Collaterals

A collateral is a property, such as securities, items of value, pledged by a borrower to protect the interests of the lender. A lender can seize the collateral from a borrower if the latter fails to repay a loan according to the agreed terms. A collateral acts as a guarantee that the lender receives the amount lent even if the borrower does not repay the loan as agreed. For example, when contracting a mortgage, the bank asks the customer to provide their house as collateral. If the customer fails to meet the repayment terms of their mortgage, the bank has the right to take ownership of the house. The bank can then sell the house in order to recoup the money that it lent to the customer.

Collateral management is the method of granting, verifying and managing collateral transactions in order to reduce credit risk in unsecured financial transactions. It is an essential and integral part of any financial institution's risk and regulatory compliance framework.

There is a wide range of possible collaterals used to hedge credit exposure with various degrees of risk:

- Cash Collateral: Fixed Deposit, Stocks, etc.

- Real estate: Property, Land

- Other: metals, commodities, etc.

In Core Banking, a registered collateral has the following statuses:

-

Draft - the status of a newly created collateral registration record that was not yet cleared to be used. While in this status, you can edit its fields. Change the status of the record to Active after editing all the necessary details in order to use it later in contracts.

-

Active - the status of a collateral registration record after being authorized for usage in contracts.

-

Owned - the collateral is being used by a contract. It is linked to a loan or any other secured product (overdraft, bank guarantee, etc).

-

Released - the status of a collateral after closing the contract to which it was attached.

In order to use the collateral as a guarantee for covering a secured loan contract, it must have the Active status.

Managing Collaterals

Perform the following steps to manage collaterals in FintechOS Core Banking:

-

Add new guarantee types, if your financial institutions wishes to work with guarantee types other than the default ones. If not, skip to Registering Collaterals.

-

Create collateral types based on the newly added guarantee types, if applicable. If not, skip to Registering Collaterals.

-

Register a collateral before using it within a contract. Registration is performed based on a collateral type.

The first two steps are usually performed during Core Banking configuration, while the 3rd step is performed each time you must register an asset as a collateral, to be later on used to cover a contract.

You must first register a collateral so that you can use it as a guarantee for covering a secured loan contract.

There are two guarantee types defined by default in the GuaranteeTypes option set that cover most of the business requirements: Real Estate and Cash Collateral.

if your financial institutions wishes to work with guarantee types other than the default ones, add new guarantee types following these steps:

- In FintechOS Studio, click the main menu icon, expand the Admin menu, and click Option Sets to open the Option Sets List page.

- Find the

GuaranteeTypesoption set, storing the guarantee types, and double-click it to open the Edit Option Set page. - In the Option Set Items section, click the Insert button to open the Add Option Set Item page.

- Add the details of the new guarantee type by filling in the following fields:

- Name - Enter the name of the guarantee type.

- Display Name - Enter the display name of the guarantee type.

- Value - Enter the value of the guarantee type.

- Status Id - Select the status of the item within the option set: active or inactive. Default value:

Active.

- Click the Save and Close button. The id of the option set item is automatically generated when saving the record.

Guarantee types are further used to define collateral types.

In FintechOS Core Banking there is a large range of predefined collateral types:

- Predefined collaterals for Cash Collateral guarantee: Fixed Deposit, Stock, Bonds.

- Predefined collaterals for Real Estate guarantee: Land and Property.

You can create new ones for your business specific needs. To add new collateral types, follow the steps described in the Collateral Type page within the Banking Product Factory user guide.

You should register a collateral to support managing secured loans. You can attach a registered collateral to multiple contracts if the contracts total amount does not exceed the collateral available amount.

In order to use the collateral as a guarantee for covering a secured loan contract, you must first insert it in the collateral register. Follow these steps to register a collateral:

- In the FintechOS Portal, click the main menu icon and expand the Core Banking Operational menu.

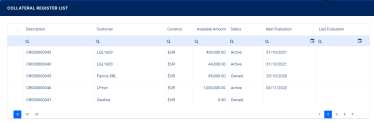

- Click Collateral Register menu item to open the Collateral Register List page. On the Collateral Register List page, you can add new collateral records or search, edit, and delete existing ones.

Collateral register records with an

Owned status cannot be deleted. See Collateral System Statuses for more details.-

Click the Insert button on the Collateral Register List page to add a new collateral register.

-

In the newly displayed Add Collateral Register page, fill in the following fields:

-

Name - Automatically completed by Core Banking after saving the record, it displays the id of the collateral.

-

Customer - Select the customer who owns the collateral. A collateral may have many owners. If this is your case, enter the rest of the owners in the Collateral Owners section as guarantors.

Only displayed when registering a new collateral. -

Collateral Type - Select the type of the collateral from the drop-down list.

-

Currency - Select the currency of the collateral. It can be different from the currency of the contract which uses this collateral as a guarantee.

-

Next Evaluation Date - For Real Estate collaterals, you can insert the next evaluation date. Only displayed when editing an existing collateral register.

-

-

Optionally, fill in the following fields:

-

Market Value - Enter the market value of the collateral which is taken into consideration. Only applicable for Real Estate and Others collateral types.

-

Adjusted Value - The percent that should be covered by the collateral is set in at the banking product level, in the

Collateral Cover Percentfield. Only applicable for Real Estate and Others collateral types, it is automatically calculated by Core Banking. -

Available Value - If the collateral is used to cover other loans, Core Banking automatically calculates the remaining value and displays it in this read-only field.

-

Bank Account - Enter the customer's current account so that the funds within the account can serve as a guarantee.

-

Deposit Bank Account - Select the deposit bank account of the customer from the list of accounts with Open status and type different than Loan Term Account. Only applicable for Cash collateral types.

-

Start Date - Select the start date for the collateral registration.

-

Expiry Date - Select the end date for the collateral registration.

-

Renewal Date - Select the date when the collateral registration is renewed.

-

Evaluated By - Select the customer who evaluated the collateral.

-

Right On Good - Select the type of rights held on the collateral goods. Possible values:

Full Property,Naked PropertyandUsufruct. -

Last Evaluation Date - For Real Estate collaterals, you can insert the previous evaluation date. Only displayed when editing an existing collateral register.

-

Description - Enter a suggestive description for the collateral.

-

Attached File - Attach files relevant for the collateral.

-

-

Click the Save and Reload button.

After saving the record, fill in the new sections displayed in the page, with specific information:

In the Collateral Register Rank section, you can insert, delete or export collateral register ranks.

To add a rank:

-

Click Insert and fill in the following fields:

-

Parity On Rank - Select the checkbox to mark the collateral with parity on rank.

-

Rank - Select the rank of the collateral.

-

Owner - Select the customer who owns the collateral.

-

-

Click the Save and Close button.

The list within the Contract Collateral section is automatically generated, displaying the contracts where the current collateral is used as guarantee, if such contracts exist. The following information is displayed:

-

Contract - The id of the contract where the collateral is attached.

-

Status - The status of the contract.

-

Collateral Register Value - The value of the registered collateral.

-

Collateral Register Value Usage (%) - The percent from the collateral used for coverage within the contract.

-

Value in Contract Currency - The value of the collateral expressed in the currency of the contract.

To edit a collateral attached to a contract from this list:

-

Double-click the record and perform the desired updates in the Edit Contract Collateral page.

-

Click the Save and Close button.

A collateral may have multiple owners. The customer whom you previously entered before saving the collateral register record becomes the main owner. To add other registered customers who partially own the collateral, use the Collateral Owners section of the Edit Collateral Register page. The other owners of the collateral are considered guarantors of the contract, and they should consent on this. They are stored in the Collateral Register Owner entity.

To add an owner:

-

Click Insert and fill in the following fields:

-

Collateral - Automatically filled in by Core Banking with the id of the collateral register record.

-

Customer - Select the customer who partially owns the collateral and becomes a guarantor for contracts where the collateral is used.

-

-

Click the Save and Close button.

In the Collateral Register Participants section, you can insert, delete or export customers who participate to the collateral in a specific role such as notary, valuer, etc.

To add a participant:

-

Click Insert and fill in the following fields:

-

Participant - Select the customer who is a participant to the collateral.

-

Participant Role - Select the role of the customer in this collateral.

-

-

Click the Save and Close button.

In the Collateral Register Documents section, you can insert, delete or export collateral documents.

To add a document:

-

Click Insert and fill in the following fields:

-

Document Type - Select the type of the document that is uploaded for the collateral.

-

Collateral File - Attach the file to be uploaded.

-

-

Click the Save and Close button.