Role-Based Limits

Role-based limit capabilities allow you to manage limits for different customer types, such as merchants. Using role-based limits, the limit for a customer who is a merchant within several contracts can be configured properly, allowing the customer to take loans until they reach their set limit.

To use role-based limits within your contracts, follow these steps:

-

Define new limit types that are based on roles associated with contract participants specific to your business.

You can use these new limit types throughout Loan Management with all the functionality of any other default limit type. For example, you can configure aMerchant Exposurelimit type, to enable the creation of limits for customers who have theMerchantrole associated at a customer level.

-

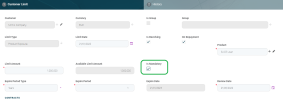

Associate the same role to the customer.

You can associate as many roles as you need for a customer to be able to have within contracts, using theRolefield added to the Customer page accessible through the Customer Core menu.

Limits defined for roles at a customer level are treated as system limits and they are affected by contracts where that specific customer plays that role. For example, if the customer has aMerchantrole, you can define them aMerchant Exposuretype limit.

-

Decide whether a customer limit is a mandatory limit or not.

TheIs Mandatoryfield's value within the Customer Limit page configures the limit validation at the contract level. When the existing limit's available amount is smaller than the value of the contract, Loan Management checks the limit'sIs Mandatoryfield. IfIs Mandatory = True, then an error is raised that the limit is reached and the contract cannot be approved, otherwise, ifIs Mandatory = False, a warning is presented but the contract can be approved. The default value isTrue.

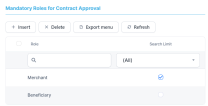

- Configure mandatory roles at the banking product' service configuration level.

The Mandatory Roles for Contract Approval section at the product admin configuration level allows you to add the roles of the participants that are mandatory to exist at the contract level for contracts based on this banking product. In other words, when creating contracts based on products with service configurations with theMerchantrole in this section, you must add a customer with the sameMerchantrole as a contract participant, otherwise, the contract cannot be approved.

WhenSearch Limitis selected for a role on a product's service configuration, Loan Management checks if the contract participant with this role has an attached limit configured with a limit type associated with the same role.

Verify the access rights for users with Corporate Credit Officer, Retail Credit Officer, and Risk Officer security roles. The out-of-the-box settings for these security roles allow users to add and update limits, while users with other associated roles can only read limit information. Update the access rights according to your financial institution's needs.

Role-Based Limits Validations

Role-based limits have all the functionality of any other system limit type. The limits defined for participants at the contract level can be updated according to the contract's value. If a limit is set as revolving, it is replenished with capital repayments.

For contracts based on products with a product admin configuration with a mandatory role configured, Loan Management checks whether the contract contains a participant with the same role. For example, for a product admin configuration with Merchant mandatory role, if Loan Management doesn't find a participant with this Merchant role on the contract, then an error message informs you that "Contract participants are blocking disbursement (Merchant)!". In this case, add a participant with the Merchant role to the contract.

If the Search Limit checkbox was selected for the mandatory role at the product admin configuration level, then Loan Management checks whether there is a contract participant whose limit is of the limit type associated with the same role. In the example above, Loan Management checks the existence of a participant who has a Merchant Exposure type limit.

If the existing limit's available amount is smaller than the value of the contract, then Loan Management checks the limit's Is Mandatory field. If Is Mandatory = True, then an error is raised that the limit is reached and the contract cannot be approved, otherwise, a warning is presented but the contract can be approved.

The

Is Mandatory field's value cannot be changed from False to True when versioning a limit until Available Limit Amount >= 0.The way the system is configured by default, there are no validations at Contract Version approval for contract participants' limits. If this is desired, the version settings for

Contract Participants need to be changed from IsUpdate= true to IsUpdate = false.