Creating A New Secured Loan

Secured loans are business or personal loans that require some type of collateral as a condition of borrowing. A financial institution can request collateral for large loans for which the funds are used to purchase a specific asset or in cases where the customer's credit scores aren’t sufficient to qualify for an unsecured loan.

Before creating a secured term loan contract, make sure that:

-

the customer is recorded in Loan Management,

-

a settlement account (a current account contract for the same customer) is set up for the desired currency,

-

the collateral is registered in Loan Management,

-

and the limits are configured according to Loan Management's setup.

To create a new secured loan contract:

The process of creating an secured loan contract is similar to that of creating an unsecured loan contract. The difference is that you must choose a banking product that is secured when creating the contract.

After performing the steps described in the Creating A New Unsecured Loan page, perform the actions required to link collaterals to the contract.

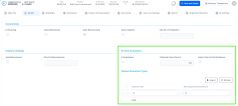

You can set collaterals as guarantees for secured loan contracts in the Collaterals tab. This tab is displayed only for contracts based on secured products.

The fields Cover Value and Product Collateral Cover Percent are automatically populated from product level.

You can send a contract for approval only if

Cover Value = Financed Amount * Product Collateral Cover Percent / 100. You can use collaterals not owned by the customer, but by a guarantor to cover the contract risk. To add guarantors to the contract, follow these steps:

- Click the Insert button within the Contract Guarantor section.

- In the newly displayed Add Contract Guarantors page, fill in the Guarantor field by selecting the customer who acts as a guarantor for the contract.

- Click the Save and Close button.

To link a collateral to the contract, follow these steps:

- Click the Insert button from the Contract Collateral section.

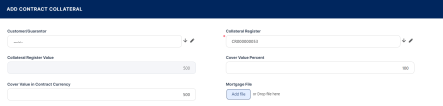

- In the newly displayed Add Contract Collateral page, fill in or modify the following fields:

Customer / Guarantor - Select the customer who acts as guarantor for the contract. The field is automatically completed with the customer selected in the contract, but you can select any of the customers already added as guarantors for this contract.

Collateral Register - Select a collateral registered to the current customer. When selecting a collateral, the

Cover Register Value,Cover Register Value UsageandCover Value in Contract Currencyfields are automatically calculated.NOTE

Make sure that the collateral you are planning to use for the secured loan contract is previously registered, otherwise you can't use it for covering the contract.

You can link a registered collateral to multiple contracts if the contracts total amount does not exceed the collateral available amount.When selecting a Fixed deposit collateral, the status of the associated bank account becomes

Blocked.

If the contract's status changes fromOwnedorActiveintoReleased, the status of the bank account becomesOpened.Collateral Register Value Usage (%) - Edit the percentage to be used from the registered collateral's total value. It was set at banking product level, in the

Collateral Cover Percentfield. As a result, theCollateral Register Valueand theCover Value in Contract Currencyvalues are automatically recalculated by Loan Management.Cover Register Value - The value is taken from collateral, expressed in the collateral's currency. If the collateral is in a different currency than the contract currency, the exchange rate is automatically applied in order to have the available amount correctly calculated. Further, a job runs daily in order to recalculate the available amount for each collateral.

Cover Value in Contract Currency - This is the cover value converted in the contract's currency at the exchange rate defined in Loan Management.

Mortgage File - Attach a file relevant for the mortgage.

- Click the Save and close button.

- Change the status of the collateral to Secured before approving the contract, otherwise Loan Management triggers an error.

After defining the relevant details of the contract, proceed to contract approval.