Managing Banking Products

The Banking Product Factory allows you to create, adjust and maintain banking products such as bank accounts, term and mortgage loans, overdrafts, deposits, cards, and credit cards.

Banking Product Factory enables you to manage banking products via the user interface or via integration through APIs. For information about the available endpoints, please visit the Banking Product Factory Developer Guide.

For information about managing banking products via the user interface, continue reading this page.

Below you can see how to manage these banking products and how to change their statuses through their life cycle.

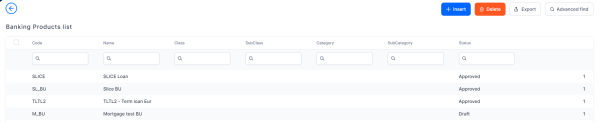

- In the main menu, click Product Factory > Banking Product Factory, and the Banking Products List page opens.

- On the Banking Products List page, you can create a new banking product, edit an existing banking product from the list by double-clicking it, delete, export or find a product.

- Once you have created the banking product, you can duplicate it, create a new version, or open the banking product workflow transition list.

For banking products in Active status, you can't change any of their related entities (such as features, discounts, product guarantee, interest or commission item, formula, test scenario, product covenant, product disbursement, product availability item filter). To change any of the product's related entities, create a new version of the banking product record.

If you want to duplicate a new product, basically creating a clone of the existing one that you can customize according to your needs and save time during this process, follow the steps below:

-

On the Banking Product list page, select and open the product you want to duplicate.

-

Click the

Duplicate button available on the page, and the duplicated product is created containing all the settings of the pre-existing one.

Duplicate button available on the page, and the duplicated product is created containing all the settings of the pre-existing one. -

Customize the duplicated product according to your needs, editing the settings already populated. The Banking Product code and Name should be changed according to your business needs.

-

Click the Save and Reload button.

-

Approve the product to use it in your customer journeys or in Core Banking right away.

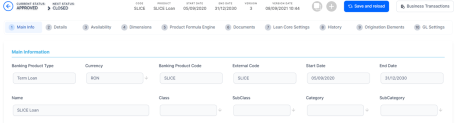

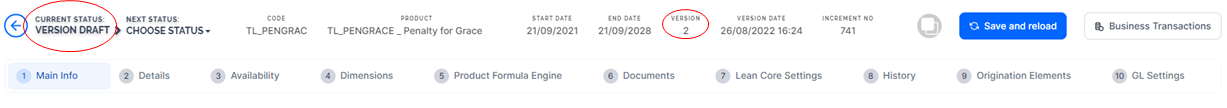

In Banking Product Factory, the products are set up for versioning. Thus, if you want to update the details of an approved product, that is already in use, then you must create a new version of the product.

To create a new version for a product with the Approved status, follow these steps:

-

Open the product that you want to update and click the

New Version button.

New Version button. -

View the new version of the product created by Banking Product Factory, with Version Draft status.

-

Edit the desired fields.

-

Approve the new version before you start using it. If it is not approved, then the initial version can still be used.

If you approve the product in Version Draft status, then the original record transitions into the Version Closed status and the secondary version becomes the Approved currently active product record.

Read more details about versioning a record on the How to Version an Entity Record page.

Changing Banking Products Statuses

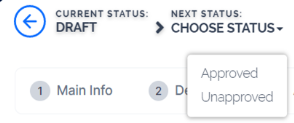

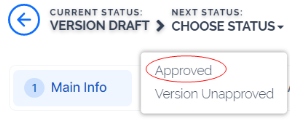

You can manage a banking product's life cycle by changing its status from the top left corner of the screen.

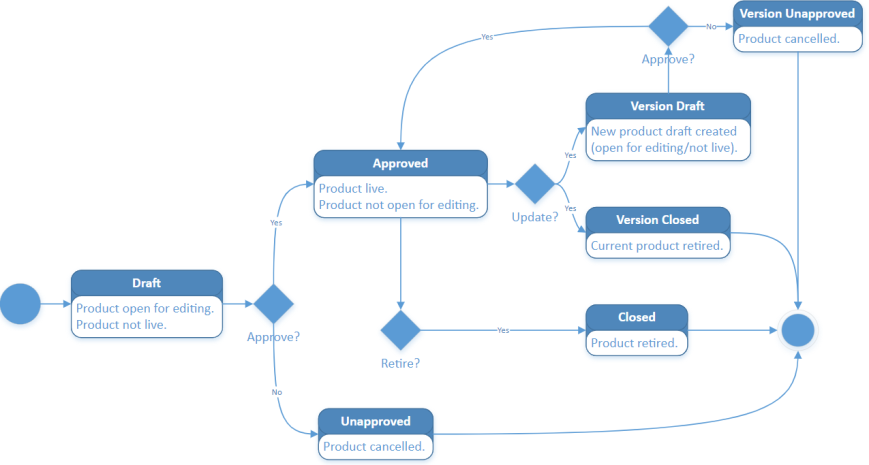

The product status transitions are illustrated below:

-

Every product version starts in Draft status and must go through an approval process before going live.

-

Once a product is Approved, its settings can no longer be modified.

-

If you want to update an approved product, you must create a new product version.

-

When you create a new product version, the current version is retired. The new version has to be approved before you start using it. If it is not approved, then the initial version can still be used.

-

Only one version of a product can be live at one time.

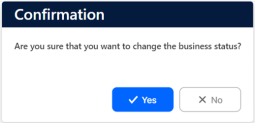

To approve a product, follow the steps below:

-

Select a product in Draft (or Version Draft) status.

-

Change its status into Approved.

-

Click Yes to confirm your action.

If Banking Product Factory performs all the validations successfully, then the current status of the product changes to Approved and you can't perform any other changes. Now you can use your product in customer journeys or Core Banking.