined |

|

Penalty for grace period |

No | If you select the checkbox, the penalty interest is applied on the loan contract without taking into consideration the grace period defined at contract level, being calculated for the difference between system date - due date, if the grace period passed and the customer didn't pay the due amounts. If you leave this checkbox unselected, the penalty interest is applied on the loan contract taking into consideration the grace period defined at contract level, being calculated for system date - due date + grace days for repayment. | undefined |

| Field | Required | Description | Default value |

|---|---|---|---|

| Name | No | Insert a suggestive name for the type. | Equal installments |

| Payment schedule code | No | Insert a code for the type to keep track of them. | MEIM360 |

| Product Type | No | Select a product type to associate with the payment schedule type. Depending on the Product Type, different calculation rules are triggered. For example, the product type Overdraft has only the payment at maturity. | Mortgage |

| Schedule Interest Calculation Type | No |

Select from the list a type of calculation for the interest. When an annual interest rate is specified, in order to calculate the Installment for an interval of days, first the annual interest rate should be transformed in to a daily base. To make this transformation there are some accepted conventions. Innovation Studio implemented the following conventions: 30/360, 30/365, Actual/Actual, where Actual for years can be either 365 or 366. Other schedule interest calculation types can also be defined, as needed. In practice may be also encountered the Actual/360 or Actual/365. |

30/360 |

| Is With Equal Installments | No | Select the checkbox if the installments are equal. If there are Commissions that appear on the Payment Schedule, these Commissions are added to the equal Installments, not included within. | true |

| Installment Value Custom | No |

If you select the checkbox, with multiple disbursements, the Principal component of the Installments is the one calculated for the entire Financed Amount, even if it was not entirely disbursed. For example, if Financed Amount is 10.000 EURO and the value calculated for Principal component of the Installments is 800 EURO, and the customer disburses only 5.000 EURO, the Principal component remains 800, but the Interest is calculated for 5.000 EURO that were disbursed. |

true |

| Use Fix Maturity Date (from Activation Date) | Yes |

If you select the checkbox, then the Maturity Date equals to Activation Date plus the Contractual Period in Months, i.e. the number of installments depends on the Activation Date. If the checkbox remains unselected, the number of installments are fixed, the Maturity Date is equal to the First Installment plus the Contractual Period in Months, e.g. Installment date is on the first day of the month, this results in the Maturity day to be the first day of the month. |

null |

| Measurement Unit | Yes | Select from the list the type of measurement unit applicable for the payment schedule type. | Months |

For the PAYMENT SCHEDULE TYPE DETAILS:

| Column Repayment Schedule | Calculation Method |

|---|---|

| AnalysisFee | FeeOnce |

| RemainingValue | RemainingFormula |

| PMT | FixedValue |

| Interest | Effective Rate |

| Principal | ColumnFormula |

| TotalInstallment | ColumnFormula |

| Field | Required | Description | Default value |

|---|---|---|---|

| Name | No | Insert a suggestive name for the type. | Equal principal payments |

| Payment schedule code | No | Insert a code for the type to keep track of them. | MEIM360 |

| Product Type | No | Select a product type to associate with the payment schedule type. Depending on the Product Type, different calculation rules are triggered. For example, the product type Overdraft has only the payment at maturity. | Mortgage |

| Schedule Interest Calculation Type | No |

Select from the list a type of calculation for the interest. When an annual interest rate is specified, in order to calculate the Installment for an interval of days, first the annual interest rate should be transformed in to a daily base. To make this transformation there are some accepted conventions. Innovation Studio implemented the following conventions: 30/360, 30/365, Actual/Actual, where Actual for years can be either 365 or 366. Other schedule interest calculation types can also be defined, as needed. In practice may be also encountered the Actual/360 or Actual/365. |

30/360 |

| Is With Equal Installments | No | Select the checkbox if the installments are equal. If there are Commissions that appear on thePaymentSchedule, these Commissions are added to the equal Installments, not included within. | false |

| Installment Value Custom | No | If you select the checkbox, with multiple disbursements, the Principal component of the Installments is the one calculated for the entire Financed Amount, even if it was not entirely disbursed. | true |

| Use Fix Maturity Date (from Activation Date) | Yes |

If you select the checkbox, then the Maturity Date equals to Activation Date plus the Contractual Period in Months, i.e. the number of installments depends on the Activation Date. If the checkbox remains unselected, the number of installments are fixed, the Maturity Date is equal to the First Installment plus the Contractual Period in Months, e.g. Installment date is on the first day of the month, this results in the Maturity day to be the first day of the month. |

null |

| Measurement Unit | Yes | Select from the list the type of measurement unit applicable for the payment schedule type. | Months |

For the PAYMENT SCHEDULE TYPE DETAILS:

| Column Repayment Schedule | Calculation Method |

|---|---|

| AdministrationFee | FixedValue |

| AnalysisFee | FeeOnce |

| RemainingValue | RemainingFormula |

| Interest | Effective Rate |

| Principal | ColumnFormula |

| TotalInstallment | ColumnFormula |

| Field | Required | Description | Default value |

|---|---|---|---|

| Name | No | Insert a suggestive name for thetype. | Only interest |

| Payment schedule code | No | Insert a code for thetypeto keep track of them. | MOPM |

| Product Type | No | Select a producttypeto associate with thepaymentscheduletype. Depending on the ProductType, different calculation rules are triggered. For example, the producttypeOverdrafthas only thepaymentat maturity. | Mortgage |

| Schedule Interest Calculation Type | No |

Select from the list a type of calculation for the interest. When an annual interest rate is specified, in order to calculate the Installment for an interval of days, first the annual interest rate should be transformed in to a daily base. To make this transformation there are some accepted conventions. Innovation Studio implemented the following conventions: 30/360, 30/365, Actual/Actual, where Actual for years can be either 365 or 366. Other schedule interest calculation types can also be defined, as needed. In practice may be also encountered the Actual/360 or Actual/365. |

30/360 |

| Is With Equal Installments | No | Select the checkbox if the installments are equal. If there are Commissions that appear on the Payment Schedule, these Commissions are added to the equal Installments, not included within. | false |

| Installment Value Custom | No | If you select the checkbox, with multiple disbursements, the Principal component of the Installments is the one calculated for the entire Financed Amount, even if it was not entirely disbursed. | true |

| Use Fix Maturity Date (from Activation Date) | Yes |

If you select the checkbox, then the Maturity Date equals to Activation Date plus the Contractual Period in Months, i.e. the number of installments depends on the Activation Date. If the checkbox remains unselected, the number of installments are fixed, the Maturity Date is equal to the First Installment plus the Contractual Period in Months, e.g. Installment date is on the first day of the month, this results in the Maturity day to be the first day of the month. |

true |

| Measurement Unit | Yes | Select from the list the type of measurement unit applicable for the payment schedule type. | Months |

For the PAYMENT SCHEDULE TYPE DETAILS:

| Column Repayment Schedule | Calculation Method |

|---|---|

| AdministrationFee | FixedValue |

| AnalysisFee | FeeOnce |

| RemainingValue | RemainingFormula |

| Interest | Effective Rate |

| Principal | ColumnFormula |

| TotalInstallment | ColumnFormula |

For the Product Destination Types grid:

- First time buyer

- Green Loan.

Availability

The Availability tab determines the monetary range and the time frame when the product is available for customers.

| Field | Required | Description | Default value |

|---|---|---|---|

| Currency | Yes | Choose the currency for this banking product. | GDP |

| Period Type | No | Choose one: Days/Weeks/Months/Years/Once. | Months |

| Minimum Period | No | The minimum duration of the product mentioned in the contract. | 1 |

| Maximum Period | No | The maximum duration of the product mentioned in the contract. | 480 |

| Minimum Amount | No | The minimum amount of the product for which the bank opens a contract. | 500 |

| Maximum Amount | No | The maximum amount of the product for which the bank opens a contract. | 9500,000 |

| Minimum Advance (%) | No | The minimum down payment that must be paid for the leasing contract to be signed. | 10% |

| Maximum Advance (%) | No | The maximum advance that can be paid for the leasing contract to be signed. | 90% |

Dimensions

The Dimensions tab displays the interests, commissions, insurances, discount and questions valid for a product. Interests & Commissions: for Interest RWM_01

| Field | Default value |

|---|---|

| Banking Product | 5Y Fixed - Green Mortgage |

| Code | IRWM_01 |

| Item Name | Interest RWM_01 |

| Start Date | 19/01/2022 |

| End Date | 29/11/2029 |

| Interest List | IRWM_01 |

| Commission List | Mortgage fee 0 |

| Minimum Interest Rate ( % ) | undefined |

| Is Negotiable | null |