Direct Debit UK

The Billing and Collection solution helps UK insurers to handle direct debit payment operations - starting with the direct debit mandate activation procedure (in order to notify the bank about the payment arrangement between insurer and insured) up to the moment the payment is collected.

Follow the steps detailed in the Direct Debit page, for setting the solution to perform direct debit processing for UK area.

For direct debit payments that respect some rules (such as providing the correct payment details), the process or billing and collecting is completely automated, and you can check the technical details about it on the UK Direct Debit page. Details about the automated jobs handling the direct debit processing can also be found on the Flow Parameters And Scheduled Jobs page.

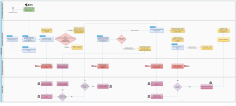

The following is a diagram of how the Billing and Collection solution handles the processing of direct debit payments for the UK area.

Below is an example of a mandate activated automatically, by the Billing and Collection solution:

The direct debit mandates cannot be deleted manually.

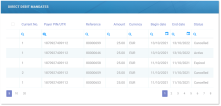

In your portal, the Direct Debit Mandates section offers you an overview of the UK direct debit mandates registered in your system - with the newest activated mandate at the top.

This view is permanently updating since many of the files are generated by the system, based on available connections with other third-party systems that feed different kinds of direct debit data into the Billing and Collection solution, and also based on different scheduled jobs that automate direct debit processing. Second to that, some functionalities allow manual interaction. Scroll down to the Direct Debit UK Functionalities section, for more details.

This list also gives you the possibility to search and sort the mandates for easier processing. For example if you want to view all the mandates in Active status - that is mandates from which premiums are paid, you can use the Search by Status option and sort all your mandates accordingly.

Follow the steps below to view the UK direct debit mandates registered into your system:

-

In your FintechOS Portal, navigate down the main menu of the Billing and Collection solution.

-

From the dropdown list, click Direct Debit Mandates to open the Direct Debit Mandates list.

On the Direct Debit Mandates page:

-

To inspect a record from the grid, double-click it. The form allows you to see the direct debit mandate related details and its history, in a second tab. See details in the next section, below.

-

To add a new mandate, manually, click Insert, at the top right corner of the page, to open the Insert Mandate Form. See details in the Insert Mandate section, below.

-

To edit a mandate, press Edit Mandate and use the form to make your adjustments. Editing is available for mandates in Draft, Pending or Active status. See details in the Edit Mandate section, below.

You can export one or more records by pressing Export, at the top right corner of your screen.

The UK Direct Debit Mandate Form allows you to inspect, edit or cancel a mandate. The form is organized as follows:

Inside this first section, the following fields are automatically populated with details extracted from the direct debit activation file, coming from the bank and the related policy. These fields are not editable.

| Field | Description |

|---|---|

| Account Holder | The name of the payer. |

| Bank Sort Code | The bank sort code. |

| Account Number | The account number used for direct debit payments. |

| Begin date | The beginning date of the mandate. It is automatically completed with the current date - the date when the direct debit Instructions File (containing the instructions for the current mandate, also) is generated in the system. |

| Reference | The reference for the payments - policy number. |

The versioning functionality allows you to edit a mandate, and all your updates are logged into the system. After editing, you must manually approve the new mandate version. See the instructions below.

Mandates in Cancelled status cannot be edited.

1. Click Edit Mandate to allow the read-only fields to become editable.

Below, an example of a UK mandate ready to be adjusted:

However, some fields are still not editable (see the table below). Proceed to make your changes into the form. Inside this first tab, the fields are automatically populated with the direct debit record details. The following fields are available:

| Field | Description |

|---|---|

| Account Holder | The name of the payer, account holder. |

| Bank Sort Code | The bank sort code. |

| Account Number | The account number of the payer. |

| Begin date | The beginning date of the mandate. Not editable! |

| Reference | The reference for the payments - policy number. Not editable! |

2. Use the Status picker, at the top left of the form, to approve your changes.

Below is an example of a UK mandate History tab and the Status picker (actually available on both tabs of the form):

3. Once approved, the History tab opens and you can check the logging of the version you recently created on the selected direct debit mandate.

4. Click Save and close.

Canceling a mandate triggers the cancellation of all its correlated invoices - that are either in Generated or in OnGrace status.

Follow the steps below, to cancel a mandate:

1. Click Cancel mandate to move the mandate into this final state.

Cancellation is irreversible and the mandate cannot be edited after this step.

2. Once cancelled, the History tab opens and you can check the logging of this final adjustment you made on the mandate.

Below is an example of the History tab of a cancelled UK mandate:

3. Click Save and close.

Even if rare, there are cases when you need to manually insert a mandate, on behalf of a customer. For this, you use the Insert Mandate Form. All mandates inserted manually are registered in Draft status, with mandateStage =N (new) and Begin Date = null. Next, for all the mandates - SEPA and UK, registered in the system, the FTOS_PYMT_DirectDebitMandateStatus scheduled job moves the mandate in Active status, based on some rules. More on the UK Direct Debit page.

You can only add mandates with the mandate stage set to New. Additionally, a system validation is in place that prevents you from adding a mandate with the same reference (policy number) as any other mandate already existing in the system.

Below is an example of an Insert Mandate Form:

Follow the steps below to add a mandate:

-

In your FintechOS Portal, navigate down the main menu of the Billing and Collection solution.

-

From the dropdown list, click Direct Debit Mandates to open the Direct Debit Mandates list.

-

On the Direct Debit Mandates page, click Insert, at the top right corner of the page, to open the Insert Mandate Form.

-

Proceed to insert the necessary details into the form, as follows:

| Field | Description |

|---|---|

| Account Holder | The name of the payer, account holder. |

| Bank Sort Code | The bank sort code. |

| Account Number | The account number of the payer. |

| Begin date | The beginning date of the mandate. Not editable! |

| Reference | The reference for the payments - policy number. |

5. Click Save and close.

Direct Debit UK Functionalities

In order to accommodate the differences regarding the direct debit payments, the Billing and Collection solution has dedicated workflows for the Single Euro Payments Area (SEPA) and for the UK financial area. Each flow has different menu items that display their respective functionalities and help you to handle direct debit payments processing according to SEPA or UK regulations.

Read below about the different functionalities that are part of the UK direct debit flow.

The bulk of handling of these operations is done through automatic flows. Where file insert is possible, you will find an Insert button. Uploading direct debit data into the system, triggers automatic changes and tracking of those changes. Updates are made and logged for every record through FintechOS standard versioning mechanism.

The following sections are available:

All the details from this section are automatically filled in by the system and they are not editable.

A direct debit job runs daily in the system, verifying all the policies with direct debit payment type and their payment schedules, for all the insurance products that are in Active status. Where the case, for all the qualifying installments, this job generates invoices and automatically sends to the bank a request for payment in form of a direct debit instruction file containing the invoice details.

The Direct Debit Payment Instruction Files section hosts all your files containing the instructions for direct debit payments generated by the system. You can search inside this repository by File or Date of Generation. You can inspect a record by double-clicking it. If you want to inspect the details inside any Direct Debit Payment Instruction File, you must download the file.

The ADDACS report (file) contains data that impact the status of the UK Direct Debit Mandates.

Once a Direct Debit Instruction (Mandate) has been set up, it might change.

When it does, the Paying Bank reports the change to BACS (Bankers Automated Clearing Service). BACS generates an ADDACS (Automated Direct Debit Amendment and Cancellation Service) report about the changes that were made and sends it to the insurer.

The following are the Reasons which can be received in the ADDACS file, and the corresponding behavior of the Billing and Collection solution:

| Code | Mention |

|---|---|

| 0 | Instruction cancelled refer to Payer.

If this reason is received, then the mandate status is changed to Cancelled. |

| 1 | Instruction cancelled by Payer.

If this reason is received, then the mandate status is changed to Cancelled. |

| 2 | Payer deceased.

If this reason is received, then the mandate status is changed to Cancelled. |

| 3 | Account transferred to a new Bank or Building Society

If this reason is received, then the mandate status is changed to Cancelled. |

| B | Account closed.

If this reason is received, then the mandate status is changed to Cancelled. |

| C | Account/ Instruction transferred to a different branch of Bank/ Building Society.

If this reason is received, then the mandate status is changed to Cancelled. |

| D | Advance notice disputed.

If this reason is received, then no action is taken. |

| E | Instruction amended.

If this reason is received, then update the mandate. |

| R | Instruction re-instated.

If this reason is received, then reactivate the mandate. |

An ADDACS report (file) is produced whenever a change is made to the details of an existing Direct Debit Instruction (Mandate).

It is critically important that the correct action is taken in response to an ADDACS report as this will enable the insurer to continue to receive payments. These updates should be acted upon within 3 days of receipt. It is in the best interest of insurers to act quickly on receipt of an ADDACS report, otherwise, it can be risky making incorrect collections and facing indemnity claims, loss of revenue, and damage to organization’s reputation as offering poor customer service.

ADDACS files are emitted by the BACS (Bankers Automated Clearing Service) payment network, the most popular method for sending and receiving business payments in the UK.

The ADDACS Files section contains all the ADDACS files ever imported in the system. The mandates can be accessed from the ADDACS Mandates Grid even if their effective date is in the future. You can search inside this repository by File or Import Date. You can inspect a record by double-clicking it.

In this section, file import is possible and you use this functionality to upload ADDACS reports (files) about the existing mandates, whenever you receive them. A file must have .csv or .txt format in order to be processed and stored by the system.

Follow the steps below in order to manually import an ADDACS report. See right below:

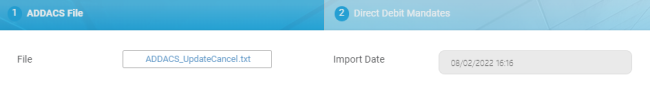

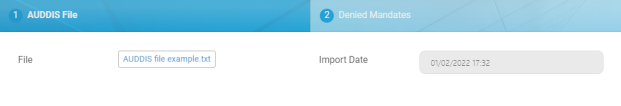

Below is an example of an Import Form:

1. While in the same section, click Insert, at the top right corner of your screen.

2. When the Import Form opens, select your file and then click Import Data.

3. (Optional) Check the second tab of the record, for further details. When you upload an ADDACS file, the system automatically parses the data and displays the findings in the second tab of the ADDACS record. See also the next paragraph that explains how the record is organized.

4. Click Save and close.

Inside any ADDACS report record, the details about the notified mandates are organized as follows:

-

The ADDACS File tab - This first tab includes the actual File with the notification (or notifications) for the mandates existing in your system. The Import Date field is completed automatically.

Below is an example of the first tab for an ADDACS record:

-

The Direct Debit Mandates tab - This second tab includes a View Mandate button which allows you to visualize the actual mandate record that was updated. When an ADDACS record cancels more than one mandate, the record points to all those mandates that have the reference specified in the ADDACS file. Accordingly, this form displays all the mandates, in the grid, with view buttons next to every one.

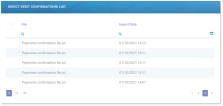

Below is an example of the second tab for an ADDACS record, which informs about different status changes for multiple mandates:

The ARUDD report (file) contains data that impact the status of the payments for an UK Direct Debit Mandate.

Once a Direct Debit Instruction (Mandate) has been set up, it might fail to deliver payments.

When it does, the Paying Bank reports the change to BACS (Bankers Automated Clearing Service). BACS generates an ARUDD (Automated Return of Unpaid Direct Debits) report about the unpaid premiums and sends it to the insurer.

An ARUDD report (file) is triggered after you have submitted a payments collection file in an attempt to collect from your Payers. It becomes available to insurers one day after Direct Debits are due to be collected. This report contains information about any of the payments that could not be collected.

An ARUDD report (file) is produced whenever a payment failed, for any of your existing Direct Debit Instructions (Mandates).

ARUDD files are emitted by the BACS (Bankers Automated Clearing Service) payment network, the most popular method for sending and receiving business payments in the UK.

In this section, file import is possible. An ARUDD File must have .txt format in order to be processed and stored by the system.

The ARUDD Unconfirmed Payments section contains details about all the unconfirmed direct debit payments, registered in the system.

You can search inside this repository by File or Import Date. You can inspect a record by double-clicking it. When the case, you can also manually import a ARUDD file. See right below:

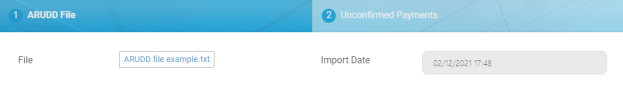

Below is an example of an Import Form:

1. While in the same section, click Insert, at the top right corner of your screen.

2. When the Import Form opens, select your file and then click Import Data.

3. (Optional) Check the tabs of the record, for further details. See also the next paragraph that explains how the record is organized.

4. Click Save and close.

Inside any ARUDD File record, the details about the unconfirmed payments are organized as follows:

The first tab - includes the actual File with the unconfirmed payment for a specific mandate and the auto-populated Import Date field.

The second tab - includes a grid containing every denied payment extracted from the imported file. For the case when there are many records listed, you also can search inside this grid by different keywords - such as Reference, Payment amount, Currency, Payer name, and Sort code.

All the details from this section are automatically filled in by the system and they are not editable.

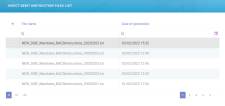

For the new direct debit mandate calls, received through the Generate UK Mandate API, there is a daily job - DIDEUK_Instructions, that is scheduled to generate mandate activation instructions for the BACS system, compliant with the BACS standardized .txt file format. This section holds all the files containing the instructions for the activation of direct debit mandates generated by Billing and Collection solution. This is where you go to check how many new mandates were activated.

You can search inside this repository by File name or Date of Generation. You can inspect a record by double-clicking it.

If you want to inspect the details inside a particular mandate activation request, you must download the file.

The AUDDIS report (file) contains data that impact the status of the payment collection for an UK Direct Debit Mandate.

Once a policyholder agreed to pay the premiums by direct debit, the insurer must regularly send direct debit payment instructions to BACS. These instructions might not be accepted (either by BACS or the Payer’s bank). When this happens, BACS (Bankers Automated Clearing Service) generates an AUDDIS (Automated Direct Debit Instruction Service) report about the failed direct debit instruction for payment and sends it to the insurer.

The following are the Reasons which can be received in the AUDDIS file:

| Reason code | Comments |

|---|---|

| F | Invalid account type |

| 1 | Instruction cancelled by payer |

| 2 | Payer deceased |

| H | Instruction has expired |

| C | Account transferred |

| I | Payer Reference is not unique |

| B | Account closed |

| L | Incorrect payer’s Account Details |

| 5 | No account |

| K | Instruction cancelled by paying bank |

| 6 | No Instruction |

| G | Bank will not accept Direct Debits on account |

Upon importing an AUDDIS report in the system, the following is the corresponding behavior of the Billing and Collection solution:

| Field | Description |

|---|---|

| Record type | No validations, receive the exact value from the file. |

| Reference | Policy number. |

| Reason code | See related table from above. |

| Payer’s name | No validations, receive the exact value from the file. |

| Sort code | Sort code for the initiated mandate. No validations, receive the exact value from the file. |

| Account number | Account number correlated with the initiated mandate No validations, receive the exact value from the file. |

| A/C type | No validations, receive the exact value from the file. |

| Original proc date | No validations, receive the exact value from the file. |

| Effective date | Date when the mandate validation decision has been made. No validations, receive the exact value from the file. |

| Tran code | No validations, receive the exact value from the file. |

| Originator sort code name | No validations, receive the exact value from the file. |

| Details account no | No validations, receive the exact value from the file. |

| Note | No validations, receive the exact value from the file. |

| ADDACS sequence | No validations, receive the exact value from the file. |

An AUDDIS report (file) is produced whenever a payment transfer problem appears to an existing Direct Debit Instruction (Mandate).

AUDDIS files are emitted by the BACS (Bankers Automated Clearing Service) payment network, the most popular method for sending and receiving business payments in the UK.

In this section, manual file import is possible. An AUDDIS file must have .csv.txt format in order to be processed and stored by the system.

The AUDDIS Files section contains details about all the requests for direct debit payment that were denied and are registered into your system. If necessary, you can also manually import AUDDIS reports.

You can search inside this repository by File name or Import Date. You can inspect a record by double-clicking it. If necessary, you can manually import an AUDDIS report file. See right below:

Below is an example of an Import Form:

1. While in the same section, click Insert, at the top right corner of your screen.

2. When the Import Form opens, select your file and then click Import Data.

3. (Optional) Check the tabs of the record, for further details. See also the next paragraph that explains how the record is organized.

4. Click Save and close.

Inside any AUDDIS record, the details about the denied payment are organized as follows:

The first tab - includes the actual File with the details of the denied request for a specific mandate and the auto-populated Import Date field.

The second tab - includes a grid containing every denied mandate extracted from the imported file. For the case when there are many records listed, you also can search inside this grid by different keywords - such as Record type, Reference, Reason code, Payer name, Account number, Effective date, and Option.

For more information about the import rules and configurations, consult also the UK Direct Debit and the Flow Parameters And Scheduled Jobs pages.