Verify Your Identity

After the loan data was successfully inserted into the system, the user can move to the next step where they give information about their identity. The data is collected from a document, the system ensures that the user is part of the right audience. The data collected is mandatory due to regulatory laws for contracting a loan or any financial product. From the list, the user can scan the following types of documents:

- personal identity document

- passport

- USA driver's license.

1 Let's find you a loan

But first, let's verify your identity. Please scan your passport, ID card or Drivers license to proceed with the loan application.

Click Continue to scan the document.

or

Click Skip to fill in manually the data from step 2.

2 Check Data Collected

| Field | Data Type | Description |

|---|---|---|

| Full Name | Text | Edit your full name. |

| Address | Text | Edit your address. |

| City | Text | Edit your city. |

| Phone number | Text | Select your phone number. |

| Zipcode | Text | Select your zipcode. |

| Do you own or rent? | Option set | Select the type of residence: own/ rent/ other. |

Click Edit to modify the first three fields with data collected from the scanning of the ID.

Click Continue.

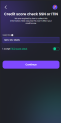

3 Credit score check SSN or ITIN

This screen collects the Social Security Number![]() In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as 42 U.S.C. § 405(c)(2). (SSN) or Individual Taxpayer Identification Number

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as 42 U.S.C. § 405(c)(2). (SSN) or Individual Taxpayer Identification Number![]() An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN). (ITIN). There is the input field with the format: NNN-NN-NNNN. It's a nine-digit series of numbers only.

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN). (ITIN). There is the input field with the format: NNN-NN-NNNN. It's a nine-digit series of numbers only.

After you insert the SSN or ITIN, toggle the field I accept FICO score check. To view more information about the FICO score, click FICO score check, which is a hyperlink to a static document explaining the scoring procedure.

Click Continue to get to the selfie step.