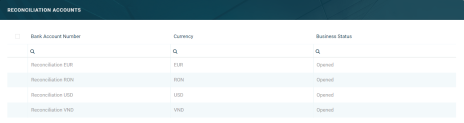

Reconciliation Accounts

Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. Reconciliation also confirms that accounts in the general ledger are consistent, accurate, and complete. Core Banking uses reconciliation accounts in its accounting processes and in the product definition itself to be used as tools for monitoring the activity for a specific product or groups of products. Reconciliation accounts are also known as self-bank accounts or internal bank accounts. When creating a banking product, you must choose such a reconciliation account within the Associated Transactions tab of the banking product. These accounts are later used by the contracts based on those banking products when performing debit or credit transactions.

Core Banking enables you to manage the reconciliation accounts used within your bank in the FintechOS Portal's dedicated menu, Reconciliation Accounts.

To manage reconciliation accounts:

-

Log into FintechOS Portal.

-

Click the main menu icon at the top left corner.

-

In the main menu, expand the Core Banking Operational menu.

-

Click Reconciliation Accounts menu item to open the Reconciliation Accounts page.

On the Reconciliation Accounts page, you can:

-

Create a new reconciliation account by clicking the Insert button at the top right corner.

-

Edit an account from the list by double-clicking it.

-

Delete an account by selecting it and clicking the Delete button at the top right corner

-

Search for a specific record by filling in any or all the column headers of the displayed records list.

-

View the debit and credit operations performed through each reconciliation account by double-clicking the desired account and observing the Debit Operations and Credit Operations sections.

Reconciliation accounts can be opened in every currency, but for the sake of automating some processes, Core Banking allows you to define which reconciliation account opened in a specific currency should be used within a period of time. Thanks to these settings, Core Banking determines automatically the reconciliation account to be used for a currency at a specific date. Read about these settings on the Reconciliation Account Settings page.

Creating Reconciliation Accounts

Follow these steps to create reconciliation accounts:

-

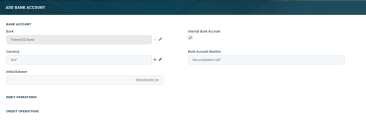

In the FintechOS Portal, click the Insert button on the top right side of the Reconciliation Accounts page. The Add Bank Account page is displayed.

-

Fill in the following fields:

| Field | Mandatory | Data Type | Details |

|---|---|---|---|

| Bank | Yes | Lookup | Core Banking automatically completes this field with the bank marked as Main Bank in the system. |

| Internal Bank Account | Yes | Bool | This checkbox specifies that the account is an internal bank account, used for reconciliation. Automatically checked by the system as True. Not editable. |

| Currency | Yes | Lookup | Select from the list the currency of the reconciliation account. |

| Bank Account Number | Yes | Text | Enter the bank account number for the reconciliation account. |

| Initial Balance | Yes | Numeric | This field represents the reconciliation account's initial amount. It is automatically completed with the value of 999,999,999.00. You can edit the value. The initial balance is needed especially for those accounts that are used for debit purposes, representing the source for some transactions. |

-

Click the Save and Reload button at the top right corner of the page. The reconciliation account is saved and its status becomes Opened, ready to be used.

The Debit Operations and Credit Operations sections are now displayed, still empty. New lines show up in these two sections when transactions are performed for contracts based on banking products that use this reconciliation account. The following information is displayed about each transaction:

| Field | Details |

|---|---|

| Value Date | The date when the transaction was requested in the system. |

| Operation Date | The date when the transaction was operated by the system. |

| Currency | The currency of the transaction. |

| Amount | The amount of the transaction. |

| Detail Text | The text representing information about the transaction, such as event type, repayment notification number, due date, and so on. |

Reconciliation Accounts Usage in Core Banking

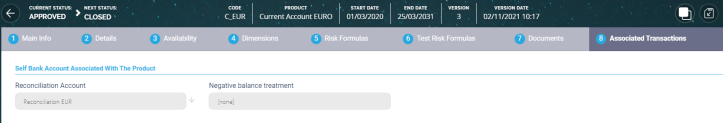

Let’s consider the product definition of the Current Account EURO banking product, where the value selected for the Reconciliation Account field = Reconciliation EUR:

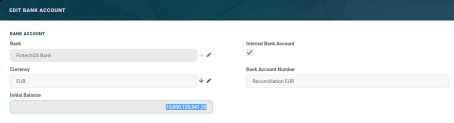

Checking the balance of the Reconciliation EUR account in the Reconciliation Accounts menu, we see the Initial Balance = 10,000,139,541.26:

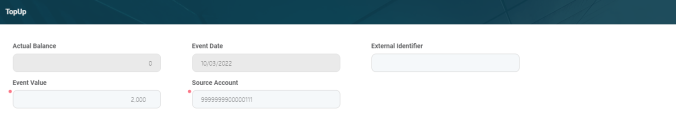

Using an approved contract based on the Current Account EURO banking product, we inserted and approved a Top-Up Account transaction type, with an Event Value = 300:

Checking back to the Reconciliation EUR account in the Reconciliation Accounts menu, the balance of the reconciliation account is updated to reflect the transaction just inserted above. The new balance value is 10,000,139,241.26, with a difference of -300 from the previous value. Observe that the same debit transaction is listed in the Debit Operations section: