Rescheduling and Refinancing Loans

Core Banking allows you to reschedule the overdue amounts of a loan contract, or to perform an early repayment of the due amounts, effectively refinancing the loan. This page covers the steps you must follow when performing these transactions on a loan contract.

A reschedule overdues transaction represents an operation where overdue installments are merged to the following installments, turning the remaining amounts on the notifications into capital, and they are no longer collecting penalties. Core Banking also recalculates the repayments schedule.

You can add reschedule overdues transactions to an approved contract via Core Banking's user interface or through API calls, using the Core Banking endpoints. Read more about these endpoints in the Core Banking Developer Guide.

In order to add a reschedule overdues transaction to a loan contract through the menus available in Core Banking, follow these steps:

-

In FintechOS Portal, select a contract with Approved status with notified overdue amounts and double-click to open it.

-

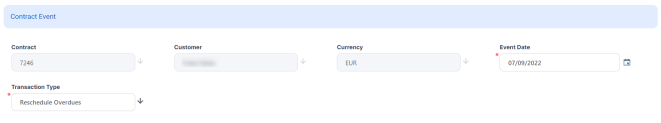

Navigate to the contract's Payments tab and click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields:

-

Event Date - This is pre-filled with current date.

-

Transaction Type - Select from the list the Reschedule Overdues transaction type. If you can't find it, then the transaction type is not associated with the banking product which is at the base of the contract.

Other values are automatically completed: contract, customer, and currency.

-

-

Click the Save and Reload button.

The event is saved in Draft status and a transaction number is automatically generated for it. The Edit Contract Event page corresponding to the selected transaction type is displayed. -

Fill in the external identifier of the transaction, if available.

-

Decide whether to keep the period of the contract or recalculate it. Select the Keep Contract Period checkbox to keep the period.

-

View the transaction fee applicable for the transaction, if it was defined, displayed in the Charge Fee field.

-

View the fee for repayment or the repayment fee percent, depending on which is displayed. The fee value or the percentage are pre-filled by Core Banking according to the Charge Fee defined for this transaction type. Depending on the

ManualRepaymentFeeCore Banking system parameter's value, the system may allow you to change the fee or the percentage. See Transaction Fees for more details. -

Decide whether you want to use the repayment schedule calculated by Core Banking through automatic processes, or you want to import a custom schedule. For custom schedule, select the Import Schedule checkbox. Read more about importing a custom schedule file in the Manually Upload Repayment Schedules section of the user guide.

-

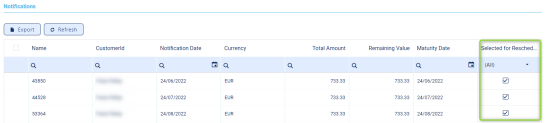

Select from the Notifications list the overdue payment notifications that you wish to reschedule.

-

Click the Save and Reload button.

If the event value meets the business requirements defined within Core Banking, the event is saved. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.

While the event is in Draft status, you can modify all the event's fields except Transaction Type. The event value is not applied to the contract while the event is still in this status. -

Click the Simulate Reschedule Overdues button to view the details of each installment of the calculated repayment schedule.

-

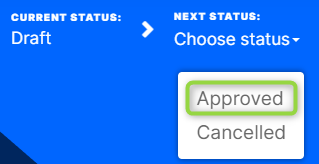

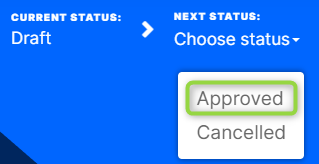

Approve the event by changing its status to Approved in the upper left corner of the Event page.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status and Core Banking applies the recalculated repayment schedule to the contract, displaying the previous schedule version in the Contract Repayment Schedule Versions section of the contract's Payments tab.

The transaction becomes visible in the Transactions section.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.

An early repayment transaction represents the early return of funds previously borrowed from a lender. Core Banking also recalculates the repayments schedule. Early repayments can result in a decrease of term while keeping the monthly installment, or a decrease of installment amount while keeping the term. You can also perform early repayments with the collection of interest accrued to date or leaving it until the next regular due date. When you insert the early repayment principal amount, make sure that you also have available funds for the interest accrued to date in case you want to collect it, as well as any transactional fee, for cases when you have an early repayment fee.

Various activities can be orchestrated according to the internal procedures of the financial institution. If the refinancing takes place in another bank, then it's possible that the amounts are released only after the proof of closing the other loan. Some financial institutions may refinance Principal + Costs, others only Principal and so the customer must cover from their own funds the interests and potential fees.

All these must be orchestrated during the implementation process, before actually starting to use Core Banking, if they must be automated, otherwise they can be implemented as internal procedures.

You can add early repayment transactions to an approved contract via Core Banking's user interface or through API calls, using the Core Banking endpoints. Read more about these endpoints in the Core Banking Developer Guide.

In order to add an early repayment transaction to a loan contract through the menus available in Core Banking, follow these steps:

-

In FintechOS Portal, select a contract with Approved status, already disbursed, and double-click to open it.

-

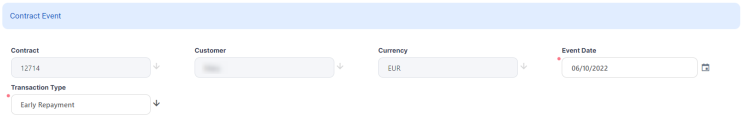

Navigate to the contract's Payments tab and click the Insert button above the Transactions section. The Event page is displayed.

-

Fill in the following fields:

-

Event Date - This is pre-filled with current date.

-

Transaction Type - Select from the list the Early Repayment transaction type. If you can't find it, then the transaction type is not associated with the banking product which is at the base of the contract.

Other values are automatically completed: contract, customer, and currency.

-

-

Click the Save and Reload button.

The event is saved in Draft status and a transaction number is automatically generated for it. The Edit Contract Event page corresponding to the selected transaction type is displayed. A series of value fields are automatically calculated, their values are displayed, and you can't edit them: the contract's unpaid information such as accrued interest, unpaid amount on contract or on customer, interest value for capital, remaining principal at date, future installments number and future annuity. -

Fill in the external identifier of the transaction, if available.

-

View the interest accrued up until the event date, the unpaid amount on the contract , and the unpaid amount for the customer. The values are pre-filled by Core Banking and you can't change them.

-

Edit the principal amount to be repaid with this event, in the Repayment Principal Amount field.

-

View the interest value applicable to the payment and the remaining value of the principal at the current date, as calculated by Core Banking.

-

View the transaction fee applicable for the transaction, if it was defined, displayed in the Charge Fee field.

-

View the fee for repayment or the repayment fee percent, depending on which is displayed. The fee value or the percentage are pre-filled by Core Banking according to the Charge Fee defined for this transaction type. Depending on the

ManualRepaymentFeeCore Banking system parameter's value, the system may allow you to change the fee or the percentage. See Transaction Fees for more details. -

View the total value of other fees applicable for the transaction, if any.

-

Set the early repayment options:

-

Keep Contract Period - Select this checkbox to instruct Core Banking to keep the period of the contract. If left unselected, the contract period is recalculated.

-

Collect accrued interest - Select this checkbox to instruct Core Banking to collect the interest accrued up to date. If the checkbox is not selected, then the

Accrued Interest= 0.00, if it's selected, thenAccrued Interest= the value of accrued interest until the event's date. The payment schedule projection takes into consideration both the payment schedule type defined at the banking product level, and whether to collect the interest accrued on the contract until the date of an early repayment event, thus repaying the accrued interest, or not, thus adding the accrued interest to the next installment due after the early repayment event.

TheCalculateAccrualEarlyRepaymentCore Banking system parameter specifies whether the accrual and provision should be calculated for early repayments with the event value equal to a part of contract's unpaid amount (partial early repayments) or only for full early repayments. -

Accrued interest - View the interest accrued up until the event date, as calculated by Core Banking.

-

-

View the early repayment results, with the number of installments to be paid in the future, and either the future value of the installment as recalculated after this payment in the Future Annuity field, or the future value of the principal in the Future Principal For Installment field.

-

Decide whether you want to use the repayment schedule calculated by Core Banking through automatic processes, or you want to import a custom schedule. For custom schedule, select the Import Schedule checkbox. Read more about importing a custom schedule file in the Manually Upload Repayment Schedules section of the user guide.

-

Click the Save and Reload button.

If the event value meets the business requirements defined within Core Banking, the event is saved. Otherwise, an error message appears. Change the values as instructed in the message and try saving the event again.

While the event is in Draft status, you can modify all the event's fields except Transaction Type. The event value is not applied to the contract while the event is still in this status. -

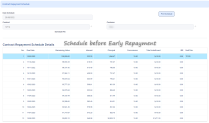

Click the Simulate Early Repayment button to view the details of each installment of the calculated repayment schedule.

-

Approve the event by changing its status to Approved in the upper left corner of the Event page.

-

Confirm the change of status in the Confirmation window, clicking Yes. The event is now in Approved status and Core Banking applies the recalculated repayment schedule to the contract, displaying the previous schedule version in the Contract Repayment Schedule Versions section of the contract's Payments tab.

The transaction is visible in the Transactions section.

All existing versions of the contract in Contract Version Draft status are automatically changed to Contract Version Closed when a payment event is approved for that contract.