Creating New Versions of Existing Current Account Contracts

In Core Banking, the contracts are set up for versioning. Thus, if you want to update the details of an approved contract, then you must create a new version of the record.

To create a new version for a record with the Approved status, follow these steps:

-

While in the Contract page of the record selected for updates, click the New Version button.

-

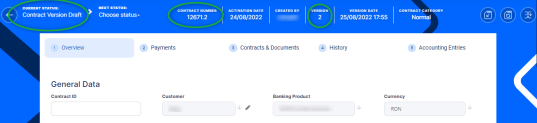

View the new version of the contract created by Core Banking, with Contract Version Draft status.

-

Edit the desired fields in the Overview tab. You can only edit a set of fields for contracts based on specific banking products.

-

Select a versioning reason in the newly displayed editable Versioning Reson section.

NOTE Select theClosure of current accountreason when closing the current account with overdraft contract, as it signals Core Banking to perform the procedures needed in order to settle all the costs of the overdraft and of the current account. -

Click the Save and Reload button.

If you approve the contract in Contract Version Draft status, then the original record transitions into the Contract Version Closed status and the secondary version becomes the Approved currently active contract record.

Read more details about versioning a record on the How to Version an Entity Record page.

Possible Changes on New Current Account with Overdraft Contract Versions

-

The Financed Amount value can either be increased or decreased. The amount can be decreased with a number smaller than or equal to the Available amount. Financed amount can be increased up to the maximum value specified at banking product level.

-

The Current Account attached to the contract can be changed to any other active account belonging to the customer.

-

Product Interest can be changed to any other type set at banking product level.

-

Schedule Type can be changed with any other type set at banking product level.

-

Contract Period cannot exceed the maximum set at banking product level.

-

Interest Grace Period can be changed up to the maximum number of months set at banking product level.

After any of the above changes, in order to approve the new version of contract, the Contract Repayment Schedule must be recalculated.