Excess Management

In Core Policy Admin the system is able to capture and store the excess (deductibles) for coverages, sub-coverages and risks (perils). The excess represents the part of the loss that is paid by the Insured. The insurer's liability starts after the deductible or is in excess of that, hence the name.

The excess is set at coverage level and is automatically inherited (sub-coverages) and also all the risks that are bound to them. Either the system or an elevated user can modify the excess (the deductible that is set at risk level at a different value than the one that is set at coverage level). The deductibles inherit the policy currency.

On different policies from the same product, the same peril can have different excess types. For example, fire can have a 5% of loss on one policy and 5000 excess on another policy. Deductibles have the same currency as the policy they are bound to.

There are three steps where the system shows if there are any excesses.

-

Firstly, in the Policy Coverage grid of a policy record, in the Excess column.

The Excess types can be:

-

Flat amount;

-

Percentage of Sum Insured;

-

Percentage of Loss.

-

-

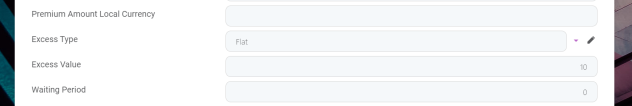

Secondly, when you access the policy insurance item, you can edit the Excess Type and Excess Value fields.