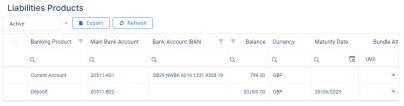

View Liabilities Products

The Liabilities Products tab displays a retail customer's liability products. Liabilities are usually amounts that a person owns, which can include current accounts, deposits, or savings accounts.

By default, the active records are displayed but the inactive ones can also be viewed by changing the status filter to Inactive. To view additional information, double-click on a record. Depending on the banking product selected, certain tabs are displayed.

A current account is a bank account where customers store and withdraw money. It can be used for debit or credit transactions internally (disburse/ repay loan, transfer between accounts) or via integrated solution for card management or payments. For more details, see the Current Account page.

Basic elements such as the banking product type, account details, or contract details are displayed in the Overview tab.

For the General Data section, the following data is displayed:

-

Banking Product: The customer's banking product name. For example: Current Account.

-

Bank Account (IBAN): The customer's IBAN number.

-

Main Bank Account: The main bank account number.

-

Balance: The account's balance.

-

Contract Number: The contract number.

-

Currency: The account's currency.

-

Activation Date: The date the account was activated.

-

Close Date: The date account was closed.

-

Bundle Type: The bundle type.

-

No of Debit Cards: The number of debit cards associated with the account.

-

Bundle Attached: If selected, the contract is part of a bundle.

-

Debit Card Attached: If selected, the contract has a debit card attached.

-

Overdraft Attached: If selected, the contract has an overdraft attached to the account.

-

Set Off Exception: If selected, an exception is set.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Total Interest Rate: The total value of the interest rate.

This section is displayed only for Current Accounts with Overdraft baking products.

For the General Data section, the following data is displayed:

-

Banking Product: The banking product selected.

-

Amount: The amount of the overdraft.

-

Main Bank Account: The main bank account number.

-

Used Amount: The used amount from the Amount field value.

-

Contract Number: The contract number.

-

Unused Amount: The unused amount from the Amount field value

-

Activation Date: The date the account was activated.

-

Currency: The account's currency.

-

Overdraft Close Date: The overdraft close date.

For the Product Interest Rate section, the following data is displayed:

-

Overdraft Interest: The interest rate of the overdraft. For example: EURIBOR 3M, ROBOR 6M.

-

Overdraft Margin: The overdraft margin.

-

Overdraft Total Interest Rate: The total interest rate of the overdraft which is the sum of the overdraft margin + the overdraft reference rate.

-

Overdraft Reference Rate: The reference rate of the overdraft valid at the reference date rate.

-

Date for Review Overdraft Interest Rate: The review date of the overdraft interest rate.

-

Overdraft Reference Rate Date: The overdraft reference rate date.

For the Repayment Overview section, the following data is displayed:

-

Contract Period: The contract period.

-

Contract Period Type: The contract period type.

-

Maturity Date: The date of the final payment for the overdraft repayment.

For the Contract Participants section, the following data is displayed:

-

Status: The status of the participant: active or inactive.

-

Participant: The participant's name.

-

Role: The role of the participant in the contract.

-

Start Date and End Date: The start date of the contract and the end date of the contract.

For the Contract Covenants section, the following data is displayed:

-

Covenant: The covenant, for example, the borrower should perform tax obligations, the lender can monitor the borrower's current ratio, the lender posses the right to prevent merges or acquisitions.

-

Value: The covenant value.

-

Covenant Type: The covenant type, for example: financial, affirmative, negative. For additional information, see the Covenant page.

-

Review Date: The date when the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Created On: The record creation date.

For the Contract Fees section, the following data is displayed:

-

Fee Name: The name of the fee.

-

Fee Currency: The currency of the fee.

-

Periodicity Type: The type of periodicity. For example, monthly, quarterly, or annual.

-

Percent Fee: The commission percentage applicable, if the commission is defined as a percentage.

-

Negotiated Fee: If selected, the fee is negotiated.

-

Value Fee: The commission value applicable, if the commission was defined as a value

-

Created On: The record creation date.

For the Contract Document section, the following data is displayed:

-

Document Name: The name of the document.

-

Created On: The creation date of the contract.

-

Document Type: Select the contract type from the following options: Agreement, Contract, Application, External Report, Statement or Other Documents.

-

View: All contracts related to the customer's account are displayed in this field.

A deposit is a bank account where customers deposit and withdraw money. For more details, see the Deposits page.

The Overview tab displays basic elements such as the banking product type, account details, or contract details.

For the General Data section, the following data is displayed:

-

Banking Product: The customer's banking product name. For example: Current Account.

-

Current Account: The current account attached to a deposit.

-

Main Bank Account: The main bank account number.

-

Financed Amount: The amount used to constitute the deposit.

-

Contract Number: The contract number.

-

Currency: The account's currency.

-

Activation Date: The date the account was activated.

-

Close Date: The date account was closed.

-

With Capitalization: If selected, the contract has an overdraft attached to the account.

-

With Auto-Rollover: If selected, an exception is set.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Total Interest Rate: The total value of the interest rate.

For the Product Interest Rate section, the following data is displayed:

-

Product Interest: The interest rate applied to the banking product.

-

Margin: The margin.

-

Total Interest Rate: The total value of the interest rate.

-

Reference Rate: The reference rate of the overdraft valid at the reference date rate.

-

Reference Rate Date: The reference rate date.

For the Repayment Overview section, the following data is displayed:

-

Contract period: The contract period.

-

Contract Period Type: The contract period type for example: months years, and so on.

-

Maturity Date: The contract maturity date.

-

Due Date: The installment repayment date.

-

Number of Installments: The number of installments.

-

Periodicity Type: The time interval for the repayment schedule, for example: once, days, years, months, weeks.

-

Schedule Type: The schedule type, for example, equal installments, equal principal.

For the Grace Period section, the following data is displayed:

-

Principal Grace Period (Months): The value in months for the grace period for principal repayment of a contract.

-

Interest Grace Period (Months): The value in months for the grace period for interest repayment of a contract.

For the Contract Participants section, the following data is displayed:

-

Status: The status of the participant: active or inactive.

-

Participant: The participant's name.

-

Role: The role of the participant in the contract.

-

Start Date and End Date: The start date of the contract and the end date of the contract.

For the Tranches section, the following data is displayed:

-

Status: The status of the contract tranche: active or inactive.

-

Tranche Date: The date of the disbursement tranche.

-

Tranche Percent: The percentage from the contract value (amount) that has to be disbursed with a tranche.

-

Amount: The amount from the contract value that has to be disbursed with this tranche.

-

Unusage Commission Percent: The commission percent applicable for the unused loan amount from a tranche

-

Interest Percent: The interest percent applicable for a tranche, if it is different from the interest rate applicable for the entire contract.

-

Created On: The record creation date.

For the Contract Covenants section, the following data is displayed:

-

Covenant: The covenant, for example, the borrower should perform tax obligations, the lender can monitor the borrower's current ratio, the lender posses the right to prevent merges or acquisitions.

-

Value: The covenant value.

-

Covenant Type: The covenant type, for example: financial, affirmative, negative. For additional information, see the Covenant page.

-

Review Date: The date when the covenant has to be reviewed.

-

Review Frequency (Months): The number of months after which the covenant has to be reviewed.

-

Created On: The record creation date.

For the Contract Fees section, the following data is displayed:

-

Fee Name: The name of the fee.

-

Fee Currency: The currency of the fee.

-

Periodicity Type: The type of periodicity. For example, monthly, quarterly, or annual.

-

Percent Fee: The commission percentage applicable, if the commission is defined as a percentage.

-

Negotiated Fee: If selected, the fee is negotiated.

-

Value Fee: The commission value applicable, if the commission was defined as a value

-

Created On: The record creation date.

For the Documents section, the following data is displayed:

-

Account: The customer's account.

-

Contract: The contract number.

-

Document Type: Select the contract type from the following options: Agreement, Contract, Application, External Report, Statement or Other Documents.

-

Entity Id: The entity ID.

-

Entity No: The entity name.

-

External ID: The external ID.

-

File: Select the document to attach it to the customer's account.

-

Name: The document name.