Interests

Innovation Studio has a dedicated menu item, Interests, to aid the users in creating and updating interests and applying them to a product. There are three main types of interests: fixed, base and variable. Banks can set up variable interests for loans and also calculate the amount each customer has to pay.

The following picture illustrates how the interests can be shown in a loan origination digital journey:

To manage interests:

- Log into Innovation Studio.

- Click the main menu icon at the top left corner.

- In the main menu, expand Product Factory-> Banking Product Dimensions.

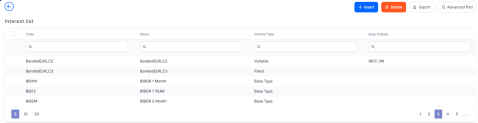

- Click Interests to open the Interest List page.

-

In the Interest List page, you can:

- Add a new interest by clicking the Insert button at the top right corner.

- Edit an existing interest from the list by double clicking it.

- Delete an interest by selecting it and clicking the Delete button at the top right corner.

The Edit Interest page allows you to configure interest settings.

Read about how and when to use each interest type on the dedicated Interest Definition Best Practices page.

Adding Interests

To create a new interest, click the Insert button on the top right side of the page. In the newly opened Add Interest page, fill in the following fields from the Interest section:

| Field | Required | Data Type | Details |

|---|---|---|---|

| Code | Yes | Text | Insert a code for this particular interest. |

| Name | Yes | Text | Insert a name. |

| Is Default | No | Boolean | Select the checkbox if the interest is a default one. |

| Use Banking Formula | No | Boolean | Select the checkbox if the interest is of type Banking Formula. |

| Interest Type | Yes | Option set |

Select the type of interest:

IMPORTANT!

If you choose Variable, a new field Base Interest is displayed. |

| Base Interest | Yes | Lookup | Only displayed for variable interest types. Select (or insert) the base type interest used for calculating the variable interest. |

| Reference Interest Period | No | Option set | Choose the interest reference period (where M = months, Y = years):

|

| For Sight Deposit | No | Boolean | Used only for deposits when the interest is at sight. It is used when a customer wishes to end a deposit before the maturity date (end date). The customer does not receive the full interest, but a sight interest because the deposit has not reached its maturity. |

| Is For Overdraft | No | Boolean | If this interest is an interest applicable to the overdraft amount of a contract based on a banking product that allows overdraft operations, select this checkbox. If the Interest Type = Collection, then the Banded Interests section is displayed for you to enter the banded interests. |

| Is Penalty | No | Boolean | If this interest is a penalty interest, select this checkbox. Penalty interests are only possible for loans. IMPORTANT! If you select this checkbox, two new fields, Is General and Apply to Loan Item (If Overdue) are displayed. |

| Is General | Yes | Boolean |

Only displayed for interests applicable as penalties. If selected, this penalty interest is applied to all the loan contract's operation items that are overdue for payment, instead of having to define different penalty interests for each operation item that is subject to penalty interest calculation on a contract. This can be useful when you need to define one mass penalty interest to be applied to all the overdue amounts subject to penalty interest calculation resulting from repayment schedule processing. If a banking product has in its attached interests list an interest with Is General = True, then at the contract level the penalty percent is applied to all operation items that are overdue and are marked with Include In Penalty Calculation = True. NOTE

You can specify which operation items should be used by Core Banking for penalty interest calculation within the Add/ Edit Operation Item pages, selecting the Include In Penalty Calculation checkbox and then selecting an item from the Penalty Item (for Repayment Notification) list. Read more about operation items in the Core Banking user guide. An interest list cannot contain a penalty interest with Is General = True and another penalty interest with Is General = False. |

| Applied To Loan Item (If Overdue) | Yes | Boolean | Only displayed for interests applicable as penalties that have Is General = False. Select the operation item of the loan contract for which the penalty interest is applied. |

| Is Credit Line Interest | No | Boolean | Interest that is applicable to the credit line. |

| Is Debit Order Interest | No | Boolean | Interest that is applicable at each debit order. |

| Description | No | Text area | Insert a description for the interest. |

Click the Save and Reload button.

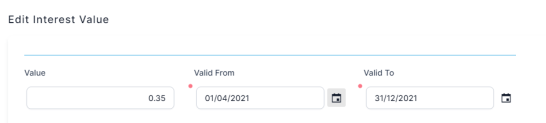

Interest Value

The Interest Value section is available only for Fixed, Base Type, and Variable interest rates . Insert the values (usually the interest rate index to your margin) by filling in the following fields:

| Field | Data Type | Description |

|---|---|---|

| Value | Numeric | Interest rate percentage. |

| Valid From | Date | Select the day when the interest rate becomes applicable. |

| Valid To | Date | Select the last day when the interest rate is applicable. |

The margin is placed in a variable interest.

Click the Save and Reload button.

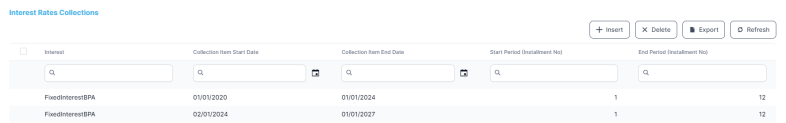

Interest Rates Collections

The Interest Rates Collections section is available only for Collection type interests. Such collections can hold more than one interest types, each with its own start period and installment. This is useful for example, when applying a fixed interest rate for the first 7 years of a mortgage loan, and applying a variable interest rate for the remaining period.

Insert the values in the section fields:

| Field | Data Type | Description |

|---|---|---|

| Master Interest | Text | The name of the interest. |

| Interest | Option set | Select a previously defined interest (fixed, variable or formula type). |

| Collection Item Start Date | Date | Select the day when the interest rate becomes applicable. This date must be greater then current system date. |

| Collection Item End Date | Date | Select the last day when the interest rate is applicable. |

| Start Period (Installment No) | Whole Number | Select the first installment when the interest rate becomes applicable. |

| End Period (Installment No) | Whole Number | Select the last installment when the interest rate is applicable. |

Click the Save and Reload button. The system performs validations to ensure that the time intervals and the installment intervals do not overlap and no time or installment interval is left undefined.

Validations Performed at Banking Product Approval

A series of additional validations are performed by the system when a banking product with a Collection type interest attached within its selected Interests List field goes through a status change from Draft or Version Draft to Approved:

-

The Start Period (Installment No) and End Period (Installment No) are validated to accommodate the maximum availability period of the banking product.

-

The period for interest is validated that there are no uncovered periods, the interests don't overlap over the same period, and there are no overlapping periods.

-

The Collection Item Start Date and Collection Item End Date dates don't overlap and there is no missing interval.

The interest rate collection can't be updated if an interest is attached to an approved banking product.

As an exception, the Collection Item End Date can be updated if Collection Item End Date

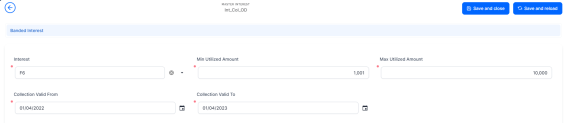

>= the current system date. Banded Interests

The Banded Interests section is available only for Collection type interests with Is For Overdraft = True. Banded interests are interest rates that can be defined as collections of values that applied depending on the amount. For example, the bank wants to apply an interest rate of 5% for used amount between 1 and 10,000, an interest rate of 4.5 % for the used amounts between 10,001 and 20,000, and an interest rate of 4% for used amounts surpassing 20,001.

Insert the values in the section fields:

| Field | Required | Data Type | Description |

|---|---|---|---|

| Interest | Yes | Option set | Select a previously defined interest. Only Fixed and Variable type interests are displayed for selection. |

| Min Utilized Amount | Yes | Numeric | Enter the minimum used amount to apply this interest. |

| Max Utilized Amount | Yes | Numeric | Enter the maximum used amount to apply this interest. |

| Collection Valid From | Yes | Date | Select the date when the interest rate becomes applicable. |

| Collection Valid To | Yes | Date | Select the last day when the interest rate is applicable. |

Click the Save and Reload button.

Banking Formula Interest Rate

When creating an interest rate based on a banking formula, the Use Banking Formula checkbox is selected. In addition, the Banking Formula Type field allows you to pick from already defined banking formulas. Click the arrow next to the field. A list of available banking formulas opens. Click the Insert button to create a new banking formula. Add a name for the banking formula. Insert or create an interest, banking product formulas, and test scenarios.

After all configurations are made, the interest options are displayed in a Digital Journey in the following way: