Using Banking Products in Digital Journeys

To use a banking product built previously in a Form Driven Flow, a consultant or developer has to create an endpoint with a script. Later, in the Advanced tab of a digital journey, they must call the endpoint and add the product to the journey.

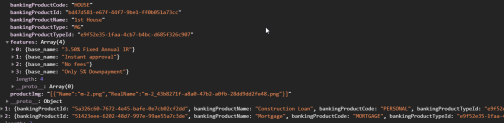

In the Advanced tab of a digital journey, apply the code example in FTOS_BP_GetBankingProductDetails, but changing the Banking product ID.

In this entity all information regarding a banking product is stored, therefore, all fields configured prior are available.

The endpoints are configured during the installation process. For more, details see Creating Endpoints.

The following are the endpoints that call the information built in a banking product:

Returns the discount information.

Inputs:

-

productDiscountId - from

FTOS_BP_BankingProductDiscount; -

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid); optional/ provided for formula association; -

formulaInputId - id of any entity used as master entity in data mapping input/ output at the formula setup; optional;

-

discountInput -

jsonfor formula input if necessary when no mapping was done for formula. The form of thisjsonshould look like the one in test formula.

Outputs:

Object with details about the provided discount from FTOS_BP_BankingProductDiscount and associated FTOS_BP_Discount. If use Banking Formula is checked, then the value is equal to the formula result.

Call example:

//with formula

var data = {

"productDiscountId": "32d391e4-9f26-4315-9c1d-ebd54bfa4e1d",

"bankingProductId": "25b9efdf-6ca5-48c5-8507-5543a22377b2",

"discountInput": {

"Amount": 6000.00

}

};

ebs.callActionByName("FTOS_BP_GetDiscountDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.discountDetail);}});

/*

[

{

"id": "32d391e4-9f26-4315-9c1d-ebd54bfa4e1d",

"name": "discountAAAA",

"discountTypeId": "f0da4a04-a513-4394-8b60-96d0a9409d7c",

"value": 5.3,

"startDate": {

"invariantDate": "2021-03-01"

},

"endDate": {

"invariantDate": "2021-12-31"

},

"appliedToDimension": "a16d6728-76ac-4d72-8fa7-a992e9a6a63f",

"interestTypeId": "3a5ffd12-bfc6-4826-bb81-7e49d2f1c2c6",

"commissionTypeId": null,

"insuranceClassId": null,

"insuranceId": null,

"isOptionalDiscount": false,

"isPercentage": true,

"useFormula": true,

"formulaTypeId": "a0dd56a6-a0b9-446b-8e1d-b2c052cafe0b"

}

]

*/

//without formula (value only)

var data = {

"productDiscountId": "32d391e4-9f26-4315-9c1d-ebd54bfa4e1d"

};

ebs.callActionByName("FTOS_BP_GetDiscountDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.discountDetail);}});

/*

[

{

"id": "32d391e4-9f26-4315-9c1d-ebd54bfa4e1d",

"name": "discountAAAA",

"discountTypeId": "f0da4a04-a513-4394-8b60-96d0a9409d7c",

"value": 5,

"startDate": {

"invariantDate": "2021-03-01"

},

"endDate": {

"invariantDate": "2021-12-31"

},

"appliedToDimension": "a16d6728-76ac-4d72-8fa7-a992e9a6a63f",

"interestTypeId": "3a5ffd12-bfc6-4826-bb81-7e49d2f1c2c6",

"commissionTypeId": null,

"insuranceClassId": null,

"insuranceId": null,

"isOptionalDiscount": false,

"isPercentage": true,

"useFormula": false,

"formulaTypeId": null

}

]

*/Returns the product image.

Input:

-

bakingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid)

Output:

-

productImage - from

FTOS_BP_BankingProduct(attribute:productImage)

Call example:

ebs.callActionByNameAsync("FTOS_BP_GetAvailableProductImage", { bankingProductId : "f625e5e5-bc51-4bf8-8ff0-b8a295694a23" })

.then(function (e) {

var img = e.UIResult.Data;

}).catch(function (err) {

console.log(err);

});Returns the product details.

Input:

-

bakingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid)

Output:

Section with the following fields:

-

product.Name - from

FTOS_BP_BankingProduct(attribute:Name) -

product.ProductImage - from

FTOS_BP_BankingProduct(attribute: productImage ) -

product.Benefits - from

FTOS_BP_BankingProduct(attribute:Benefits) -

product.DisplayConditions - from

FTOS_BP_BankingProduct(attribute:displayConditions) -

product.NoOfDebtor - from

FTOS_BP_BankingProduct(attribute:NoOfDebtor)

Call example:

ebs.callActionByNameAsync('FTOS_BP_GetBankingProductDetails', { bankingProductId : "f625e5e5-bc51-4bf8-8ff0-b8a295694a23"})

.then(function (res) {

res = res.UIResult;

}).catch(function (err) {

console.log(err);

})Returns the availability filters configured on a product.

Input:

-

BankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid)

Output:

-

filterName - from

FTOS_BP_ProductAvailabilityItemFilter(attribute:name) -

FilterValue - from

FTOS_BP_ProductAvailabilityItemFilter(attribute:textValue)

Call example:

ebs.callActionByNameAsync('FTOS_BP_GetAvailabilityFiltersOnProduct', { bankingProductId : "f625e5e5-bc51-4bf8-8ff0-b8a295694a23"})

.then(function (res) {

res = res.UIResult;

}).catch(function (err) {

console.log(err);

})Returns the types of banking product in which there are active banking products.

Input:

-

currentDate -

new Date();

Output:

-

function getProductType from library

BankingProductHelper.Utils- returns an object with product types.

Call example:

var p = {};

p.currentDate = new Date();

ebs.callActionByNameAsync("FTOS_BP_GetProductType", p).then(function (e) {

var type = e.UIResult.Data;

}).catch(function (err) {

console.log(err);

});Returns the product features.

Input:

-

BankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid)

Output:

-

section with all features from

FTOS_BP_Featurefor the sent banking product.

Call example:

ebs.callActionByNameAsync("FTOS_BP_GetAvailableProductFeatures", { bankingProductId : "f625e5e5-bc51-4bf8-8ff0-b8a295694a23"})

.then(function (e) {

var features = e.UIResult.Data;

}); Returns the product extras.

Input:

-

currentDate - date

-

productTypeId - ID of banking product Type - from

FTOS_BP_BankingProduct(attribute:bpProductTypeId)

Output:

Call example:

var p = {}

p.currentDate = new Date();

p.productTypeId = "E9F52E35-1FAA-4CB7-B4BC-D685F326C907"

p.filterList = [{ "name": "age", "value": 25 }];

ebs.callActionByNameAsync("FTOS_BP_GetAvailableProductsExtra", p).then(function (e) {

var data = e.UIResult.Data.products;

});Returns the primary attribute.

Input:

-

FromEntity - entity ID

Output:

-

the name of Primary attribute from current entity.

Call example:

var p={};

p.FromEntity = "9a9ec886-296b-487d-aff9-30b8e1eb43b8"; //ID of FTOS_BP_BankingProduct entity

ebs.callActionByNameAsync("FTOS_BP_GetPrimaryAttribute", p).then(function (s) {

if (s.UIResult.Data) {

var primaryattribute = s.UIResult.Data.Records[0].Name;

}

});

//Returns "Name"Returns the documents on a banking product.

Input:

-

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid)

Output:

-

section with data from

FTOS_BP_BankingProductDocumentfor the current banking product.

Call example:

var p = {};

p.bankingProductId = "f625e5e5-bc51-4bf8-8ff0-b8a295694a23";

ebs.callActionByNameAsync('FTOS_BP_GetProductDocuments', p).then(function (res) {

res = res.UIResult;

});Returns the interest details.

Input:

-

interestListId - from

FTOS_BP_InterestList (attribute:FTOS_BP_InterestListid); -

interestId - from

FTOS_BP_Interest(attribute:FTOS_BP_Interestid); -

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid) - optional/ provided for formula association; -

formulaInputId - id of any entity used as master entity in data mapping input/ output at the formula setup; optional;

-

interestInput -

jsonfor formula input if necessary when no mapping was done for formula. The form of thisjsonshould look like the one in test formula.

The scope of the endpoint can be an interestListId returning all interests in that list or an interestId returning all the details for a specific interest.

Output:

-

object with details about all the interests in the interest list from

FTOS_BP_InterestandFTOS_BP_InterestValue. If interest type isBankingFormula, theninterestRateis equal to the formula result.

Call example:

-

minimal:

var data = {};

data.interestListId = "c7a1b28c-e3f4-4259-b8e5-638b21bb69a7";

ebs.callActionByName("FTOS_BP_GetInterestDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});-

maximal:

var data = {

"interestListId": "a8d82639-82e3-464f-aa40-e6592daf6bd1",

"bankingProductId": "3438f5a5-fd00-4745-bb77-820baeffe3f6",

"formulaInputId": "2872f33f-b757-48b2-a1d1-203bef75813d",

"interestInput": {

"Amount": 6000.00

}

};

ebs.callActionByName("FTOS_BP_GetInterestDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});Returns details from the commission.

Input:

-

commissionListId - from

FTOS_BP_CommissionList(attribute:FTOS_BP_CommissionListid); -

commissionId - from

FTOS_BP_Commission(attribute:FTOS_BP_Commissionid); -

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid); optional/ provided for formula association; -

formulaInputId - id of any entity used as master entity in data mapping input/ output at the formula setup; optional;

-

commissionInput -

jsonfor formula input if necessary when no mapping was done for formula. The form of thisjsonshould look like the one in test formula.

The scope of the endpoint can be a commissionListId returning all interests in that list, or a commissionId returning all the details for a specific commission.

Output:

-

object with details about all the commissions in the commission list from

FTOS_BP_CommissionandFTOS_BP_CommissionValue. Ifuse Banking Formulais selected, thencommission valueorcommission percentis equal to the formula result.

Call example:

var data = {

"commissionListId": "86309408-6bf6-4550-9bb8-6d49919175bd",

"bankingProductId": "25b9efdf-6ca5-48c5-8507-5543a22377b2",

"commissionInput": {

"Amount": 6000.00

}

};

ebs.callActionByName("FTOS_BP_GetCommissionDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.commissionList);}});

/*

[

{

"id": "01c0ad2e-21bd-4290-aba5-5230a6c184e8",

"name": "TC1",

"commissionTypeId": "6e2653aa-73ee-452a-b6d6-8c0a8cdb89cb",

"periodicityTypeId": "1cc04a28-88e0-46df-a089-31d04bbde6df",

"currencyId": "fc9c53a8-31c6-41ff-a979-9c7788d32fb0",

"entityStatusId": "faccc388-151a-4c83-8953-cbac7d6c442a",

"isForUnusage": false,

"valueIsPercent": false,

"includedInRepaymentSchedule": true,

"percentAppliedTo": "f87376c8-15fc-45cc-b8c2-7786b03593aa",

"automaticLoadOnContract": false,

"mandatoryForApplicant": true,

"useFormula": true,

"formulaTypeId": "a0dd56a6-a0b9-446b-8e1d-b2c052cafe0b",

"commissionValue": 5.3,

"commissionPercent": null,

"rateValidFrom": null,

"rateValidTo": null

}

]

*/

var data = {

"commissionId": "01c0ad2e-21bd-4290-aba5-5230a6c184e8",

"bankingProductId": "25b9efdf-6ca5-48c5-8507-5543a22377b2",

"commissionInput": {

"Amount": 15000.00

}

};

ebs.callActionByName("FTOS_BP_GetCommissionDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.commissionList);}});

/*

[

{

"id": "01c0ad2e-21bd-4290-aba5-5230a6c184e8",

"name": "TC1",

"commissionTypeId": "6e2653aa-73ee-452a-b6d6-8c0a8cdb89cb",

"periodicityTypeId": "1cc04a28-88e0-46df-a089-31d04bbde6df",

"currencyId": "fc9c53a8-31c6-41ff-a979-9c7788d32fb0",

"entityStatusId": "faccc388-151a-4c83-8953-cbac7d6c442a",

"isForUnusage": false,

"valueIsPercent": false,

"includedInRepaymentSchedule": true,

"percentAppliedTo": "f87376c8-15fc-45cc-b8c2-7786b03593aa",

"automaticLoadOnContract": false,

"mandatoryForApplicant": true,

"useFormula": true,

"formulaTypeId": "a0dd56a6-a0b9-446b-8e1d-b2c052cafe0b",

"commissionValue": 5.1,

"commissionPercent": null,

"rateValidFrom": null,

"rateValidTo": null

}

]

*/Call a formula from banking product.

Input:

-

formulaType - from

FTOS_BP_Formula( attribute:formulaTypeId); -

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid); -

id - input ID.

Call example:

ebs.callActionByNameAsync("FTOS_BP_CallFormula",

{

"formulaType": FORMULA_TYPE_ID,

"bankingProductId": BANKING_PRODUCT_ID,

"id": RECORD_ID

})

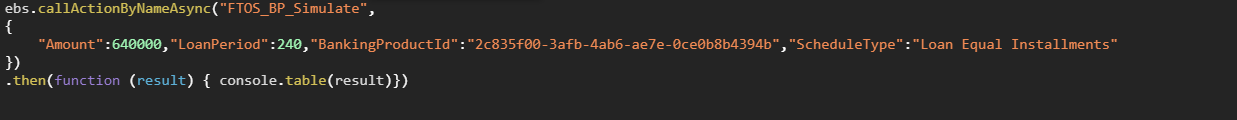

.then(function (result) { console.log(JSON.stringify(result))})Get a simulation from PaymentSchedule with different parameters.

Input:

Mandatory inputs:

- Amount

- LoanPeriod

- BankingProductId

- ScheduleType.

Optional inputs:

-

InterestType - Fixed, Variable, Collection, BankingFormula

-

Optional - list of selected optional product discounts (ex:[{"Name":"Insurance","ProductDiscountId":"35b36b84-24e0-409c-9799-7426d4273c9e"}] )

-

InterestCommission - list of filtered interest list and commission list (ex: [{"interestListId":"0e096545-f9f2-4a24-8cf9-12b39e8af039","interestListName":"ListaPL2","commissionListId":"a2e435ed-4998-4750-ab0d-e89cb81d2ecb","commissionListName":"AdminFee"}] )

-

Insurance - list of the selected or filtered insurances: (ex: [{"insuranceListId":"dbfc46f3-9f5c-4f89-ba15-383210c4cd48"}] )

-

interestCommissionFilterList - interest/ commission filter list

-

insuranceFilterList - insurance filter list

-

discountFilterList - discount filter List

-

givenInterestRate - a given interest rate that overwrites Interest Rate from product for Fixed interest type

-

givenInterestMargin - a given interest margin that overwrites Interest Margin from product for interest type Variable

-

jsonMultipleInterestRates - the list of interests to use for repayment plan Calculation (ex: [{"InterestRate":8.000000, "FromInstNo":1, "ToInstNo":5},{"InterestRate":10.00000, "FromInstNo":6, "ToInstNo":300}])

-

"InterestRate": 8.000000 interest percent defined as interest type = Collection on the banking product/Dimensions/InterestList/Interes

-

from-to installment numbers defined as interest type = Collection on the banking product/Dimensions/InterestList/Interest

-

ProductField

-

used currently only for CreditCard product

-

you can use it as bellow, multiple numeric attributes defined at the banking product level

-

"FieldName": "CapitalPercent" - percentage field defined at the banking product level / Details section, representing a percentage to be applied as formula for the schedule detail principal column

-

"FieldValue": 6 - if provided, its value is considered for calculation. If not provided the value is read from the banking product configuration.

-

jsonInputFormula - it is usually provided when interest type is BankingFormula or Collection and represents the formula input json (just like test formula). It can contain inputs for interest/commission/insurance/discount

"jsonInputFormula": {

"interestInput":{

"Amount": 6000.00

}

}Call example:

-

The reduced version:

-

The full version:

ebs.callActionByNameAsync("FTOS_BP_Simulate", {

"bankingProductId": "3783c622-c15a-476a-8834-d0850d5e8ca2",

"amount": 712000,

"downPayment": 356000,

"loanPeriod": 240,

"interestType": "f37646db-739c-477c-91df-f294737b59bd",

"recordId": "bcd1358c-aef7-4e13-bc91-c3f6e56885f3",

"scheduleType": "Loan Equal Installments",

"optional": [

{

"Name": "Income Receiving",

"ProductDiscountId": "8c1cf49e-9aff-4353-8341-9daed8e9fa88"

}

],

"discount": [

{

"Name": "Interest Discount",

"ProductDiscountId": "de770415-9bfe-4a7f-8425-02c0ebd1a5e7"

}

],

"jsonFilterCommission": [

{

"name": "FinancedAmount",

"value": 356000

}

],

"jsonInsuranceFilter": [

{

"name": "FinancedAmount",

"value": 356000

}

],

"jsonDiscountFilter": [

{

"name": "FinancedAmount",

"value": 356000

}

]

})

.then(function (result) {

console.log(result.UIResult.Data.Records[0]);

});-

Another example for Interest Type = Banking Formula:

ebs.callActionByNameAsync("FTOS_BP_Simulate", {

"bankingProductId": "3783c622-c15a-476a-8834-d0850d5e8ca2",

"amount": 712000,

"downPayment": 356000,

"loanPeriod": 240,

"interestType":"f37646db-739c-477c-91df-f294737b59bd",

"scheduleType": "Loan Equal Installments",

"optional": [{

"Name": "Income Receiving",

"ProductDiscountId": "8c1cf49e-9aff-4353-8341-9daed8e9fa88",

}],

"jsonFilterCommission": [],

"jsonInsuranceFilter": [],

"jsonDiscountFilter": [],

"jsonInputFormula": {

"interestInput":{

"Amount": 6000.00

}

}

})

.then(function (result) {

console.table(result.UIResult.Data.Records[0]);

});-

Another example for Interest Type = Collection and child interest as formula:

ebs.callActionByNameAsync("FTOS_BP_Simulate", {

"bankingProductId": "3783c622-c15a-476a-8834-d0850d5e8ca2",

"amount": 700000.00,

"downPayment": 350000,

"loanPeriod": 240,

"interestType": "f37646db-739c-477c-91df-f294737b59bd",

"scheduleType": "Loan Equal Installments",

"optional": [{

"Name": "Income Receiving",

"ProductDiscountId": "8c1cf49e-9aff-4353-8341-9daed8e9fa880",

}],

"jsonFilterCommission": [],

"jsonInsuranceFilter": [],

"jsonDiscountFilter": [],

"jsonInputFormula": {

"interestInput":{

"Amount": 700000.00

}

}

})

.then(function (result) {

console.table(result.UIResult.Data.Records[0]);

});Returns details from an insurance.

Input:

-

insuranceListId - from

FTOS_BP_InsuranceList(attribute:FTOS_BP_InsuranceListid); -

insuranceId - from

FTOS_BP_Insurance(attribute:FTOS_BP_Insuranceid); -

bankingProductId - from

FTOS_BP_BankingProduct(attribute:FTOS_BP_BankingProductid) - optional/ provided for formula association; -

formulaInputId - id of any entity used as master entity in data mapping input/ output at the formula setup; optional;

-

insuranceInput -

jsonfor formula input if necessary when no mapping was done for formula. The form of thisjsonshould look like the one in test formula.

The scope of the endpoint can be an interestListId returning all interests in that list or an interestId returning all the details for a specific interest.

Output:

Object with details about all the insurances in the insurance list from FTOS_BP_Insurance and FTOS_BP_InsuranceValue. If use Banking Formula is selected, then insurance value or insurance percent is equal to the formula result.

Call example:

var data = {

"insuranceListId": "bf2c45ba-3ea4-4447-9c96-45a708fc94c8",

"bankingProductId": "25b9efdf-6ca5-48c5-8507-5543a22377b2",

"insuranceInput": {

"Amount": 6000.00

}

};

ebs.callActionByName("FTOS_BP_GetInsuranceDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.insuranceList);}});

/*

[

{

"id": "f93416a9-c3f9-4824-9d72-05160c3666bc",

"name": "Test Insurance Formula1",

"code": "testI_F1",

"description": null,

"insurer": "ASIROM",

"isMandatoryForApplicant": true,

"isMandatoryForDebtor": false,

"valueIsPercent": false,

"periodicityTypeId": "1cc04a28-88e0-46df-a089-31d04bbde6df",

"currencyId": "fc9c53a8-31c6-41ff-a979-9c7788d32fb0",

"useOnPaymentSchedule": true,

"scheduleElementClassId": "d74c21fe-bb12-413f-83d7-26ab40f34226",

"operationItemId": null,

"useFormula": true,

"formulaTypeId": "a0dd56a6-a0b9-446b-8e1d-b2c052cafe0b",

"insuranceValue": 5.3,

"insurancePercent": null,

"interestDiscount": null,

"rateValidFrom": null,

"rateValidTo": null

},

{

"id": "24284701-7d60-4a80-8589-5ab867f9db81",

"name": "TestInsurance_Values2_Percentage",

"code": "testI_V2P",

"description": null,

"insurer": "Generali",

"isMandatoryForApplicant": true,

"isMandatoryForDebtor": false,

"valueIsPercent": false,

"periodicityTypeId": "1cc04a28-88e0-46df-a089-31d04bbde6df",

"currencyId": "fc9c53a8-31c6-41ff-a979-9c7788d32fb0",

"useOnPaymentSchedule": true,

"scheduleElementClassId": "d74c21fe-bb12-413f-83d7-26ab40f34226",

"operationItemId": null,

"useFormula": false,

"formulaTypeId": null,

"insuranceValue": 146,

"insurancePercent": null,

"interestDiscount": null,

"rateValidFrom": "2021-03-07T22:00:00Z",

"rateValidTo": "2021-12-30T22:00:00Z"

}

]

*/

var data = {

"insuranceId": "f93416a9-c3f9-4824-9d72-05160c3666bc",

"bankingProductId": "25b9efdf-6ca5-48c5-8507-5543a22377b2",

"insuranceInput": {

"Amount": 6000.00

}

};

ebs.callActionByName("FTOS_BP_GetInsuranceDetail", data,

function(s){ if(s.UIResult){console.log(s.UIResult.Data.insuranceList);}});

/*

[

{

"id": "f93416a9-c3f9-4824-9d72-05160c3666bc",

"name": "Test Insurance Formula1",

"code": "testI_F1",

"description": null,

"insurer": "ASIROM",

"isMandatoryForApplicant": true,

"isMandatoryForDebtor": false,

"valueIsPercent": false,

"periodicityTypeId": "1cc04a28-88e0-46df-a089-31d04bbde6df",

"currencyId": "fc9c53a8-31c6-41ff-a979-9c7788d32fb0",

"useOnPaymentSchedule": true,

"scheduleElementClassId": "d74c21fe-bb12-413f-83d7-26ab40f34226",

"operationItemId": null,

"useFormula": true,

"formulaTypeId": "a0dd56a6-a0b9-446b-8e1d-b2c052cafe0b",

"insuranceValue": 5.3,

"insurancePercent": null,

"interestDiscount": null,

"rateValidFrom": null,

"rateValidTo": null

}

]

*/Returns the value for the calculated PMT, or payment terms for a loan or investment.

Input:

Mandatory input parameters:

-

InstallmentsNo - The number of installments

-

PeriodicityType - The type of periodicity for PMT calculation. The possible values are the names of the records from the

FTOS_CB_PeriodicityTypeentity. -

InterestCalculationMethod - The method to be used for interest calculation. The possible values are the names of the records from the

FTOS_BP_InterestCalculationTypeoption set.

Optional input parameters:

-

FinancedAmount - The loan's financed amount

-

InterestPercent - The annual interest percentage

-

GracePeriodPrincipal - If the value is 1, then the installment is skipped at the beginning. If the parameter is not present, its value is considered 0.

-

FutureValue - The balloon value. If the parameter is not present, its value is considered 0.

-

InterestType - The type of calculation for the interest, with 0 for InArrears and 1 for InAdvance.

Output:

-

PMTValue - the calculated value of the PMT

-

PrincipalValue - the principal value.

Call example:

ebs.callActionByNameAsync('FTOS_BP_CalculatePMT', {

"jsonParam": {

"FinancedAmount": 10000,

"InterestPercent": 5,

"InstallmentsNo": 12,

"GracePeriodPrincipal": 1,

"PeriodicityType": "Monthly",

"FutureValue": 1000,

"InterestCalculationMethod": "30/360",

"InterestType":0

}

}).then(function (o) {

console.table(o.UIResult.Data)

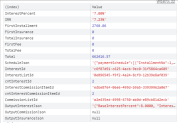

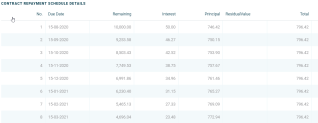

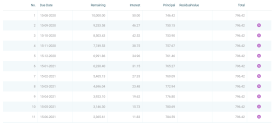

});Returns an array of json records representing the installments of a repayment schedule, that must be stored and presented as in the picture bellow, customized for every project:

Input:

Mandatory input parameters:

-

ScheduleType - the name of the Payment Schedule found in the

FTOS_BP_PaymentScheduleTypeentity -

InterestPercent - the interest rate for the calculation, defined at the banking product level. The interest rate must be annual, so if you are using a monthly interest rate, you must transform it into an annual rate, multiplying it with 12.

-

Amount - the financed amount, usually also containing the residual value if present, but not the advance value

-

InstallmentsNo - the number of installments

-

PeriodicityType - the periodicity of the schedule. The possible values are the names of the records from the

FTOS_CB_PeriodicityTypeentity. -

InstallmentDay - the day of month for each installment

Optional input parameters:

-

AdvanceAmount - the advance value, where AdvanceAmount + Amount = CreditValue

-

GracePeriodInterest - the number of installments having grace period applied on the Interest column

-

GracePeriodPrincipal - the number of installments having grace period applied on the Principal column

-

LastDueDate - the date of the last installment unmodified for recalculation

-

BlockInstallmentNo - the installment number that is blocked for recalculation

-

BlockAmount - the value of the capital that is blocked for recalculation

-

ActivationDate - the activation date of the contract. This is considered at the adjustment of the first installment for the columns that have Effective Rate as calculation method.

-

FirstDueDate - the due date of the first installment

-

BlockInterestAmount - the value of the interest for the grace period if recalculation includes the grace period

-

HolidayShift - the system takes into account not working days/ national holidays, according to the sent value. If

trueand Sunday or Saturday are defined as nonworking days, then the DueDate excepts these dates. -

CalculateDAE - specifies whether to show the effective annual interest rate: for 0 or null, the DAE is not displayed; for 1, only the DAE percent is displayed, and for 2, the original schedule containing a column wiht DAE percent is displayed.

-

installmentValue - if there is a locked value for installments, this value should be provided here (equal installments)

-

principalValue - if there is a locked value for principal, this value should be provided here (equal principal)

-

InstallmentMethod - the method for calculating the installment (Actual Month or Next Month)

-

MaturityDate - the date for the end of the contract

-

InterestCapitalization - specifies if the interest is capitalized for deposit calculation

-

UpFrontValue - the amount for upfront commissions, taxes, insurances payed once at the beginning of the contract

-

ResidualValue - the residual value amount for insurance business

-

ResidualInInstallment - the method of display for the residual value: for 0, it is displayed in a new schedule line, for 1, it is displayed in the last schedule line

-

Commission - an array [] of commissions with periodicity different than

Once.

[

-

SourceValue - the value of the commission when the commission is a defined as value. Mandatory if the line is present.

-

SourcePercent - the percent of the commission when the commission is defined as a percentage. Mandatory if the line is present.

-

FeePeriodicityType - the periodicity of the commission. Mandatory if the line is present.

-

GracePeriodFee - it can have its own grace period for a number of installments

-

BlockFeeAmount - the blocked amount is case of recalculation

-

FeeDate - the date of the fee being applied to the contract. Mandatory if the line is present.

-

FeeId - the fee from the

FTOS_BP_Commissionentity selected from the banking product level. Mandatory if the line is present. -

IsUpfront - for commissions that are included into the payment schedule and the first commission value is paid at the activation date. Possible values: 0,1. The parameter is optional and if it is not included into the JSON request, the value comes from payment schedule detail column setting.

]

-

Insurance - an array [] of insurances with periodicity different than

Once.

[

-

SourceValue - the value of the insurance when the insurance is defined as value. Mandatory if the line is present, and mutually exclusive if the SourcePercent is present.

-

SourcePercent - the percent of the insurance when the insurance is defined as a percentage. Mandatory if the line is present, and mutually exclusive if the SourceValue is present.

-

InsurancePeriodicityType - the periodicity of the insurance. Mandatory if the line is present.

-

GracePeriodInsurance - it can have its own grace period for a number of installments

-

BlockInsuranceAmount - the blocked amount is case of recalculation

-

InsuranceDate - the date of the insurance applied to the contract. Mandatory if the line is present.

-

InsuranceId - the insurance from the

FTOS_BP_Insuranceentity selected from the banking product. Optional if InsuranceClassId is present. -

InsuranceClassId - the insurance class from the

FTOS_BP_ScheduleElementClassentity selected on theFTOS_BP_Insuranceentity when defining the insurance. Optional if InsuranceId is present. -

IsUpfront - for insurances that are included into the payment schedule and the first commission value is paid at the activation date. Possible values: 0,1. The parameter is optional and if it is not included into the JSON request, the value comes from payment schedule detail column setting.

]

-

MultipleInterestRates - an array [] of interest rates

[

-

InterestRate - the interest percent defined as interest type =

Collectionon the banking product Dimensions > Interest List > Interest level -

FromInstNo - the From installment number defined as interest type =

Collectionon the banking product Dimensions > Interest List > Interest level -

ToInstNo - the To installment number defined as interest type =

Collectionon the banking product Dimensions > Interest List > Interest level

]

-

CapitalPercent - the percentage field defined at the banking product level (Credit Card) in the Details tab, representing a percentage to be applied as a formula to the schedule detail principal column.

Input variables example:

{

"ScheduleType": "Loan Equal Principal Actual with ResidualValue",

"InterestPercent": 6,

"Amount": 10000,

"InstallmentsNo": 13,

"AdvanceAmount": 400,

"GracePeriodInterest": null,

"GracePeriodPrincipal": 0,

"PeriodicityType": "Monthly",

"LastDueDate": "2020-8-12",

"BlockInstallmentNo": 0,

"BlockAmount": 0,

"ActivationDate": "2020-8-12",

"FirstDueDate": "2020-8-12",

"BlockInterestAmount": 0,

"HolidayShift": true,

"HolidayCountry": "Country:Thailand",

"CalculateDAE": 2,

"installmentValue": 796.42,

"principalValue": null,

"InstallmentDay": 15,

"InstallmentMethod": "ActualMonth",

"MaturityDate": "2021-8-12",

"InterestCapitalization": 0,

"UpFrontValue": 400.00,

"ResidualValue": 200,

"ResidualInInstallment": 0,

"Commission": [

{

"SourceValue": 1,

"SourcePercent": 0.01,

"FeePeriodicityType": "Trimestrial",

"GracePeriodFee": 0,

"BlockFeeAmount": 0,

"FeeDate": "2020-8-12",

"FeeId": "c86d68e5-2b48-439f-9bc6-38df317bff2a",

"IsUpfront": 0

}

],

"Insurance": [

{

"SourceValue": 10,

"SourcePercent": null,

"InsurancePeriodicityType": "Trimestrial",

"GracePeriodInsurance": 0,

"BlockInsuranceAmount": 0,

"InsuranceDate": "2020-8-12",

"InsuranceId": "66128D6D-C2AA-4B5C-932B-7502C2E18288",

"InsuranceClassId": "61D36493-3DF9-44F0-B372-BAC569346E80",

"IsUpfront": 0

}

],

"MultipleInterestRates":[{

"InterestRate": 8.000000,

"FromInstNo":1,

"ToInstNo":3

}],

"CapitalPercent":6

}Output:

An array of json records representing the installments of a repayment schedule.

Case Studies

Loan Equal Installment - Minimal Call

Call example:

var jp = {

"ScheduleType": "Loan Equal Installments",

"InterestPercent": 6,

"Amount": 10000,

"InstallmentsNo": 13,

"PeriodicityType": "Monthly",

"ActivationDate": "2020-8-12",

"InstallmentDay": 15

};

ebs.callActionByName("FTOS_BP_CalculateRepaymentSchedule", {jsonParam:jp},

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});Returned data:

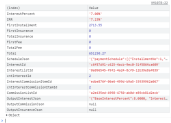

Loan Equal Principal Actual with Fees and Insurances

The actual Annual Admin Fee must be defined within the FTOS_BP_Commission entity, and also the Insurances within the FTOS_BP_Insurance entity, Make sure you have at least one insurance with class Life Insurance, Monthly, defined as percentage, and one with class HomeInsurance, Monthly, defined as value. These Commissions and Insurances are called by Id within the request of the FTOS_BP_CalculateRepaymentSchedule endpoint.

Call example:

var jp = {

"ScheduleType": "Loan Equal Principal Actual",

"InterestPercent": 6,

"Amount": 10000,

"InstallmentsNo": 13,

"PeriodicityType": "Monthly",

"ActivationDate": "2020-8-12",

"InstallmentDay": 15,

"InstallmentMethod": "ActualMonth",

"Commission": [

{

"SourceValue": null,

"SourcePercent": 2,

"FeePeriodicityType": "Monthly",

"GracePeriodFee": 0,

"BlockFeeAmount": 0,

"FeeDate": "2020-8-12",

"FeeId": "6ab39765-f535-4560-be0b-24c92755946c"

}

],

"Insurance": [

{

"SourceValue": 5,

"SourcePercent": null,

"InsurancePeriodicityType": "Monthly",

"GracePeriodInsurance": 0,

"BlockInsuranceAmount": 0,

"InsuranceDate": "2020-8-12",

"InsuranceId": "a2f2230e-ec59-44ad-bf73-39556b2ed15d" ,

"InsuranceClassId": null

},

{

"SourceValue": null,

"SourcePercent": 1.5,

"InsurancePeriodicityType": "Monthly",

"GracePeriodInsurance": 0,

"BlockInsuranceAmount": 0,

"InsuranceDate": "2020-8-12",

"InsuranceId": "1c67cf62-032d-49d1-bfa1-e36299ace050" ,

"InsuranceClassId": null

}

]

};

ebs.callActionByName("FTOS_BP_CalculateRepaymentSchedule", {jsonParam:jp},

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});Part of the returned data:

Loan Equal Installments with Residual Value

Call example:

var jp = {

"ScheduleType": "Loan Equal Installments with ResidualValue",

"InterestPercent": 6,

"Amount": 10000,

"InstallmentsNo": 13,

"AdvanceAmount": 400,

"GracePeriodInterest": null,

"GracePeriodPrincipal": 0,

"PeriodicityType": "Monthly",

"LastDueDate": "2020-8-12",

"BlockInstallmentNo": 0,

"BlockAmount": 0,

"ActivationDate": "2020-8-12",

"FirstDueDate": "2020-8-12",

"BlockInterestAmount": 0,

"HolidayShift": true,

"HolidayCountry": "Country:Thailand",

"CalculateDAE": 2,

"installmentValue": 796.42,

"principalValue": null,

"InstallmentDay": 15,

"InstallmentMethod": "ActualMonth",

"MaturityDate": "2021-8-12",

"InterestCapitalization": 0,

"UpFrontValue": 0.00,

"ResidualValue": 200,

"ResidualInInstallment": 0,

"Commission": [],

"Insurance": []

};

ebs.callActionByName("FTOS_BP_CalculateRepaymentSchedule", {jsonParam:jp},

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});Part of the returned data:

Data Visualization Example

Code:

<div class="row" data-template-id="row_11">

<div class="col-xs-12">

<div id="payment-details"> </div>

</div>

</div>Call example:

var stId = ebs.getCurrentEntityData().scheduleTypeId; // stId = Schedule Type Id

function unCapitalize(string) {

return string[0].toLowerCase() + string.slice(1);

}

var status = '';

function compareValues(key, order = 'asc') {

return function innerSort(a, b) {

if (!a.hasOwnProperty(key) || !b.hasOwnProperty(key)) {

return 0;

}

const varA = (typeof a[key] === 'string')

? a[key].toUpperCase() : a[key];

const varB = (typeof b[key] === 'string')

? b[key].toUpperCase() : b[key];

let comparison = 0;

if (varA > varB) {

comparison = 1;

} else if (varA < varB) {

comparison = -1;

}

return (

(order === 'desc') ? (comparison * -1) : comparison

);

};

}

showRepaymentSchedule ();

function showRepaymentSchedule () {

//here we have used other entities contract, ContractRepaymentSchedule, ContractRepaymentScheduleDetai (basically this last entity contain the schedule details)

//so this endpoint bellow is arbitrary and usualy get replaced by something else

ebs.callActionByName('FTOS_CB_PaymentScheduleFields', { scheduleId: ebs.getCurrentEntityId(), scheduleTypeId: stId }, function (rsp) {

var columnsFields = [];

rsp.UIResult.Data.fields.map(function (o) {

columnsFields.push(o);

});

columnsFields.sort(compareValues('order'));

var values = rsp.UIResult.Data.values;

columnsFields.unshift({ name: 'DueDate', display: 'Due Date', cap: false });

columnsFields.unshift({ name: 'InstallmentNo', display: 'No.', cap: false, decimal: false });

paymentDetail(columnsFields, values, hasButton);

}

function paymentDetail(fields, values, hasButton) {

var dataSource = [];

values.forEach(function (v) {

var obj = JSON.parse(v.json);

var dateToFormat = new Date(obj.DueDate.invariantDate);

obj.DueDate = (dateToFormat.getDate() < 10 ? '0' + dateToFormat.getDate() : dateToFormat.getDate()) + '-' + ((dateToFormat.getMonth() + 1) < 10 ? '0' + (dateToFormat.getMonth() + 1) : (dateToFormat.getMonth() + 1)) + '-' + dateToFormat.getFullYear()

obj.InstallmentTypeId = v.sd_installmentTypeId_displayname;

obj.id = v.id;

obj.payed = v.payed;

obj.notification = v.notificationId;

dataSource.push(obj);

});

var columns = [];

fields.forEach(function (o) {

var object = {

dataField: typeof o.cap === 'undefined' ? unCapitalize(o.name) : o.name,

caption: o.display,

format: typeof o.decimal !== 'undefined' ? {} : { type: "fixedPoint", precision: 2 }

};

columns.push(object);

});

if (hasButton) {

columns.push({

type: "buttons",

width: 110,

buttons: [{

hint: "Pay Installsssment",

icon: "money",

visible: function (e) {

return e.row.data.notification === null;

},

onClick: function (e) {

//custom code on pay installment

});

}

}]

});

}

$("#payment-details").dxDataGrid({

rowAlternationEnabled: true,

showColumnHeaders: true,

alignment: "left",

repaintChangesOnly: true,

paging: {

pageSize: 10000

},

onCellPrepared: function (e) {

//console.log(e)

if (e.rowType === 'data' && e.row.data.payed === true) {

//console.log(e.row.data.payed)

e.cellElement[0].className += " payed";

}

},

columnAutoWidth: false,

columns: columns,

dataSource: {

store: dataSource,

reshapeOnPush: true

}

});

}Credit Card Schedule

Call example:

var jp = {

"ScheduleType":"Credit Card Installments",

"InterestPercent":32.000000,

"Amount":3770.00,

"HolidayShift":true,

"InstallmentsNo":60,

"PeriodicityType":"Monthly",

"LastDueDate":"2021-02-01",

"ActivationDate":"2021-02-01",

"InstallmentDay":1,

"InstallmentMethod":"ActualMonth",

"MaturityDate":"2026-02-01",

"Commission":[

{ "SourceValue":5.00,

"SourcePercent":null,

"FeePeriodicityType":"Monthly",

"FeeDate":"2021-02-01",

"FeeId":"365221CE-9F6D-4B4C-A8CE-2A2D62A38353",

"IsUpfront":null}

],

"CalculateDAE":2,

"CapitalPercent":5.000000

};

ebs.callActionByName("FTOS_BP_CalculateRepaymentSchedule", {jsonParam:jp},

function(s){ if(s.UIResult){console.log(s.UIResult.Data);}});Part of the returned data:

Returns the banking product information based on its product code. If more versions are available, only the approved one is taken into consideration.

Input:

Mandatory input parameters:

-

BankingProductCode - string, from

FTOS_BP_BankingProduct(attribute:BankingProductCode).

Optional input parameters:

- displayBPDetails - boolean, specifies whether to show the details of the banking product, such as general data, calendars, associated products or payment schedule types, product guarantees or destination types. Possible values:

true,false. The Details section of the output is only displayed fortruevalue. -

displayBPAvailability - boolean, specifies whether to show the availability information of the banking product, such as currency, period, minimum and maximum amounts and advances, or covenants. Possible values:

true,false. The Availability section of the output is only displayed fortruevalue. -

displayBPDimensions - boolean, specifies whether to show the dimensions information of the banking product, such as interests and commissions, insurances, discounts or questions. Possible values:

true,false. The Dimensions section of the output is only displayed fortruevalue.

Output:

Object with details about a specific banking product from the FTOS_BP_BankingProduct entity. The data enclosed in Banking Product is returned by default. Data within Details, Availability and Dimensions is returned only if their corresponding flags are set to true.

Call example:

var data = {

"BankingProductCode": "APICodeTst",

"displayBPDetails": true,

"displayBPAvailability": true,

"displayBPDimensions": true

};

ebs.callActionByName("FTOS_BP_GetBankingProductByCode", data, function(response) {

if (response.UIResult) {

console.log(response.UIResult.Data);

}

});Returned data:

// API Response example below:

{

"BankingProduct": {

"BankingProductCode": "APICodeTst",

"Name": "APIName",

"StartDate": "2021-10-07T21:00:00Z",

"EndDate": "2022-03-30T21:00:00Z"

},

"Details": {

"GeneralData": {

"BankAccountType": "LoanTermAccount",

"IsRevolving": true,

"AutoDisbursement": false,

"MaxNoDisbursements": 12,

"ActivationTranchesOnDocumentSubmission": false,

"IsGuaranteed": true,

"AllowCollateralPartialRelease": true,

"AllowCoDebtor": false,

"AllowRefinancing": true,

"MaxNoOfCodebtors": 5,

"PeriodicityType": "Monthly",

"RepaymentAllocationMethod": "CostOrder",

"HolidayShiftForRepaymentInstallments": true,

"HolidayShiftMethod": "Forward",

"DeferDueDate": true,

"GraceType": "Interest",

"ProductGrace": "FiveDaysGrace",

"GraceDaysForRepayment": 123,

"PenaltyForGracePeriod": false

},

"CountryCalendars": [

{

"CountryName": "Belgium"

},

{

"CountryName": "Thailand"

}

],

"AssociatedPaymentScheduleTypes": [

{

"PaymentScheduleTypeName": "Credit Card Installments"

}

],

"ProductGuarantees": [

{

"ProductGuaranteeName": "APITestProductGuarantee"

}

],

"ProductDestinationTypes": [],

"DisbursementMatrix": [

{

"Name": "DisbMatrixAPITest"

}

],

"AssociatedProducts": [

{

"AssociatedProductName": "TLVlad"

},

{

"AssociatedProductName": "TLVladAutoCommLoad"

}

]

},

"Availability": {

"Currency": "RON",

"PeriodType": "Months",

"MaxPeriodForDisbursement": 1,

"MinimumPeriod": 2,

"MaximumPeriod": 3,

"MinimumEarlyRepaymentValue": 4,

"MinimumAmount": 500,

"MaximumAmount": 50000,

"UnusageStartPeriod": 5,

"MinimumAdvance": 10,

"MaximumAdvance": 90,

"AvailabilityItemFilters": [

{

"Description": "Account Filter API TEST"

}

],

"ProductCovenants": [

{

"Name": "Lender can monitor borrower's current ratio"

}

]

},

"Dimensions": {

"InterestsAndCommissions": [

{

"InterestCommissionItemName": "InterestCommAPITest",

"CommissionListName": "Current Account RON commission ",

"InterestListName": "eMag CA Interest List",

"Commissions": [

"CA Administration Fee",

"Administration Fee ODV MAGDA"

],

"Interests": [

"Zero Interest Rate",

"Banded Test"

]

}

],

"Insurance": [

{

"Name": "InsuranceAPITEst"

}

],

"Discounts": [

{

"Name": "DiscountAPITest"

}

],

"Questions": [

{

"Name": "Question1"

},

{

"Name": "Question2"

}

]

}

}